Market Overview: DAX 40 Futures

DAX futures moved lower last week with a two-bar reversal. After hitting a MM target, we expected profit-taking. Bears will want follow-through selling, although they have struggled on this timeframe to get it. The bulls will likely buy lower, looking to scale back into longs if the bears get a leg down.

DAX 40 Futures

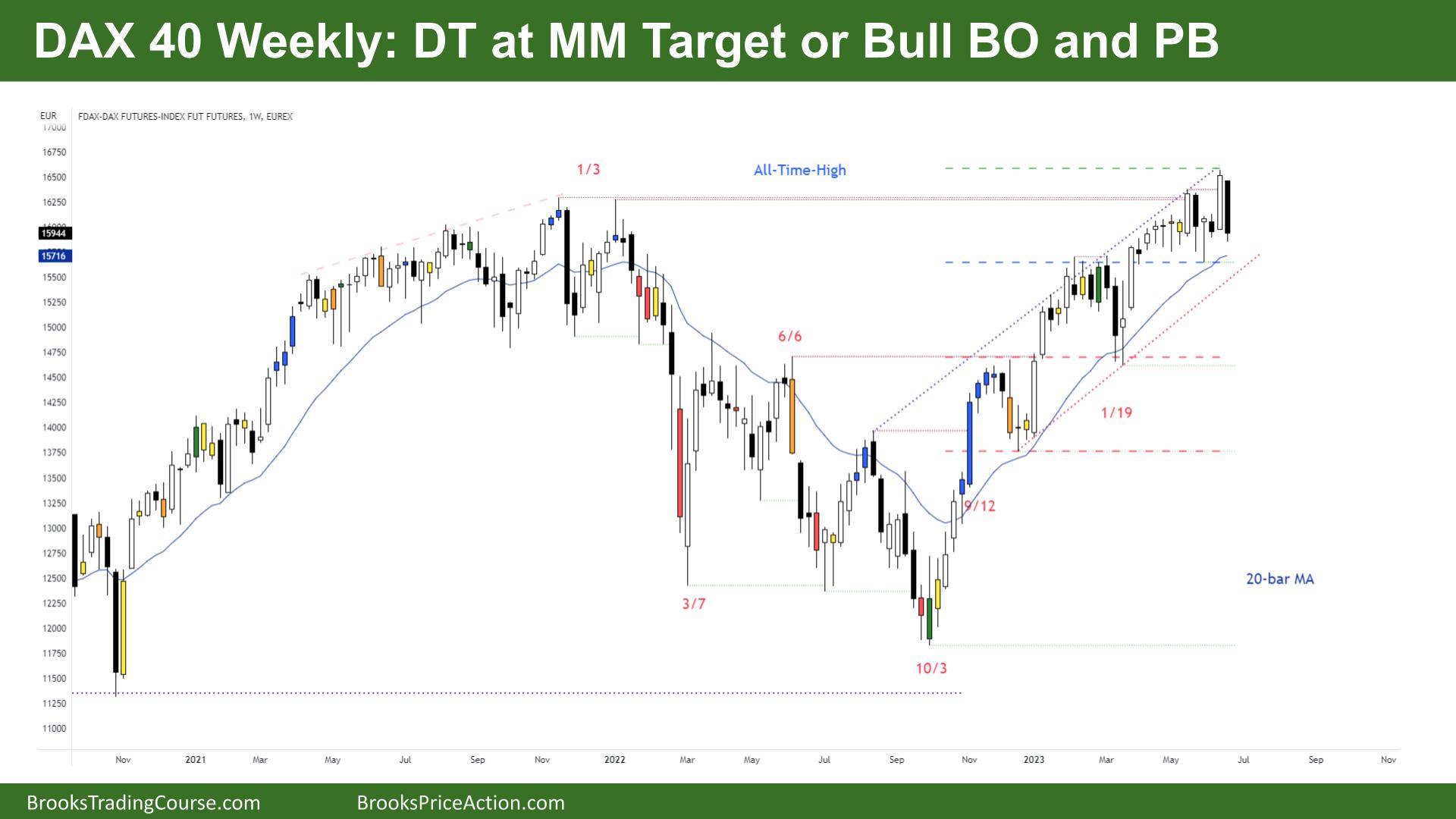

The Weekly DAX chart

- The DAX 40 futures formed a significant bear bar, closing on its low and below the low of the previous week’s large bull bar. This indicates a bear surprise and a two-bar reversal pattern.

- Bulls perceive the market as having experienced a breakout and follow-through above the all-time high, followed by a pullback. They anticipate a potential second leg up.

- On the other hand, Bears interpret the price action as a failed breakout above the all-time high and a bear surprise, expecting a bearish reversal to lead to a second leg down.

- The market has been moving sideways for the past few months, but the tight channel suggests that most attempts to reverse the trend will likely fail, as has been the case over the past six months.

- With approximately 15 bars above the moving average, the first approach to the moving average is likely to attract buyers.

- Bulls achieved one mm target after another last week, leading to profit-taking. Currently, the market is back within the magnet of the tight trading range.

- Bulls aim to trigger stop entries below last week’s low to trap the bears and increase prices. Bears seek a follow-through bar to reach the moving average and the underside of the channel.

- Bulls recognize the tightness of the channel and anticipate a potential move down to the last leg of a possible wedge top. They understand that the best outcome for bears would be a sideways-to-down movement leading to the formation of a trading range.

- Bears identify a larger pattern of a double top with the 2020 rally and have been selling at higher levels. However, they have been losing money in their trades. There are several open gaps below, which bulls need to close, but it may take time to accomplish.

- The lack of strong consecutive bars over the past few months suggests that the middle of the trading range might be lower.

- Bulls hope for two legs of sideways-to-down movement to trap bears at lower levels and anticipate a potential retest of the high if there is a broader move down.

- Can you sell here? For a swing, it’s okay. The middle of a TTR is bad math. But the context for a swing is good after the bulls hit their targets above. The end of June is typically bullish, so it’s confusing.

The Daily DAX chart

- The DAX 40 futures formed a bear spike throughout the week.

- Friday’s bar closed below its midpoint with a small tail below while also closing at Thursday’s low, which is not as bearish as it could be.

- Bulls view the bear spike as a potential opportunity to buy pullbacks and bet on continuing the upward trend, given the recent move to a new all-time high in a bull channel.

- Over the past nine months, bulls have been proven right against bears. Bears will probably scalp unless they can get consecutive bear bars.

- The bear spike appears strong and is expected to lead to a potential second leg down. However, the market has retraced to the 50% level of the expanding triangle, a tight trading range that acts as a magnet.

- Thursday and Friday formed significant bars, which can be considered a type of climax. As a result, traders may anticipate inside bars on Monday and Tuesday.

- Bears hope for a failed bull pullback to sell below, particularly at low ones and low twos. However, signals below the 50% level of a trading range often have the opposite effect, leading bulls to consider buying at those levels.

- Bears require a pullback to create a lower high, potentially involving the prior all-time high, which could set up a head and shoulders top pattern and result in a sideways movement.

- You have to wonder if all the bulls hit a MM target – who is left to buy here?

- Bears were trapped on May 31st at the inside bar, suggesting a potential move down to release them. There are no remaining open gaps above, with gaps now located below, which bears aim to close.

- Expect sideways to downward movement next week, with a potential pullback on Monday.

- As five consecutive bear bars indicate a bear micro-channel, Tuesday’s bullish pullback will likely fail.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.