Market Overview: DAX 40 Futures

DAX futures moved high with an all-time high last month but failed to close above last month. It’s a failed BO, but if the bulls can get another new high the bears might exit, and we can move higher. The bears want to sell above to prevent the bulls from getting a BO gap above the prior highs. Considering the sideways TTR price action from last year, we might go sideways until traders decide where to go next.

DAX 40 Futures

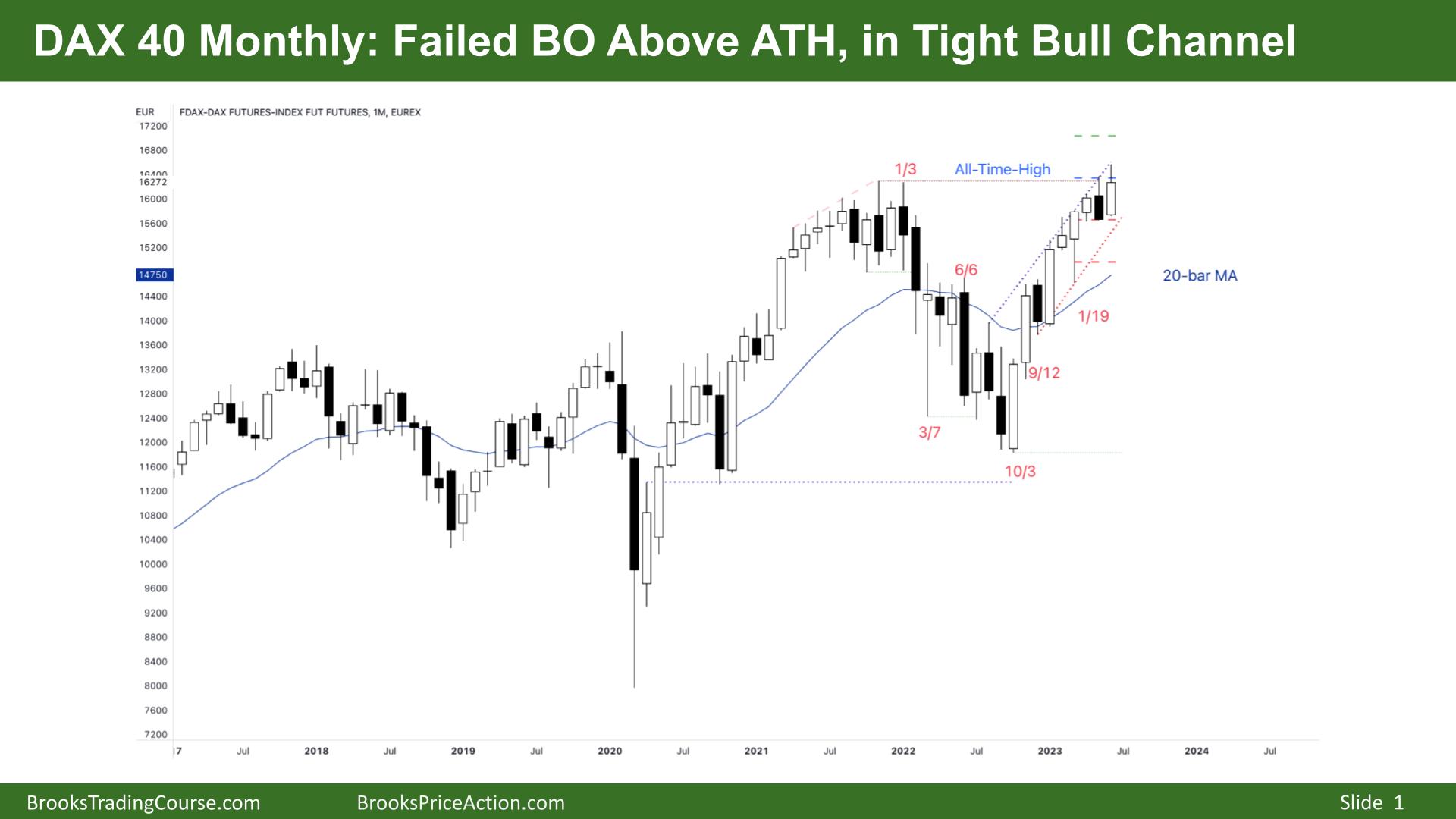

The Monthly DAX chart

- The DAX 40 futures moved higher last week with a failed BO above the ATH in a tight bull channel.

- Only 3 monthly bear bars in 10 months, so the channel is tight and possibly climactic. But where are the bear bars?

- The bulls took the chance to buy the close of the last bear bar – which in a tight channel is a reasonable strategy.

- The failed BO and the bear bar are a lower probability buy setup above. But if the bulls can hit the bear stops and flip that bar, there is a larger MM above.

- We might be at the midpoint of a larger, broader channel – a sloped trading range.

- The bears see a DT with Jan 2022 and know that many bulls will take some profits here.

- They were hoping to trigger the sell below last month but failed. It gapped up and trapped some bears.

- If they can sell down next month to the midpoint, they get a chance to exit breakeven. If not, we could shoot above.

- The bears see a parabolic wedge top, possibly with 3 legs. But no sell signal.

- The bulls have support below with the midpoint of March’s wick and the MA.

- Look left – it was a TTR for many months, so we might do that here as traders decide how the price action will go.

- Better to be long or flat. If this buy signal does not work, expect two legs sideways to down, setting up a High 2 – maybe near the MA.

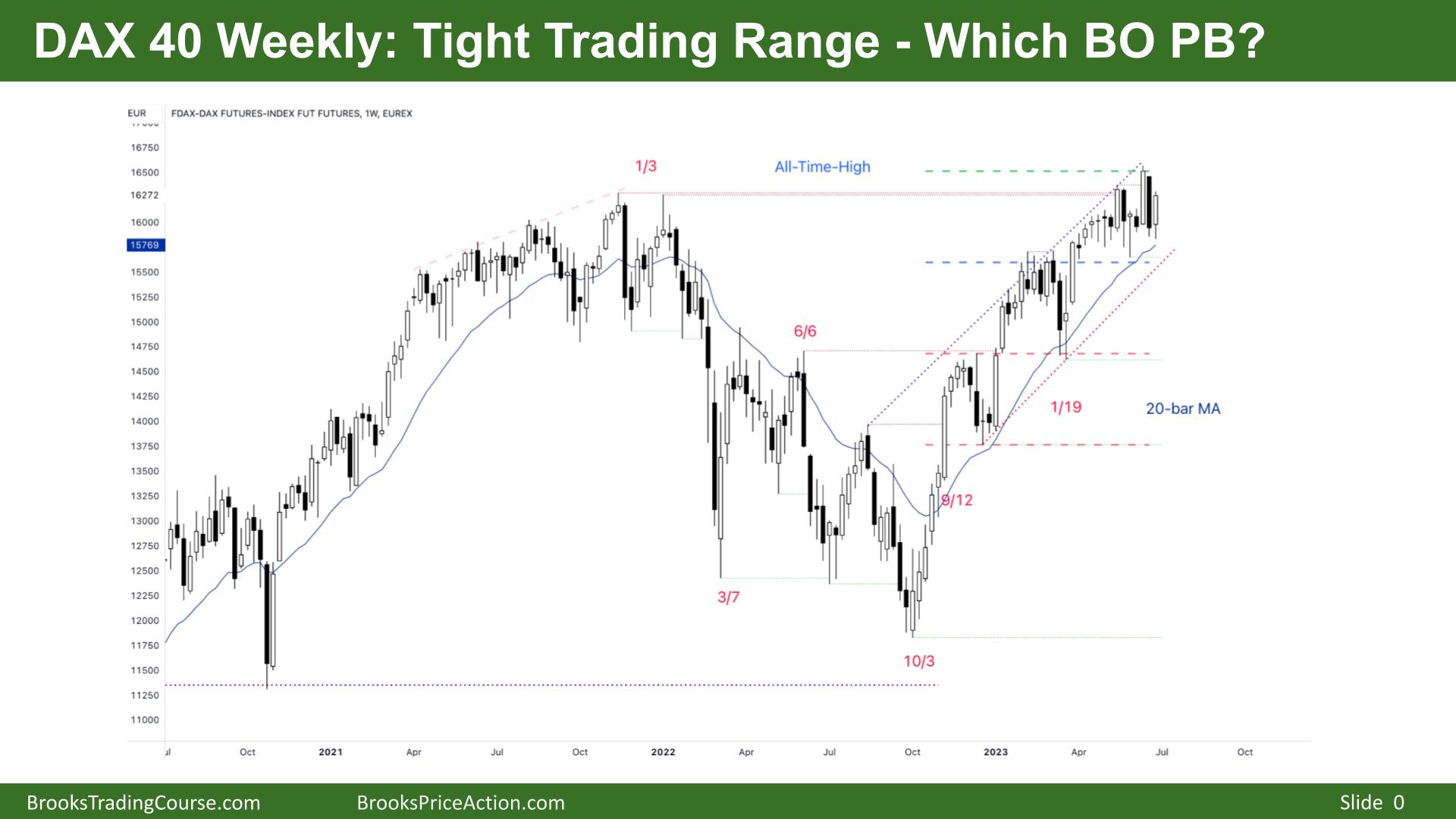

The Weekly DAX chart

- The DAX 40 futures was a strong bull bar closing on its high so we might gap up on Monday.

- Is it a bull BO and a pullback? Is it a bear BO and a pullback? It is as triangle. It’s both!

- Middle of a tight trading range, middle of a bull channel, at the all-time high. Most traders should not be trading in this timeframe.

- The always-in bulls exited below the second bear bar – a second entry short.

- Some bought more above the BO point from last year.

- The big bull bar disappointed the bulls; some scaled in to get out of longs. They will look to buy pullbacks or a High 2 from here.

- The bears want a 2nd leg, and they might get it. But selling above this week’s bar is not a high probability short. There will be sellers now above the highs. They want two legs sideways to down.

- The bull swing targets were all met, so there might not be any more swing bulls to push the price higher.

- They could get an MM above if they can trade above this TTR and hit the bear stops.

- The bears want to trap the bulls here and attack the MA.

- They know the first touch is a reasonable buy zone, the best they can get is sideways to down.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.