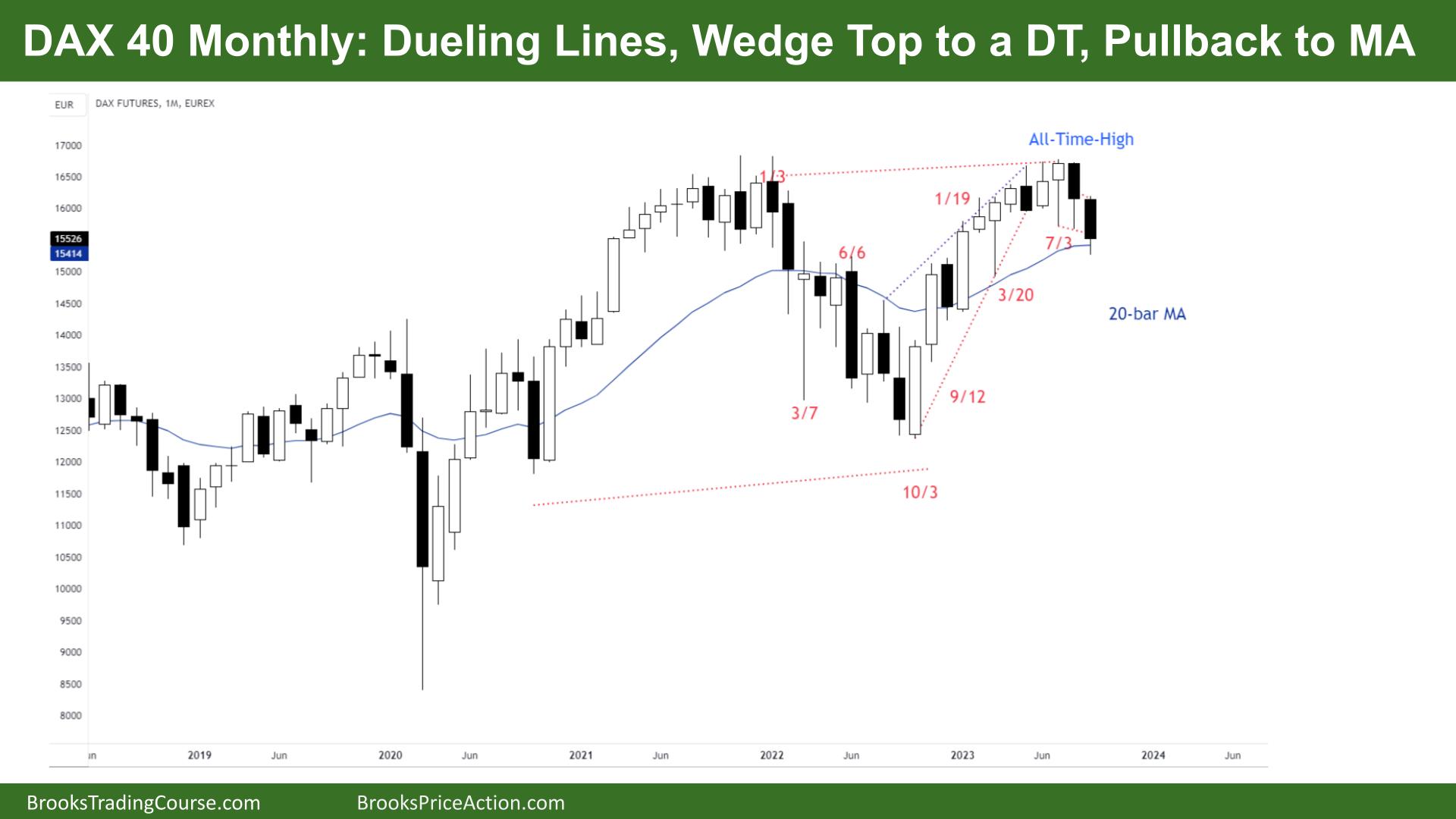

Market Overview: DAX 40 Futures

DAX futures was a dueling lines pattern last month, three pushes up a wedge top to a DT. It was a weak sell signal, but triggering a sell, high in a possible TR, and after three bull pushes up, might attract bear swing sellers. Some bulls are scaling in below at the MA, betting on a TR and they will probably be right. The bears will probably get one more leg down after some sideways price action. They want it to drop straight away, and the weekly context supports it more than the monthly.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures moved lower last month, with a bear bar closing below the low of a prior bar in a Dueling Lines pattern.

- The sell signal was not great, but sometimes that can lead to good swings. Most swing setups pull back to test the entry point before moving towards their targets.

- We have been going sideways for six months near the old high and got a new ATH. Trading ranges tend to go above and below resistance.

- The bulls see 3 pushes up and expect a 2 legged pullback to the MA. It might be disappointing for some bears because we did it so quickly.

- It is the first pair of consecutive bear bars since September last year. So this leg up has been tight, and more likely, it will turn back into a broader channel.

- The bulls want buyers at the MA and a buy signal to test the highs.

- The bears want a follow-through bar, a bear microchannel closing below the MA. Strong enough to get a second leg down.

- The bears want to close the gap above the last bear bar at the MA from 9 months ago. That tells you already the odds are not very bearish yet.

- The bears see we had a tight bull channel, broke a trendline, tested in July / August and now are breaking below. But there are tails below the bars.

- Good chance we trigger a sell below the bar but go sideways here for a few months as traders decide.

- Bears who sold last month’s close had a 1:1 target already, so we might need to go back and test that entry again before going lower.

- Bulls have been buying above the MA all year, so some will look to scale in here for a break above these bars and a MM up.

- Expect sideways to down next month.

The Weekly DAX chart

- The DAX 40 futures was a bear breakout and follow-through below the MA.

- We said several weeks ago that when an outside bar triggers buyers above an expanding triangle and then reverses, the follow-through is important.

- The follow-through bar set up a target below, which we hit last week.

- The bulls want to set up a High 2. They see a counter-trend wedge – the first leg from before the ATH. Counter-trend wedges are a high-probability trade. Here it would be a wedge-bull flag.

- But buyers were waiting below, on the bear channel line, expecting the market to go sideways to down and limit order bulls can make money.

- The bears got their breakout and follow-through, but only one close below the tight trading range. They need one more bar.

- The big tail on last week’s bar is bad for sellers, but it went a lot below the prior bar. So, more likely sellers above.

- It’s a weak buy signal, so we should go down further.

- So far, the bulls only have a High 1. They need another bull bar, and a setup buy above to stabilise here.

- The bulls tried to create a breakout above the expanding triangle, but it reversed strongly

- The bears want one more bear bar to seal it, better if it has a micro-gap above it between its high and the low of two bars prior.

- Some bears see it as always in short when the 3 bear bars put two under the MA. But it is a weak sell low in a trading range and in a tight bull channel.

- With a possible LH and breaking below, there is a higher probability.

- The bears have only got 3 bear bars twice in 52 weeks, so more likely next week is a bull bar.

- Expect a test up above the high of the bar to see if sellers are there.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.