Market Overview: DAX 40 Futures

DAX futures moved higher last week with a DAX 40 bull breakout possible above a wedge bottom so traders expect two legs sideways to up. The channel is so tight it is climactic, and might form a bull leg in a trading range. It is common in trading ranges for legs to go above swing highs and lows before reversing. The bears want last week to be a buy climax and look to sell a reversal down, although its likely to be minor.

DAX 40 Futures

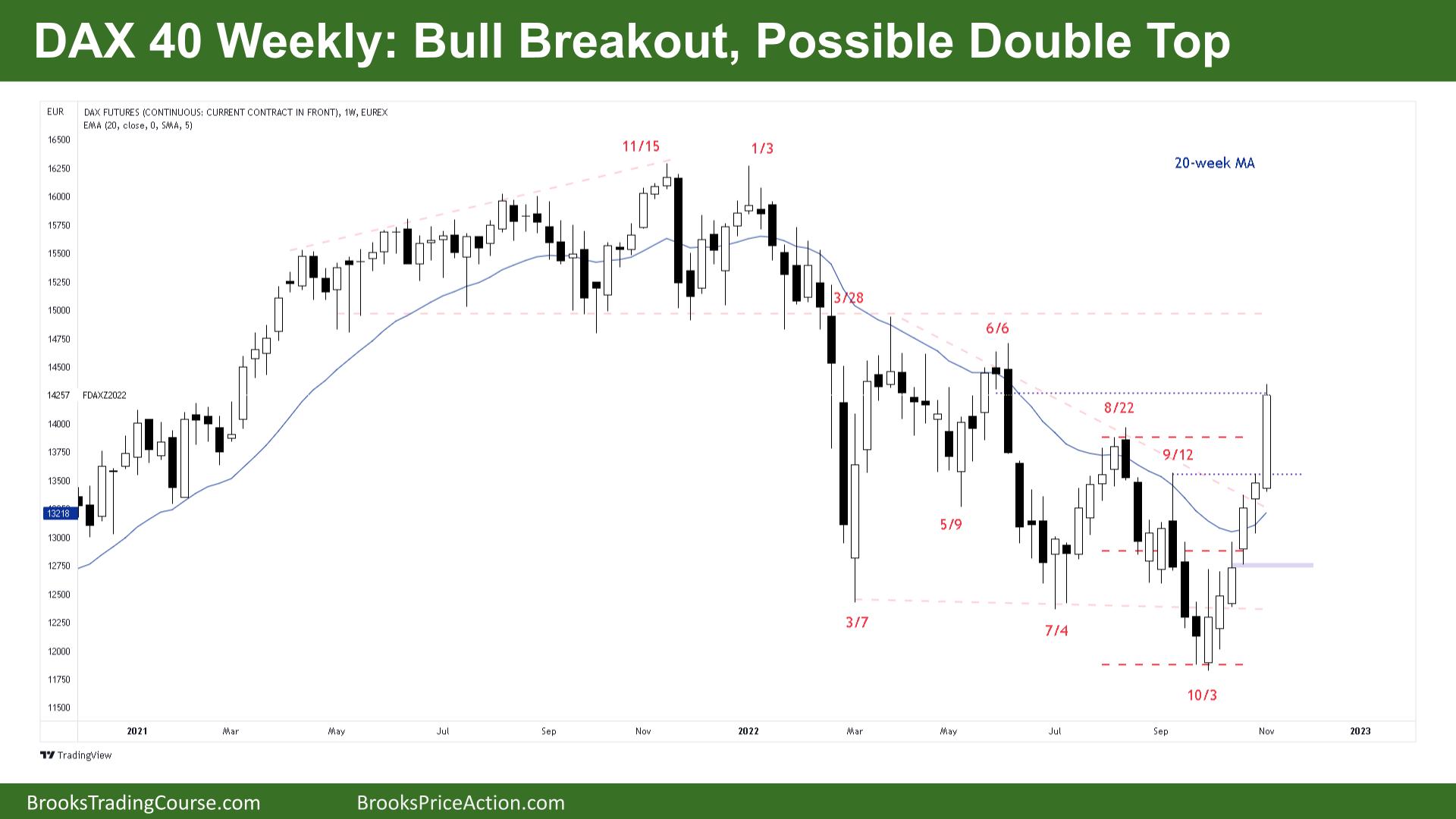

The Weekly DAX chart

- The DAX 40 futures last week was a bull breakout bar closing near its high, so we might gap up on Monday.

- It is the largest bar late in a trend, so traders will likely take profits next week.

- The bulls see a breakout above a wedge bottom and expect follow-through or a pullback to a breakout test with the September 12th high.

- It is a 6-bar bull micro channel, so traders expect the first reversal to be minor. They will also expect the first bar to go below the low of a prior bar to attract more buyers.

- It’s a big bull bar closing near its high so it is a buy signal, but traders should trade small and use a wide stop, look to scale in lower to increase probability.

- For the bulls, it is a spike, and they will be looking for a spike and channel. All traders will expect some kind of second leg, even if it is small / one bar.

- The bears see a broad bear channel, a lower low and a deep pullback but have not seen a break of a major lower high.

- They will look to short around the June 6th high, betting that bulls will have to risk too much to create follow-through to break above.

- But the channel is tight enough so that it might form a bull leg in a trading range – this is reasonable because many months have been a trading range. A weak second entry sell might attract sellers.

- The bulls want a breakout test to remain above the moving average and the breakout point.

- The bears want a buy climax and a strong reversal down.

- The March 28th high would be a stretch goal for the bulls and the underside of the previous trading range they broke out of.

- Most traders should be long or flat.

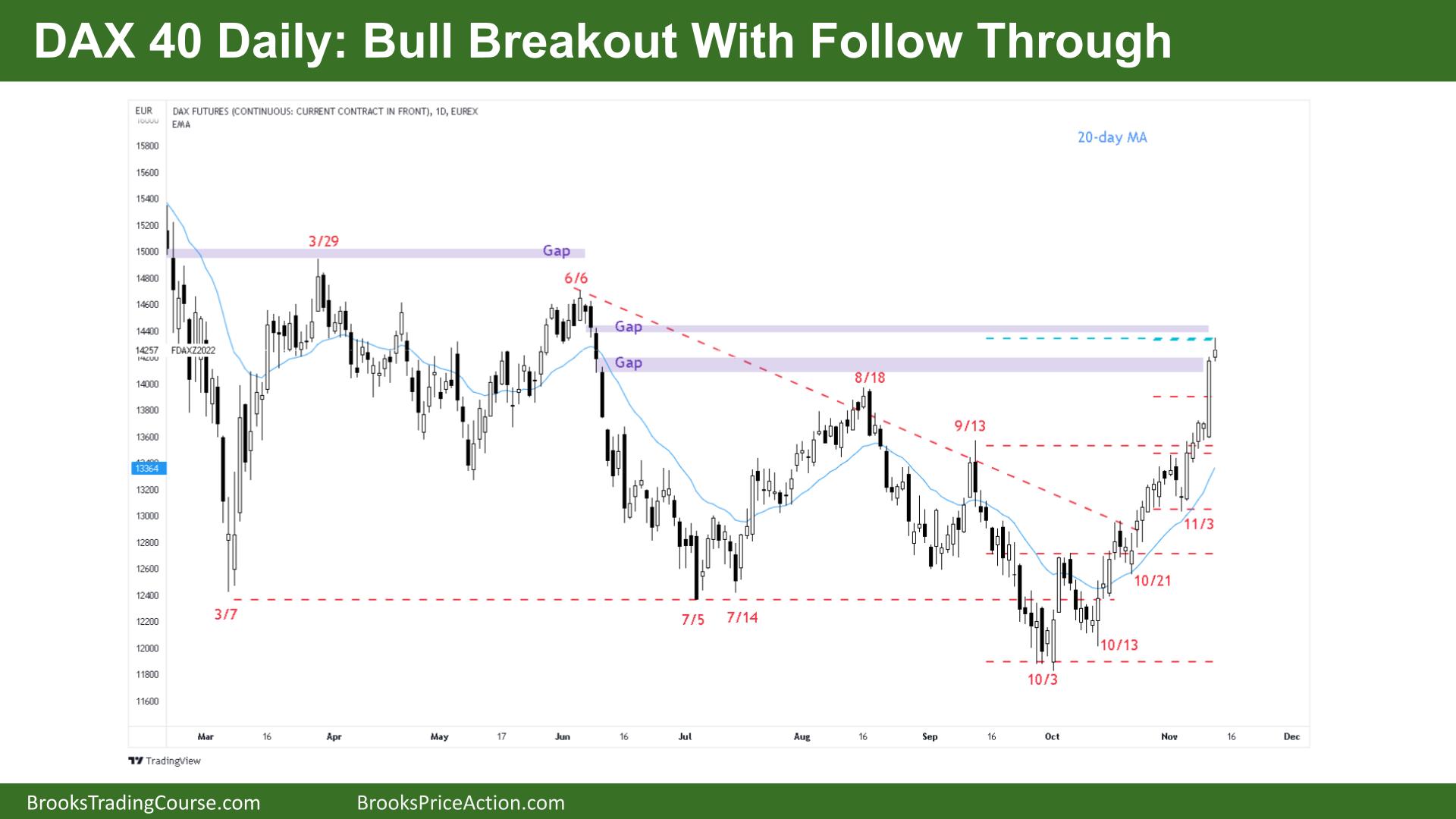

The Daily DAX chart

- The DAX 40 futures was a bull reversal bar, a doji on Friday, a pause bar, and a bull follow through bar after a breakout.

- It is a tight bull channel, a possible breakout above a wedge and a buy climax, where the price is sucked up to the highs where bears will sell.

- There were several gaps above the price last week, and we have closed many of them.

- We are also at two important measured move targets. Traders might expect profit-taking next week.

- For the bulls, it is always in long in a tight bull channel and with over 20 bars above the moving average, it is climactic, so likely to expect a pullback, perhaps two legs sideways to down soon.

- It is a bull reversal bar, so it is an ok sell signal. Better to sell below a bear bar closing on its lows.

- The channel is tight, so traders expect the first reversal to be minor. There are probably buyers not far below.

- The bulls want to close all the gaps above and get back into the trading range above – but that might be too far without a higher low.

- Look left, it is a trading range, so no matter how tight the channel looks, reversals and disappointment is common in a trading range. Traders should buy low, sell high and scalp (BLSHS.)

- Bears see a bull leg in a trading range and are waiting for a sell signal, or even better a second sell signal to go short.

- Most traders should be long or flat.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.