Market Overview: DAX 40 Futures

DAX futures moved lower last month to the middle of an expanding triangle. It is a TTR and BOM, so most traders should wait for more information. The bears were able to get below the low of the prior month but only found buyers. Any bulls that bought in July are likely to be disappointed. More likely buyers below, but bears will want to test the MA.

DAX 40 Futures

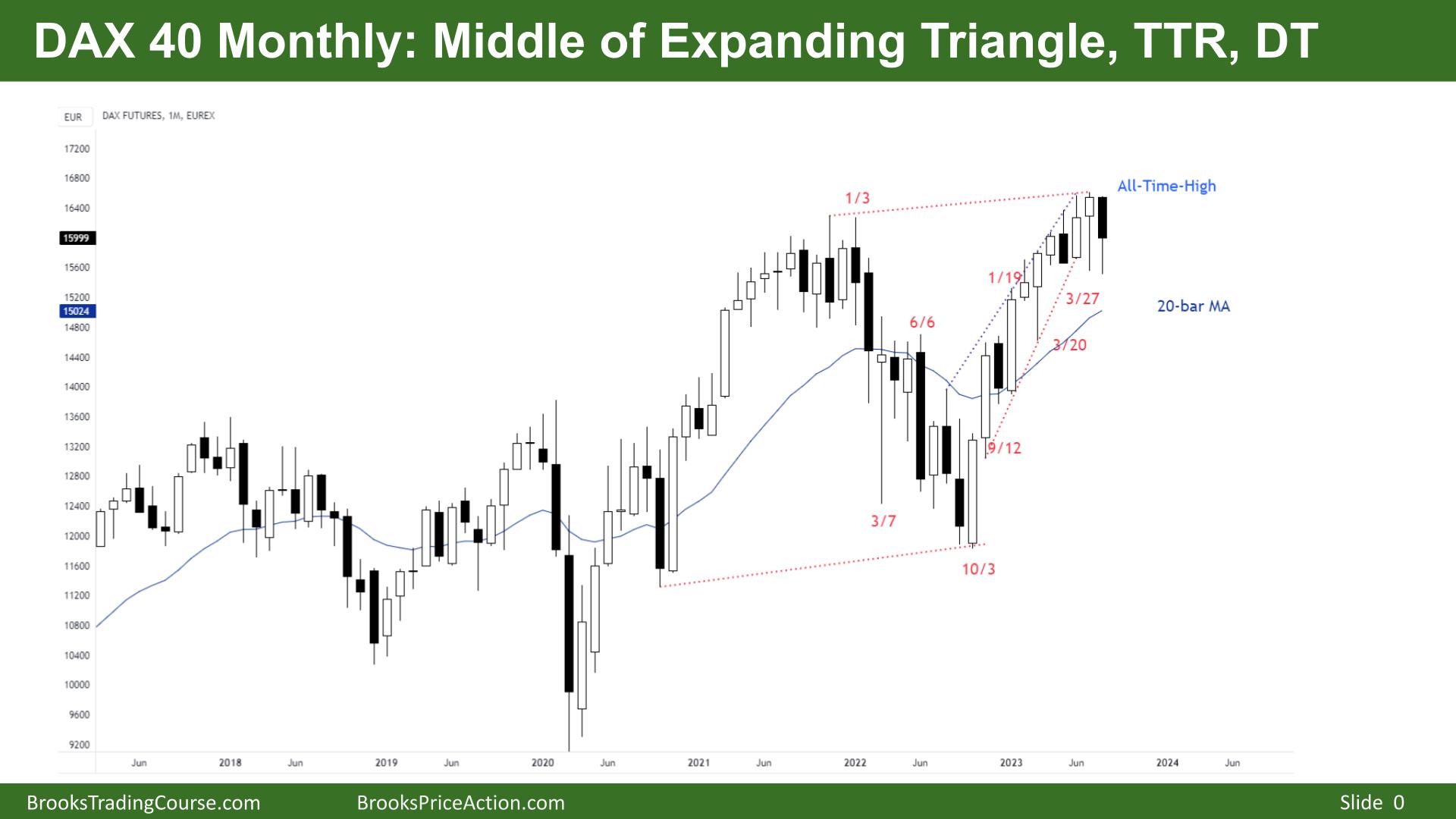

The Monthly DAX chart

- The DAX 40 futures is in an expanding triangle as it moved lower last month, with a bear bar closing near its midpoint.

- Bulls see a pullback to the middle of an expanding triangle. Its BOM.

- Bulls bought below the bull bar last week – the long tail made it a bad sell below.

- But the small body makes it a weak buy above this month. So limit order trading.

- The bears haven’t had a consecutive monthly bear bar in over 12 months – so it’s unlikely that next month will be one. If we do go down – there are likely buyers below.

- Bears see a double top and a duelling lines pattern – a wedge to a DT. But there have not been any good sell signals yet.

- Some traders might see a Low 2 below July, but it is a bull bar – not a great sell.

- August was disappointing for bulls, so most traders expect us to test the high close before turning down.

- Bears might try to get to the MA, but the bulls will likely turn it into a DB and look for a measured move up.

- If you look back 2 years ago for shape before the move down – there was a reasonable sell signal.

- Until we see consecutive bars, or a weak buy signal – it is better to be long or flat on this timeframe.

- Some bulls might get out below the bear bar. Others will look to scale in betting we will not reverse such a tight bull channel.

- Expect sideways to up next month.

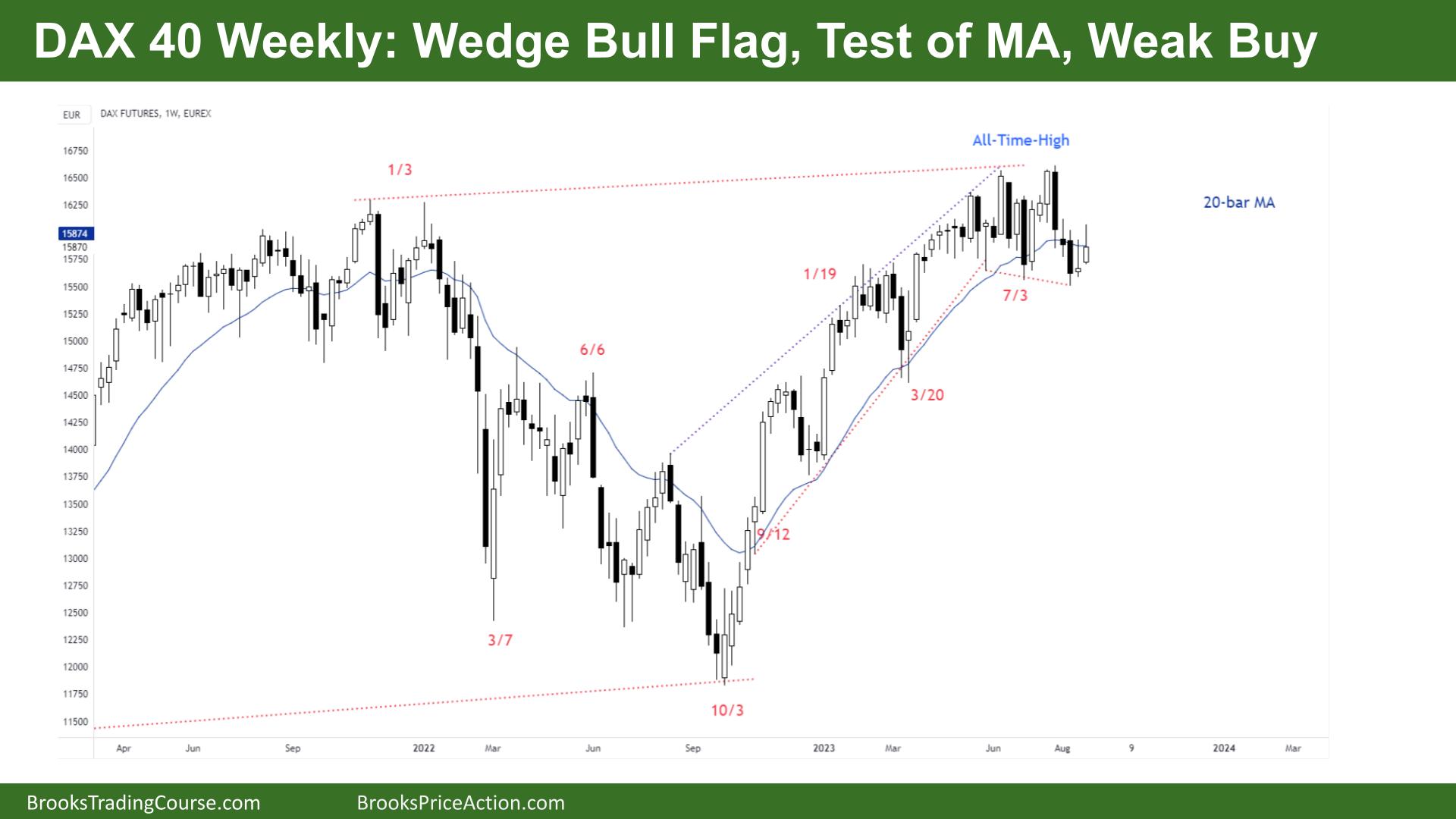

The Weekly DAX chart

- The DAX 40 futures moved higher last week but failed to close above the prior week.

- It is a weak buy signal at the MA – so probably sellers not far above.

- The bulls see a wedge bull flag, three pushes down in an expanding triangle shape.

- So far, bears have been unable to get a bar completely below the MA. The first time they do that it will likely be bought.

- Bears want a double top, a lower-high and a failed High 2 / High 3 to trap the bulls and move lower.

- Some bears see the 3 consecutive bear bars and expect a second leg sideways to down. It is reasonable, but they will want to sell high as there are more likely buyers down there.

- Most bulls will wait for a third consecutive bull bar with a good close to consider buying – even then, most will wait and buy below as we are in a TR.

- Most traders will consider it BOM and will look for the market to give an indication of momentum in either direction.

- Up would be for a test of the high monthly close. Alternatively, the bulls that got stuck up there will need to get out at 50% – around 16100.

- It is a Low 1 sell below last week, a weak sell signal and bad location. A Low 2 would be a higher probability signal.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.