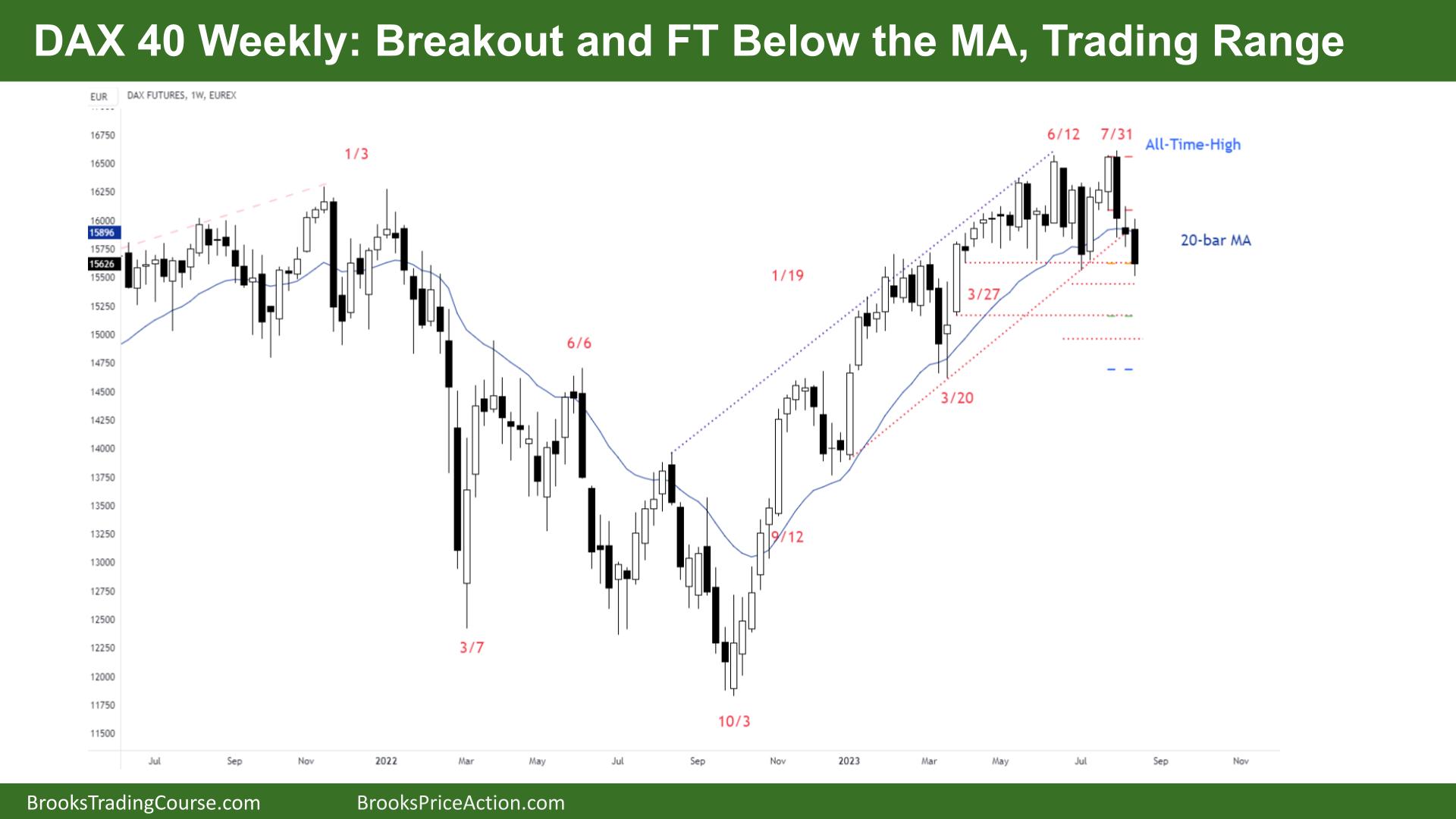

Market Overview: DAX 40 Futures

DAX futures moved lower last week with consecutive bars below the MA. It was a breakout and FT after a failed break above the ATH. This is the largest streak of bear bars in nearly 12 months, so this is probably going to pull back soon. Bears want to close the gaps below while bulls are likely to buy below bars betting this reversal will be minor before a test of the high. More likely sideways next week.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a big bear sell climax bar on the weekly chart.

- It was a breakout and FT below an outside down bar from the ATH.

- It was a bear surprise, and traders expected a small second leg. Here it was even more of a surprise.

- We should pull back here this week. It is a big-small-big pattern.

- The prior week was a low probability bar to get further selling. A bad sell, but it worked. So limit-order buyers are now stuck.

- Some buyers came in below the tight bull microchannel expecting a TR.

- Bulls have been waiting for a complete bar below the MA in over 20 bars. So it is setting up a 20-bar MA Gap buy setup.

- The problem is the channel is so tight – instead of sideways, we can get another surprise bar down.

- There are magnets below March 27th – a large open gap.

- We got a new high and low, an expanding triangle.

- In an expanding triangle, the market seeks a breakout and finds two. This traps traders and moves quickly in the middle.

- Most traders should either be short or flat. Selling low in a trading range is a low-probability trade.

- Most should wait for a pullback test of the breakout and then try to trade the second leg. Or if it sets up a reversal, wait for a 2nd entry buy.

- The bulls see we didn’t break out of anything yet. It is still more likely this becomes the low in a trading range.

- The bulls want to buy the test of the trend line and buy more and will usually make money getting back to test the high close. Bears think we have already done this and made a HH MTR.

- If that is the case, we should get a LH before making a stronger move down.

- Bears might take profit next week and then sell again higher.

- Expect sideways to up next week.

The Daily DAX chart

- The DAX 40 futures on Friday was a small bear doji just closing below the low of Thursday.

- It is the 3rd consecutive doji, so we will likely go sideways soon.

- The bulls see a pullback to the start of a very strong bull spike. A sell climax that reversed up strongly and did not give bears a chance to get out without a loss.

- The bulls want a longer pattern, a wedge bull flag. But we have been below the MA for a long time now.

- The bears see a HH DT, possibly a HH MTR. But they need a LH to make it official.

- It is an expanding triangle and we will break out soon. It looks to be down right now.

- How many legs has it been? 2 or 3? Trading ranges usually get 2 legs. If that is the case it should end here.

- There is another ET (Expanding Triangle) below, and they want to get back there to close any gaps.

- There has been buying pressure here – hence the dojis.

- The bulls likely got stuck at the MA above. They couldn’t avoid a loss. The bulls should get one more attempt, at least.

- The bears need two good bars – a breakout and FT day next week, to have a chance at a longer target below.

- It would be a stronger sell if we can make a DT bear flag with the OB bar 2 weeks ago.

- Most traders should be short or flat and looking for a stop entry.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi,

2nd last sentence: what is an OB Bar?