Market Overview: DAX 40 Futures

DAX 40 breakout of bull flag with market moving higher last week. Consecutive bull bars closing near their highs. The bulls have needed to break above the wedge bottom and get closer to their swing target above 15000, which they did last week. The bears have been selling from January 2022 until September, so they see it as a deep pullback and BO test of the range above. We will likely be in a trading range than a BO above the All-Time-Highs. Expect sideways to up next week.

DAX 40 Futures

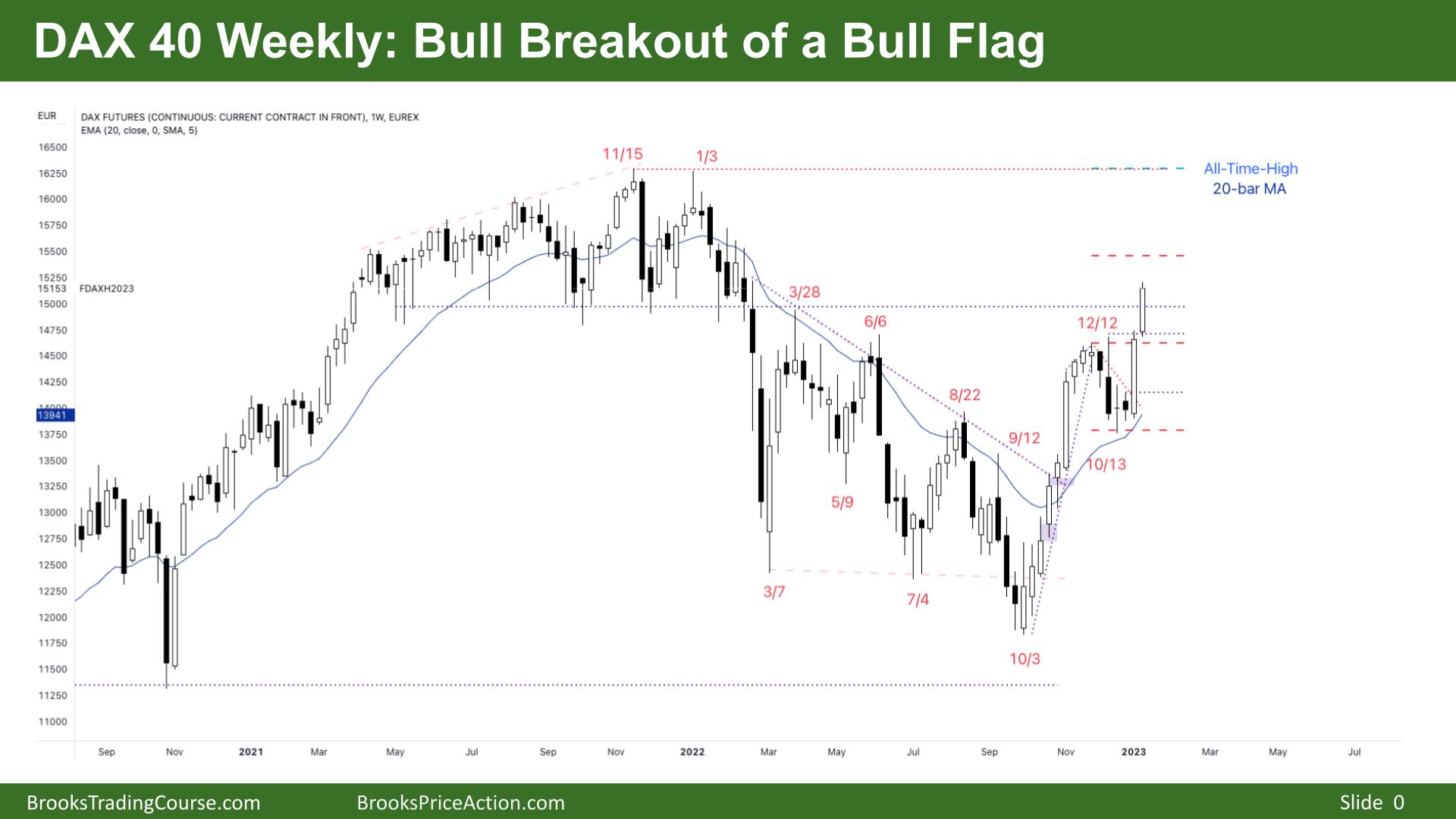

The Weekly DAX chart

- The DAX 40 futures was a big bull bar closing near its high. It is a bull breakout of a bull flag.

- It is the second consecutive bull bar, so we are likely always in long.

- A breakout and a follow-through bar is a buy signal one tick above the high of the bar.

- The bulls see a bull breakout of bull flag. They see the Dec 12th high and expect to reach a measured move target above.

- Some traders will look left and expand the breakout to include a larger trading range. Either way, traders expect higher prices, and so should you.

- Some bulls will buy the close, some buy a tick above the high, and some will wait for a pullback to enter. A prior breakout point below is also a reasonable place to enter.

- A test of the breakout will lead traders to be more confident of a move into a new price area.

- The bears see a trading range. They see the prior break below in March as the breakout point, a breakout test of that area. Trading ranges often go past BO points before continuing.

- How can it be both a signal to get long and a signal to get short? It is a trading range. So traders will be quick to exit if they don’t get the entry bar/follow-through bar they want.

- There is nothing to short for most bears, and most traders should be long or flat.

- Bears want a reversal bar and follow-through for a swing short. Most traders, should wait for swing entries. If you look left, it has been easier to make money long since October.

- Bulls want a swing target up to the All-Time-High (ATH.) The leg from October is so strong it might get several legs and form some kind of wedge/bull channel up to it.

- Bears still see it as a pullback from the bear spike and channel down, and we are slightly above the 50% point, so it is reasonable to scale in short above bars. Trading ranges often are the strongest at the edges.

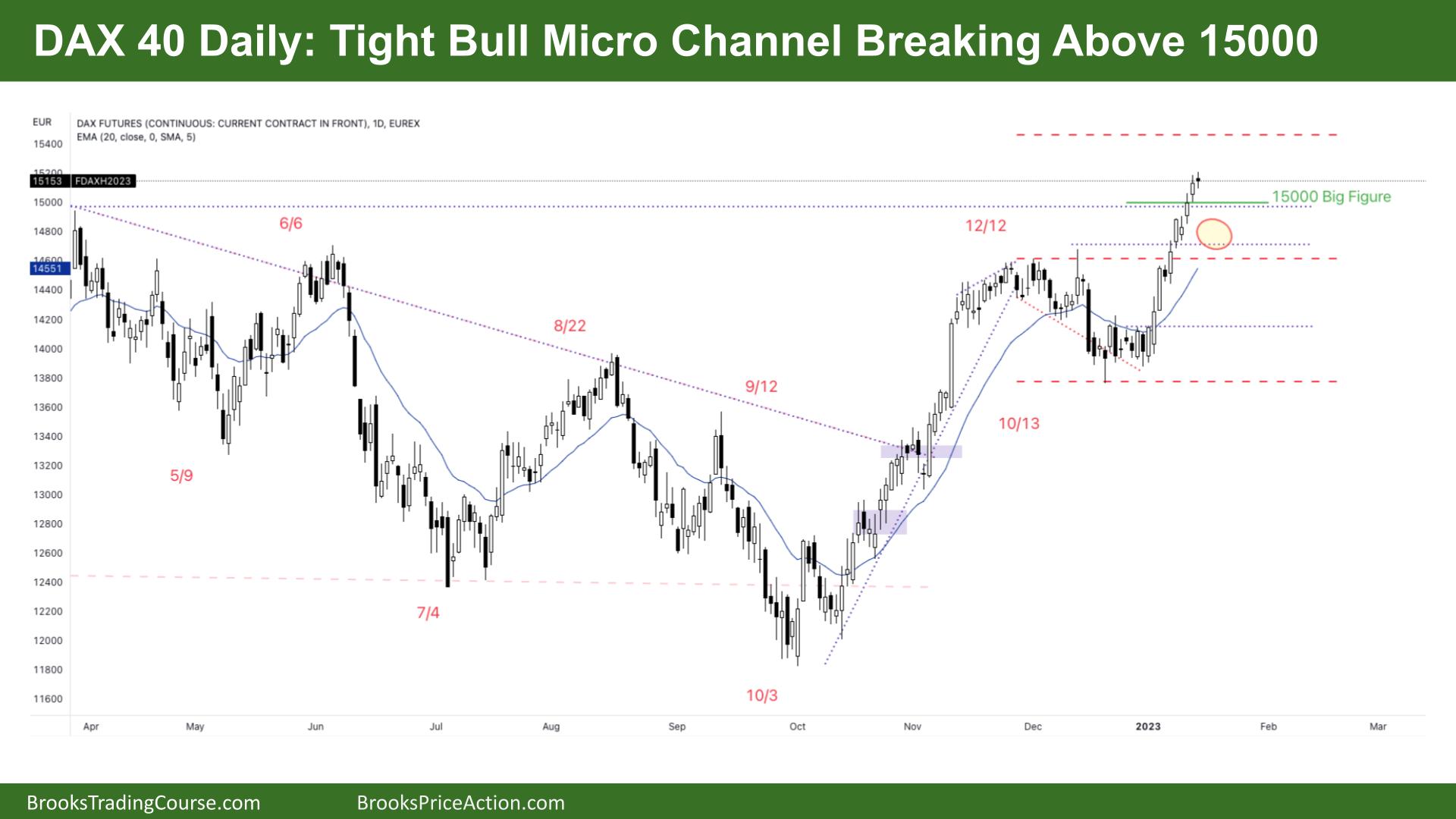

The Daily DAX chart

- The DAX 40 futures was a bear doji on Friday.

- It follows five consecutive bull bars, a tight bull micro channel. Traders will look to enter long below the low of a prior bar.

- Although most traders should be entering using stop entries, so below a bear bar if short and above a bull bar if long.

- The bulls see we broke above a prior high and expect to go for a measured move up. They also see we broke above the 15000 Big Figure.

- The bulls want a pullback, possibly a 2-legged corrective move sideways to down, maybe to the moving average, before continuing higher.

- The bears see a higher time frame trading range, which is a buy climax. This gap they expect to be an exhaustion gap and lack follow-through above the measured move target.

- But the bears need near bars. They want a bear bar closing on its low or consecutive bear bars to signal an opportunity to go short.

- Most traders should be long or flat.

- The bears want the bear bar to sell above and create a wedge top to reverse down. The best they can hope for is a move back to the moving average before likely continuation.

- The bears also see a parabolic wedge top. They see this leg as much stronger than the last leg, so it is climactic and unsustainable. An increase in acceleration and velocity late in a trend can signal profit-taking.

- If this is the case, the bears will sell a reversal down to the breakout points below where a test and continuation are more likely to appear.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.