Market Overview: DAX 40 Futures

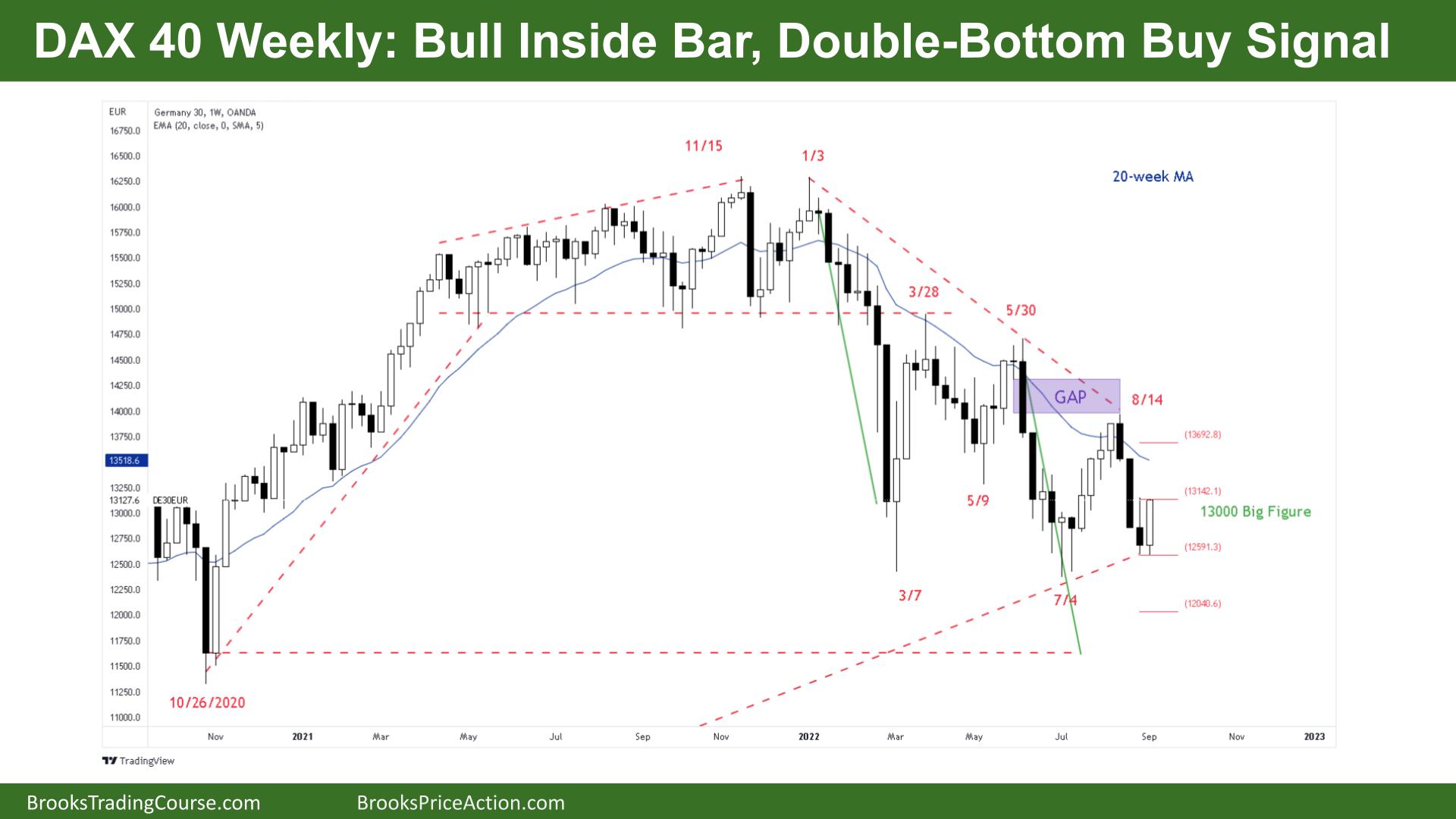

DAX futures was a DAX 40 bull inside bar, a double bottom buy signal on the weekly. It’s a second entry long setup which is a reasonable entry on this timeframe, but it’s been lower lows all year so a difficult trade to make. We are slightly above the harmonic retracement target and we might need a credible lower high to stop going down and move back up. After 3 consecutive bear bars, we can expect sellers to come in above this week and at the moving average which will keep bulls scalping.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bull inside bar closing on its high so we might gap up on Monday.

- The bulls see a reversal, a higher low double bottom buy setup and if we trade above last week it will be a High 1 buy signal.

- But after 3 consecutive bear bars closing on their lows, traders might expect the first reversal to be minor.

- The bears see a pullback for a second leg sideways to down. They see the tail on last week and know even with a strong bull bar it’s not a great buy signal, they might sell above.

- The bears see a bear channel that has gone on all year and with lower highs and selling at the moving averages, they expect reversal attempts to fail.

- It is a second entry buy setup at the low of a range with July forming the first reversal buy setup. The 2nd entry has a higher probability.

- It’s a tight trading range so reversals are common and stop entries are often not as good as they appear.

- It’s an inside bar, which is a tight trading range and breakout mode, so if it’s 50/50 either way which risk/reward is better?

- It’s better math for buying low in a range but traders should expect bulls to scalp out at the moving average again, so the potential reward is small as well. Low risk, low probability and low reward are not the kind of good math you need.

- If you had to be in, it’s better to be short or flat.

- The narrowing range is the reason — confusion over whether the measured move will be up or down, and traders will keep scalping.

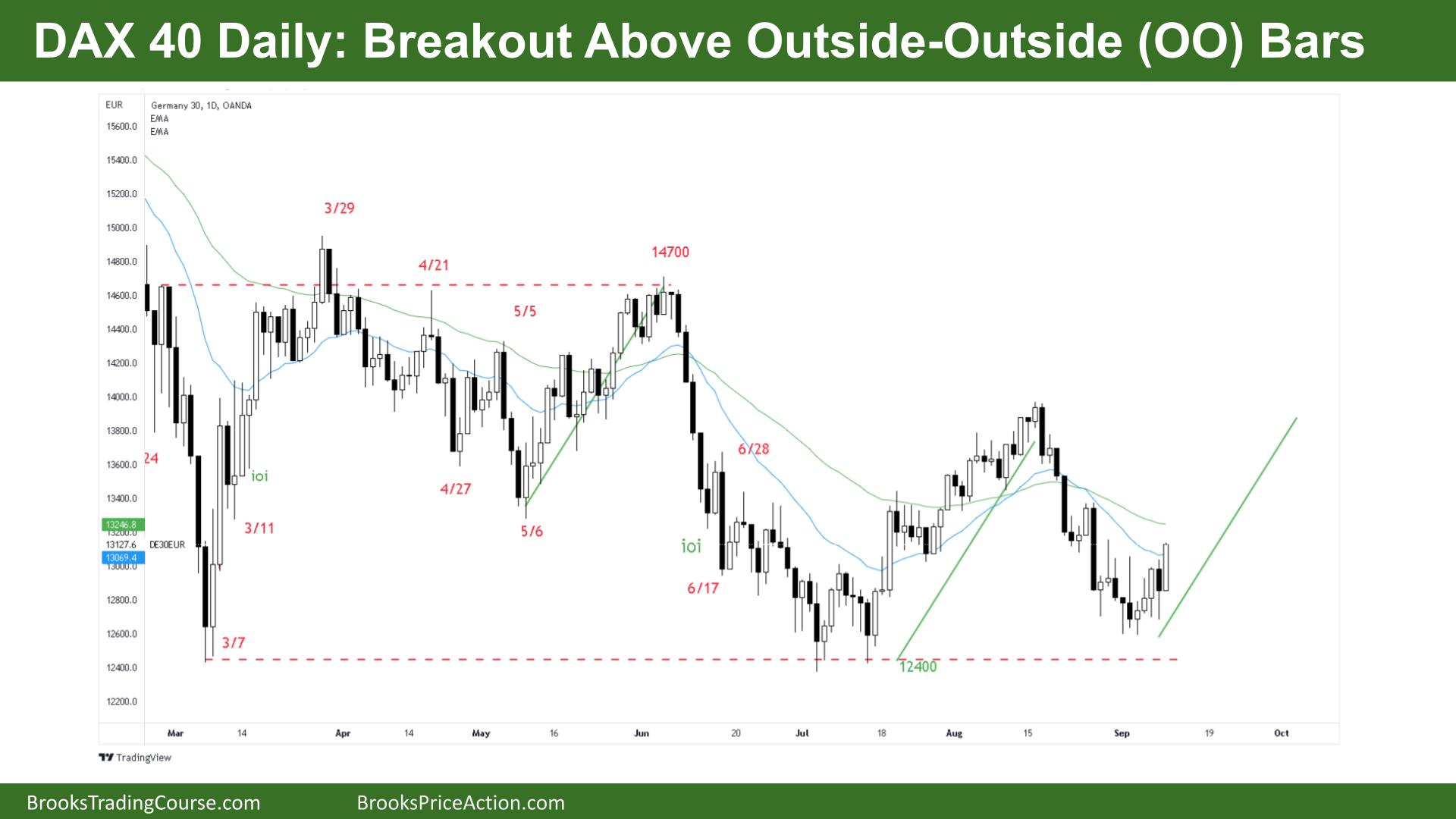

The Daily DAX chart

- The DAX 40 futures was a bull bar closing on its high so we might gap up on Monday.

- The bulls see a follow-through bull bar Friday after 3 consecutive bull bars from Monday. They see it as always in long. They want a follow-through bar to move up to the highs of the range.

- We might see a measured move up from the 3 bull bars which are right at the middle of the range.

- It’s a bull inside bar on the weekly, so it’s not as clear as traders want

- The bears see a tight bear channel and a pullback to the moving average so might scale in short above here.

- The bears want bad follow-through, a possible 2nd leg trap and another leg down to the trading range lows.

- Look left, the biggest bars are all bear bars, so it is not as bullish as it seems.

- The bulls would like another harmonic pullback up to the top of the micro-range but they might need a double bottom to do so.

- If the bears get a pause and another sell signal, it would be a Low 2 short at the moving average, which is a trend and a high probability trade. In the middle of a trading range, it is more like 50/50.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.