Market Overview: DAX 40 Futures

DAX futures moved higher last week with a DAX 40 bull surprise bar at the 20-week moving average (MA). It looks like we are always in long on the daily chart but we have been going sideways here for many weeks so no matter how bullish it looks so can still expect reversals. Bulls want a follow-through bar and a measured move up but we are still below the 20-week MA. They want to break back above the prior range above. Bears have been happy to sell below average for many weeks so are likely to sell the first moving average gap bar.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 Weekly was a bull surprise bar closing on its high so we might gap up next week.

- It was a follow-through bar breaking above the bear trend line pausing at the moving average (MA) but we are still likely always in short.

- Trading range behaviour often has something wrong with the bars and forces traders to make mistakes. The bull bars are big but the context is bad – possible double top and below the moving average in a bear trend.

- Always in traders may have exited last week and are looking to get back in short, unless the bulls can get consecutive bars closing above their midpoints.

- The bulls see a double bottom with March 7th and a higher low major trend reversal. They want to break strongly above the MA to convince traders we will get a measured move up to back inside the tight trading range above.

- The bears see a 5-bar bear channel so expect the first reversal to be minor. They want a sell signal near the top of a range, a double top with March 28th.

- Traders expect the first bar to close above the moving average, a gap bar, to be sold. Traders were happy to sell below the average price for many months, so they will be happier to sell here, expecting another leg down.

- Bulls need a decent close above the moving average but look at the pause bar before last week. That tells you there is hesitation by the bulls and they might need to come lower for a double bottom to convince them to swing up.

- The bears continue to sell above bars and we can expect them to do it again next week, betting that the bulls will exit scalps at the measured move target above.

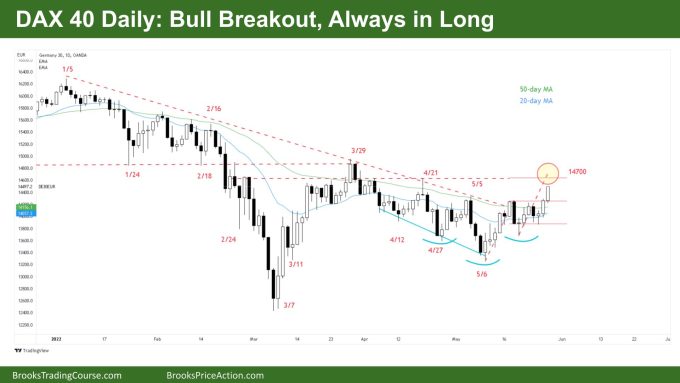

The Daily DAX chart

- The DAX 40 Daily had consecutive bull bars closing on their highs so we might gap up on Monday.

- The bulls see we are always in long, after the bull surprise bar we broke out above the May 5th high.

- You can call it an inverse head and shoulders, higher low major trend reversal, or expanding triangle breakout. Either way, the bears gave up and will look to sell higher.

- The bulls want any pullback to remain above the May 5th high to confirm the measured move chances. They would prefer a follow through.

- Monday is a holiday and Tuesday will be the end of the month. Bars can change just as they are about to print so expect low liquidity and then high volatility before we get there.

- The bears see a pullback from a bear channel and we are at the top of the trading range where the math is better for shorting. It always looks the most bullish in a trading range at the top and most bearish at the bottom.

- The bears want a double top with March 29th or April 21st, both reasonable areas to short. But they need a bear bar for a Low 1 sell signal. They expect the first reversal to be minor so traders should look to short a Low 2.

- We are back at the prior trading range breakout point and we have spent many days here so we might go sideways. It could become the middle of a developing trading range.

- Bulls want a follow-through bar to increase the chances of a measured move target above.

- It is reasonable for bulls to take profit at those prior highs and for there to be a pullback around the harmonic from May 6th, which is also the top of the range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

What and where is the holiday on monday? thank you very much for your analysis!!! From Brazil!

Hi Luisa – sorry the holiday is in the US, which means the liquidity may not be there tomorrow to trade the European session… I would expect a tight trading range and take quick profits if you can get them! Do you trade the European morning or all day? T