Market Overview: DAX 40 Futures

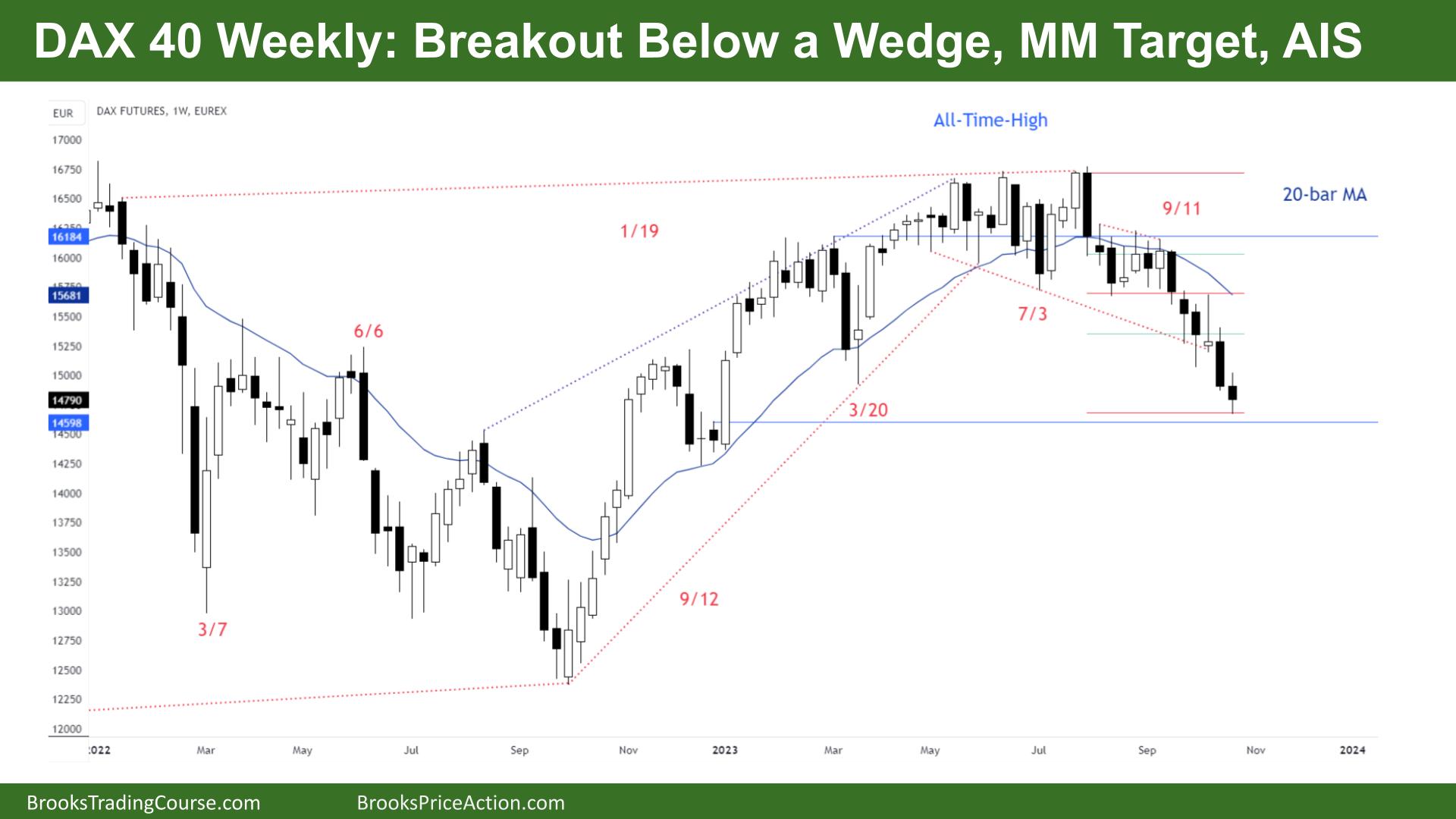

The DAX future chart has a breakout below a wedge on the weekly chart. It was a bear bar following another bear bar, so there was nothing to buy here. The stop is far away, and no opposite signals yet, so the probability is to lower prices. We might need to test the bad buy signal from January. The bears want to do the same thing as the bulls, only Southside. Sellers are waiting at the MA, and we will probably need to test 15000 again.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bear doji closing around its midpoint, a breakout below a wedge bottom.

- It is the second consecutive bear bar below the MA, a breakout below a wedge, so another always in short signal.

- A doji is a sign of TR price action, so we might be forming a trading range soon. Channels are one leg of a trading range, and we are searching for a bottom.

- Look left; it was a bad buy signal in January that got follow-through and went up for many bars. That swing point was a bear bar and a doji – a less reliable swing point.

- The bulls see an endless pullback after an expanding triangle, and we are breaking below a bear channel line after a High 1. A High 2 and High 3 in good context can be a reliable swing buyback to the MA.

- The bears see we are always short and starting to get tails below the bars – front running bulls. Their stop is far away, and they might look to take profits soon above a bull bar. That would be the High 2.

- We are at a measured move target, so some bears will take profits around here when a signal appears.

- Others will see the move as strong and expect one more leg down. That last leg can often be climactic and produce big profits as it goes further than traders expect.

- Expect sideways to down next week.

The Daily DAX chart

- The DAX 40 futures was a bear doji on Friday after a series of small bars, so it is likely the start of a trading range.

- The bulls see a weak High 2 buy signal, but it triggered, increasing the probability of a High 3 working out. We are far from the MA, so they will be looking to swing back there.

- The bears see a break below a double top and are looking for a MM down. We are around that target now.

- We broke below the 15000 number and tested it once, but I suspect we will get back there.

- The bulls want a weak sell signal, which they have now. The problem with a buy-the-market order is that it was still a bear BO below the bar.

- Some bulls would argue they broke the last trendline and have tested the low. But better to wait for a good signal to trigger.

- The price action has been mostly a broad bear channel, and bears see every bull bar as setting up a buying opportunity. It has gone on a long time, so I expect bears to take profits soon.

- We have been in a longer-term trading range, so testing the breakout point and closing their gaps is expected.

- Expect sideways to down next week unless the bulls can trigger a decent buy signal – then the swing to 15000, and the MA is back on.

- It is too low to be short here. Most bears will wait for the MA to sell again.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.