Market Overview: DAX 40 Futures

DAX futures moved higher last week with a bull outside up bar closing above the MA and back in the middle of the TTR. Most bulls will want to see a consecutive bull close above the MA to get back to always in long. Some bulls are stuck high after the OO reversal down, so we might take some time to get up there as some close early.

DAX 40 Futures

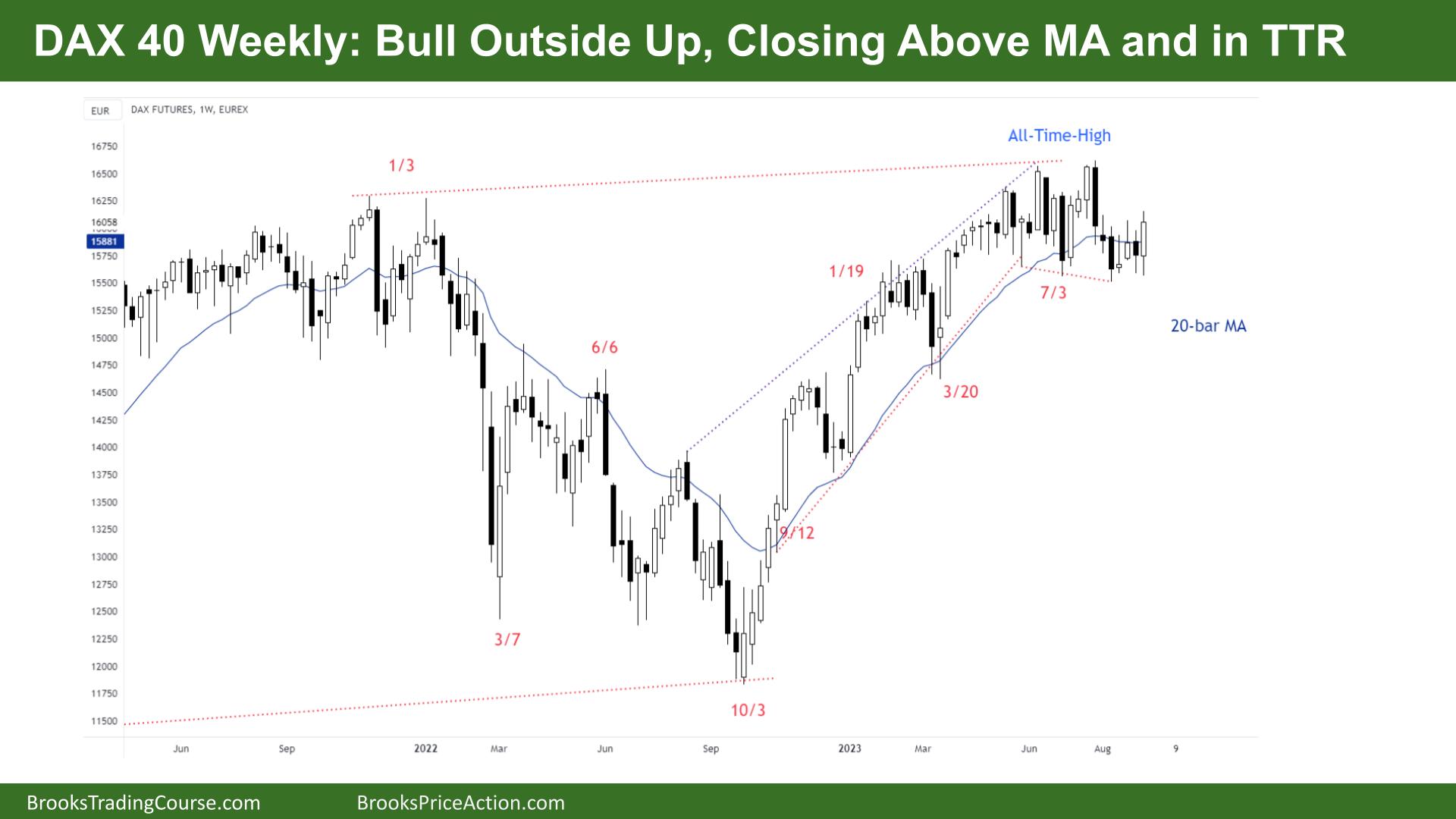

The Weekly DAX chart

- The DAX 40 futures went up last week with a bull outside up bar closing near its high.

- We have been saying for many weeks the middle of the expanding triangle and the TTR would be a magnet – we came back again!

- It is a 50% retracement from the 3 bear bars down. So the bears see a pullback and want a second-leg.

- The bulls see a HTF channel and expected this move to the MA and then a test of the highest close.

- The bears needed a gap between their 3 bars down but were not able to get one. We could move up to the high faster but struggle to get above the high.

- Bull trends do not usually have 3 consecutive bear bars – so trading range price action above could be waiting as well.

- Outside bars reduce the probability of BO and FT trading, as it is a triangle on a LTF.

- A close above the high of this week would be a reasonable buy for a test.

- The bears want it to fail at 50%, and the bulls who were disappointed would then get a chance to exit. The bears would have their LH.

- The bulls see a Micro DB and bought even before the 20-bar MA Gap bar appeared – so that is a sign of strength.

- The bears would like this reverse into a OO – two consecutive outside bars, but these are rare.

- The bears had a bearish inside bar in the prior week which is not a good sell low in the TR.

- There was an OO at the top of the range, and we might need to get back up there to let those bulls out before the pattern is complete.

- Expect sideways to up next week.

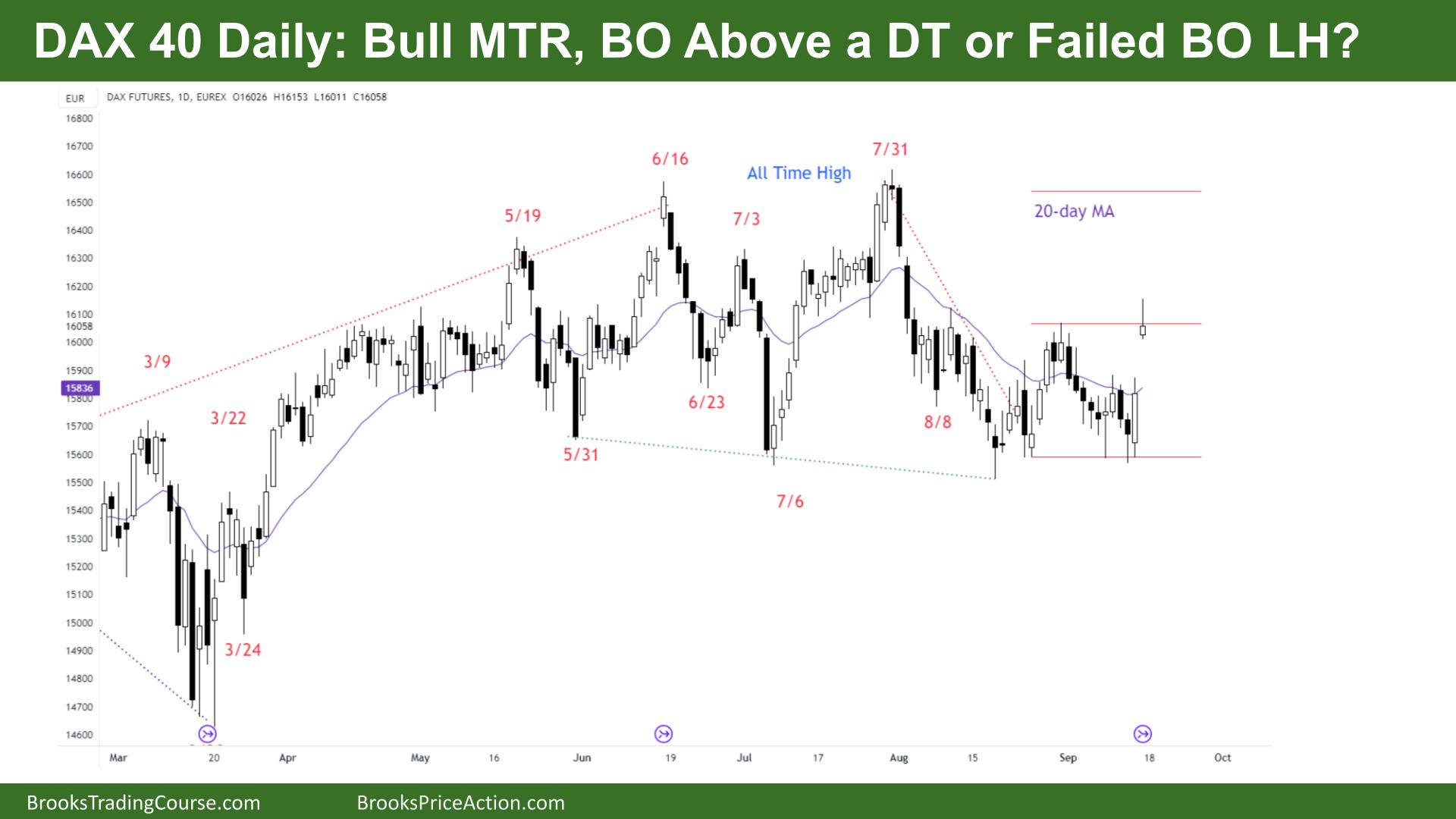

The Daily DAX chart

- The DAX 40 futures was a bull bar with a large tail on top, closing above the MA.

- The bar closed below its midpoint, so some computers will see it as a bear bar.

- It was a bull outside up on the weekly, trapping bears short below the bar.

- The bulls see a MTR and DB and a break above a DB. They want a measured move-up.

- The bears see a failed BO above the DT and a wedge bear flag from July’s move down.

- Most times, when there are equal views for both sides, you are in a trading range, and you should BLSHS and take quick profits.

- You can see on Friday that the surprise profits from long traders got closed before the weekend. That usually means we will pull back on Mon / Tue.

- It is a weak buy signal, but also difficult to sell – most traders will expect some kind of second leg.

- The second bear leg in August lacked gaps, or strong bear closes, so it was reasonable to expect we would get out of BOM soon.

- The bears might see a second leg trap – an exhaustive bull move trapping bulls into buying high.

- But because of the size of the BO, traders should expect bears to cover in the middle of that range – above the MA.

- The bull’s target is likely the MA trap from the start of August – the bull channel was tight and should have had buyers at the MA.

- Most traders should wait for a pullback or consecutive bull bars before looking for a long position, as the pullbacks can be deep in a trading range.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hello Timothy Fairweather. Do you know why my FDAX 12-23 RTHWEEK chart do not look like yours? 🙂 Last week weekly bar bar do not close above the weekly bar from 2 weeks ago on my chart setup.