Market Overview: DAX 40 Futures

DAX futures moved higher last week with a bull inside bar reversing up from the moving average. It is a triangle on a lower time frame right in the middle of a TTR. We are alternating each week but if there is any more buying it should happen above this week launching off the MA. Bears see that most late bulls have had a chance to exit so will likely scale in shorts above.

DAX 40 Futures

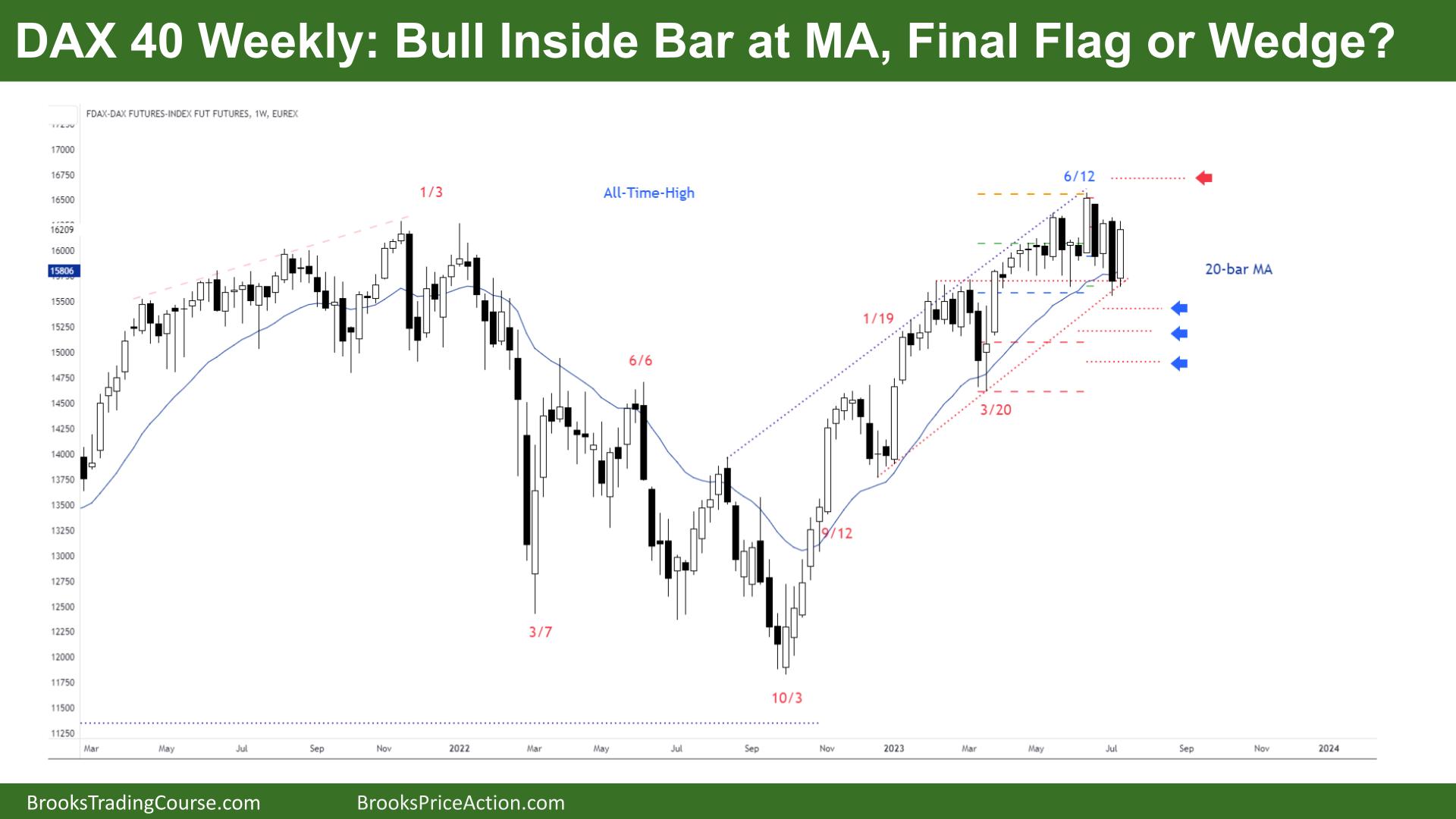

The Weekly DAX chart

- The DAX 40 futures last week was a bull inside bar at the MA.

- Bulls see a tight channel and now sideways, a possible final flag, but there is one problem. Which bulls are still in and looking for targets?

- The March 20th BTC bulls hit a 3:1 – so they are out.

- May 15th BTC bulls bought more below and made money – so they are out.

- June 12th BTC bulls bought more below, and they broke even – so they are probably out.

- What about bears?

- Bears who sold June 19th had to sit through two pullback weeks. They might hold for a swing down to 15200 area.

- The small gap below this week is the next target bears need to close.

- It is a weak buy above an inside bar here, even though it is at the MA. There is a 1:1 target I have put above but they might be it.

- If the wedge plays out for bears then 14900 might be on. It is also near the start of the 3rd leg which is a magnet test target in a wedge.

- Bulls need a strong follow-through bar to break above the high and go for a MM above this tight range. But because the last two bull weeks broke even, they might wait for a MA Gap bar lower to buy.

- Expect sideways to up to see if there are buyers above the bull inside bar but expect it to fail.

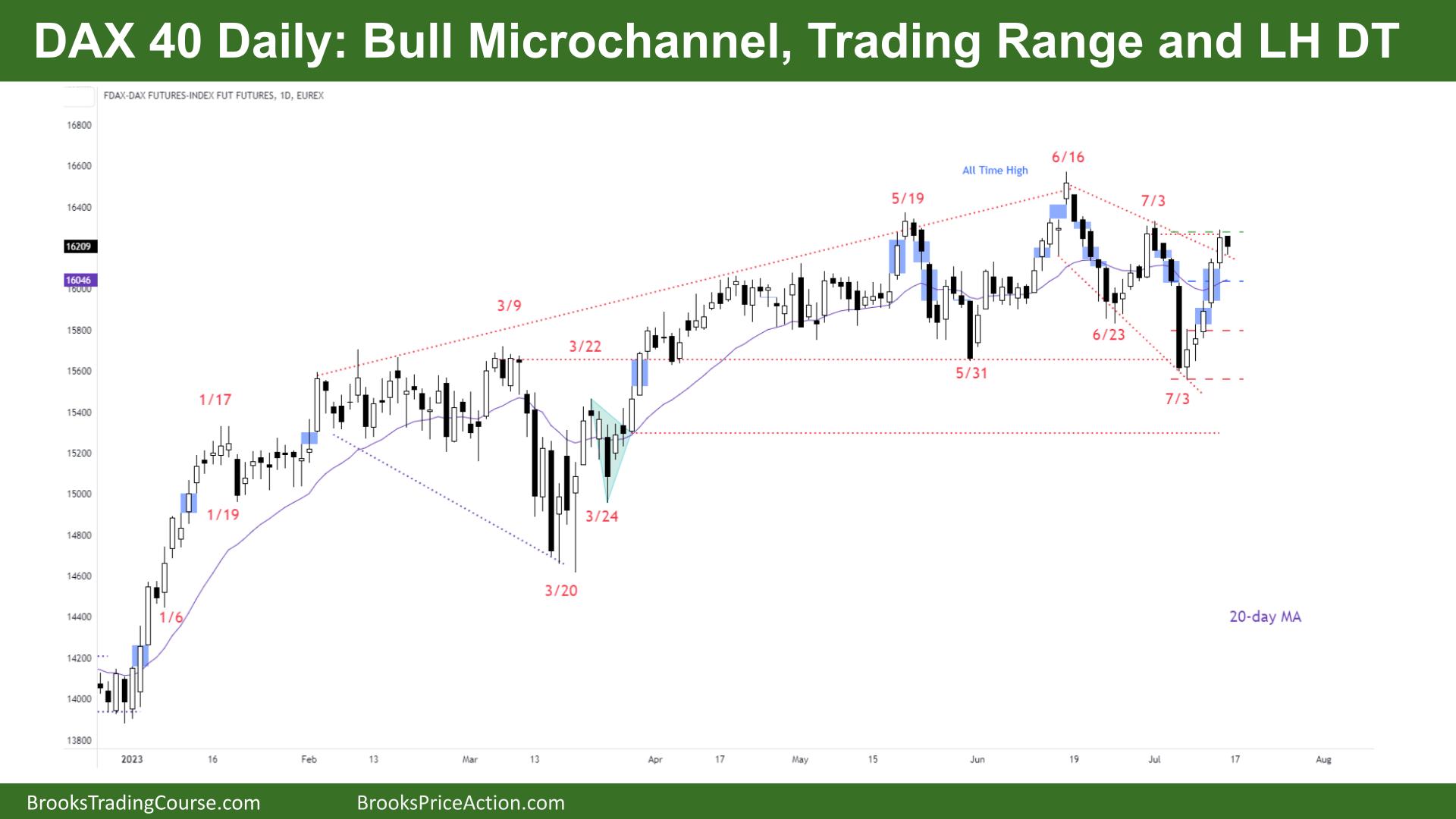

The Daily DAX chart

- The DAX 40 futures was a bear inside bar closing above its midpoint on Friday.

- Funny – bull inside bar on the week and bear inside bar on the daily!

- The bulls see a strong microchannel and probably buyers below. They saw the wedge bottom and DB and bought strongly targeting the highs of the trading range.

- Bulls have hit a swing target so we wonder how much higher it can go.

- The bears see a LH DT, a possible MTR. Some bears see a break below the neckline of the H&S but it reversed so strongly so that might have failed.

- They want a strong sell signal to swing down.

- But the bulls should get a second leg.

- The ATH bulls bought more lower and had a chance to exit breakeven.

- The July 3rd bulls scaled in, made money, and got out breakeven on their entry. So who is left?

- Traders know that IB breakouts are less reliable, so the move up may be short-lived.

- Bears had a strong move down as well, so where is their second leg? That might be coming now. The pain trade might be up as bears get stuck again in this relentless bull run all year.

- Traders should be long or flat. Some bulls will exit a scalp below the inside bar.

- The MA is below so that might another layer of support to buy at.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.