Market Overview: DAX 40 Futures

DAX futures moved higher last week with a strong bull BO, a trend bar. The bulls see a BO and FT above the ATH. The bears see a buy climax late in a trend which can attract profit-taking. Although there is nothing to sell yet, most BOs above trading ranges fail. The bulls want a pullback and a High 1 or High 2. The bears need a strong reversal here to prevent a MM above.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures had a big bull BO, a bull surprise bar that closed on its high last week.

- We might gap up on Monday or reverse strongly at the measured move target.

- The market broke above the all-time high a few weeks ago, confirming a bull breakout with a follow-through.

- The sequence of bars has been alternating, with the latest bar being one of the strongest bull bars in a tight channel. Strong bars late in a channel indicate climactic behaviour and often reverse strongly.

- Bulls perceive the breakout and follow-through as an opportunity for a measured move higher, potentially surpassing the all-time high.

- However, they acknowledge that the market is currently at the top of a trading range, making buying at this level risky due to profit-taking by traders.

- Looking at the channel line over the past six months, every touch of the line has led to profit-taking.

- Furthermore, the market has reached multiple measured move targets, including a swing buy from December and a breakout above an expanding triangle in January.

- Bears see double top formation within a trading range that originated in 2022. They also observe a duelling lines pattern – a wedge formation to a target, typically as the second leg of the double top or double bottom.

- Despite the bull BO and a strong trend observed over the past six months, it has become increasingly challenging for bulls to achieve consecutive bars. What does it mean? Either a small pullback bull trend or trading range.

- A lack of open gaps below indicates a trading range.

- The bears want a reversal and followthrough. The third push of a wedge is a reasonable sell.

- It also completes a pattern, suggesting a shift back to breakout mode.

- Furthermore, there are many trapped bears below due to failed stop entries in the two expanding triangles over the past six months.

- Traders should expect potential resistance above the highs and then support from buyers at the moving average, given the presence of numerous bars above it.

- Expect sideways to down next week with profit-taking.

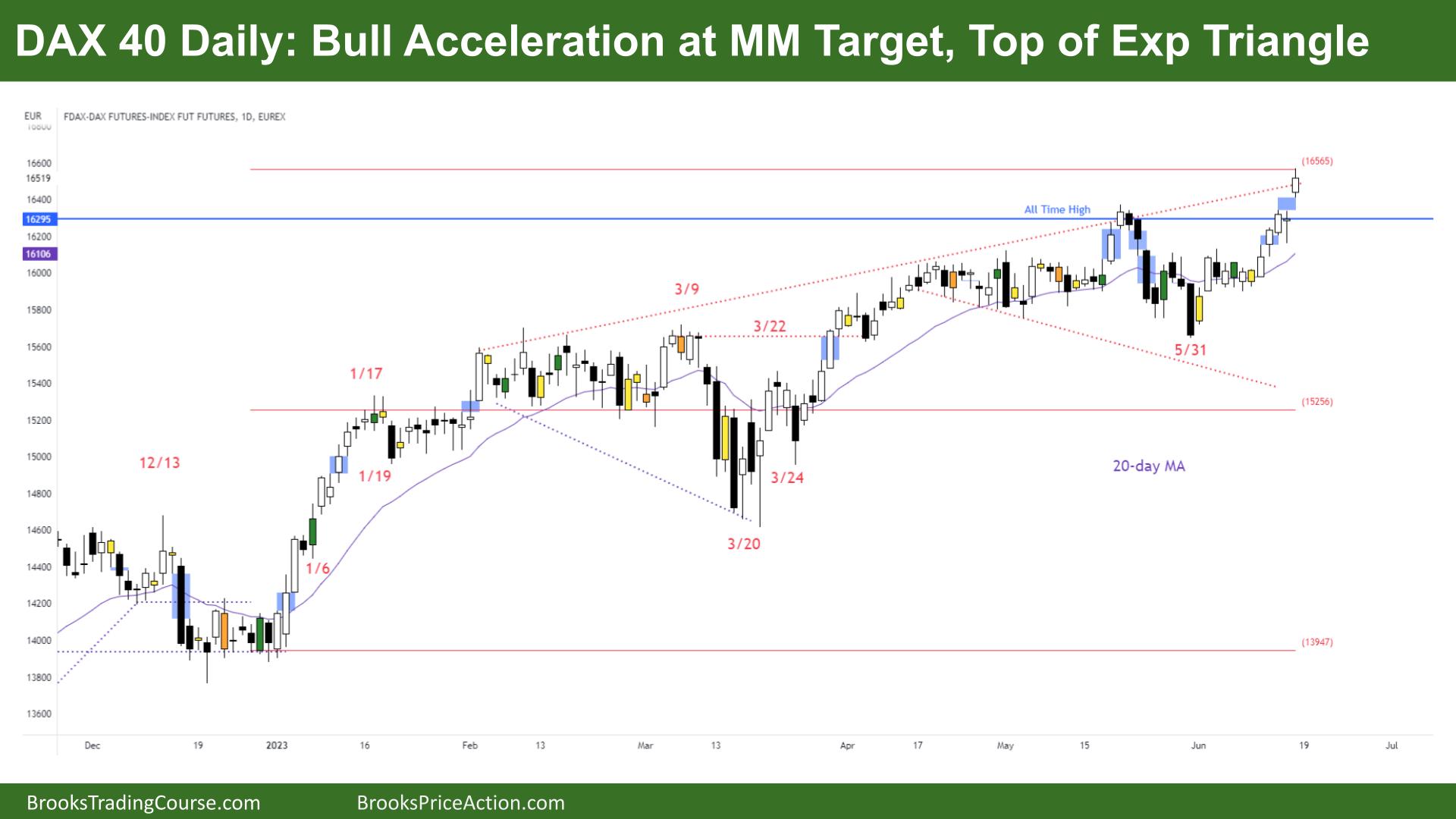

The Daily DAX chart

- The DAX 40 futures formed a bullish bar, a bull BO on Friday with a small tail above.

- It represents the fifth consecutive bull bar, indicating a tight bull channel, although it is not a microchannel, as Thursday’s bar dipped below the low of Wednesday.

- Bulls recognize a strong bear spike and anticipate a potential second leg and follow-through.

- They also note a bullish breakout above the all-time high, which created strong micro gaps that may act as magnets and layers of support.

- Bears see an expanding triangle pattern and the sudden acceleration of bulls, which they perceive as a type of climax.

- They want the market to close the gap at the breakout point of the previous all-time high.

- The historical data shows no tight bull channel but a small pullback bull trend or a trending trading range.

- Traders should focus on taking profit at the channel highs instead of buying.

- Those looking to buy a breakout of the bull channel should wait for confirmation and follow through or consider buying above the pullback.

- Bulls highlight the bears’ inability to profit with stop orders, indicating a lack of bearish momentum.

- Bears note that the market has reached a 1-to-1 measured move target, which was expected.

- This sets up potential support levels below, particularly at the May 31st level, which proved to be a bear trap and a sell climax.

- Additionally, the bears aim for consecutive bear bars to sell below, considering the absence of open gaps in the past six months.

- Traders believe the market is more likely in a trading range, suggesting a potential shift to sideways to downward movement.

- The best outcome for bears would be a return to the moving average to establish a larger trading range.

- Bulls hope the bear spike fails, followed by a measured move up.

- Traders should anticipate sideways to downward movement as bears aim to close the gaps, similar to what occurred in May.

- Bulls should exercise caution as bearish momentum can be strong.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.