Market Overview: DAX 40 Futures

DAX futures moved lower last week with a failed BO above a wedge top. It was a large outside down bar, so likely sellers above now. Buyers at the MA but will they look to buy lower instead now? Bears want a FT bar but have not had consecutive down weeks since March.

DAX 40 Futures

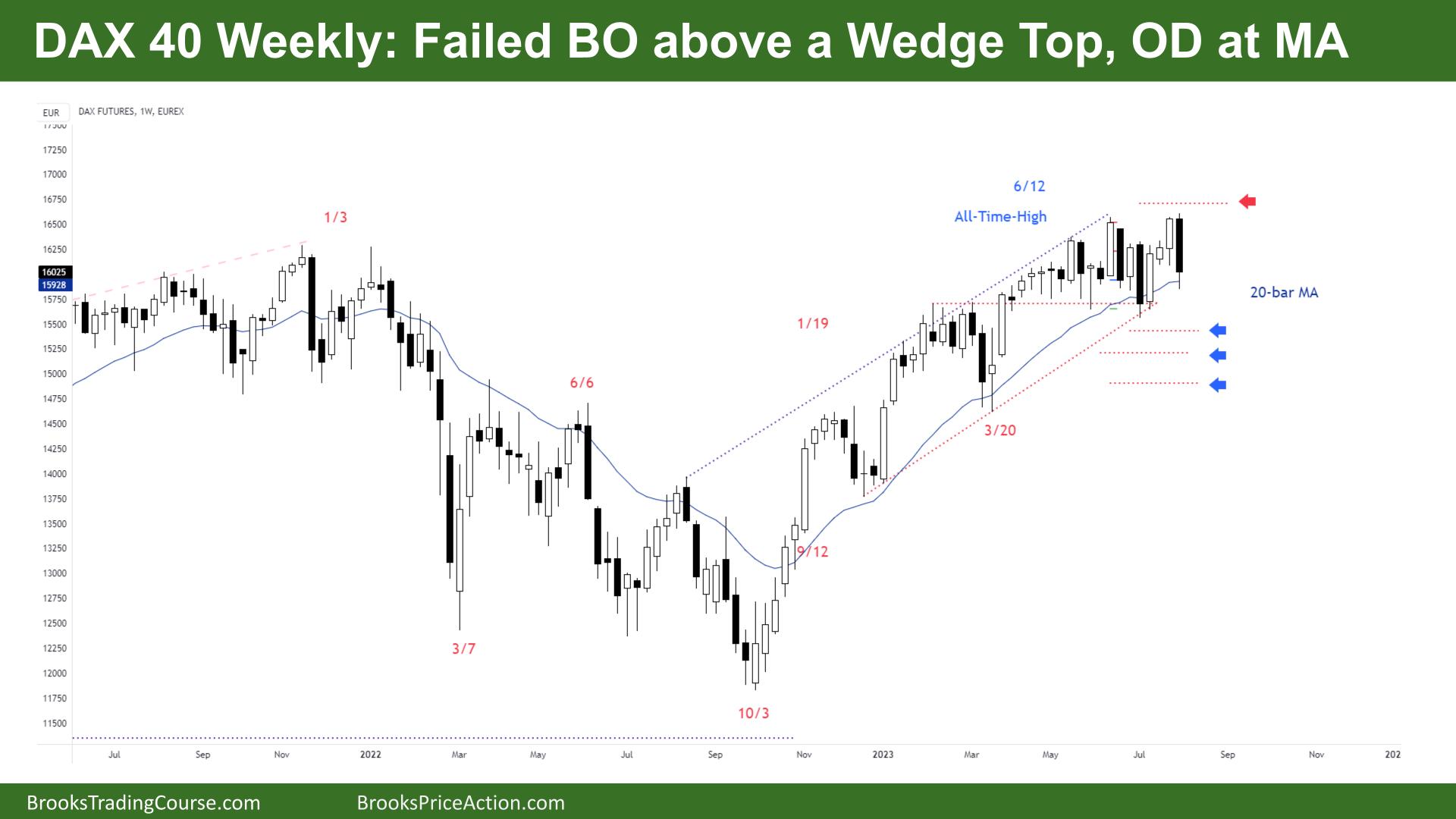

The Weekly DAX chart

- The DAX 40 futures was an outside down bar, a failed BO above a wedge top in a bull channel.

- It is an OO, an outside-outside pattern which is a BO mode pattern. OOs often breakout the way of the last outside bar, and here it is down.

- The bulls see a bull channel and have been buying the MA for many months. Each time they have made money, so they will do again here.

- The bears see a large trading range for 2 years, a possible DT, and a wedge top reversal setup.

- Both traders are disappointed as it is a tight trading range, so it is 50/50.

- The bulls want a final flag and another leg up. But at this stage, it is still only 50% likely. The failed BO is surprising.

- The bears want a swing down but have lacked follow-through. The bars have been too large for them to get momentum. Now we are in a buy zone, so a sell here is maybe 40% still.

- Traders that sell here should only do it for a swing.

- Most traders should wait for a strong stop-order entry setup.

- A few weeks ago, the inside bar limited the upside BO and will likely limit the downside BO with buyers below.

- The bears want a FT bar closing below the MA and far below last week to get a second leg down.

- The bulls want another outside bar to trap the bears – an OOO, which is very infrequent.

- Most traders should be short or flat.

- Always in bulls will exit below the outside bar. They can buy again above a bull bar.

- The bears should wait for a FT bar before attempting to swing short.

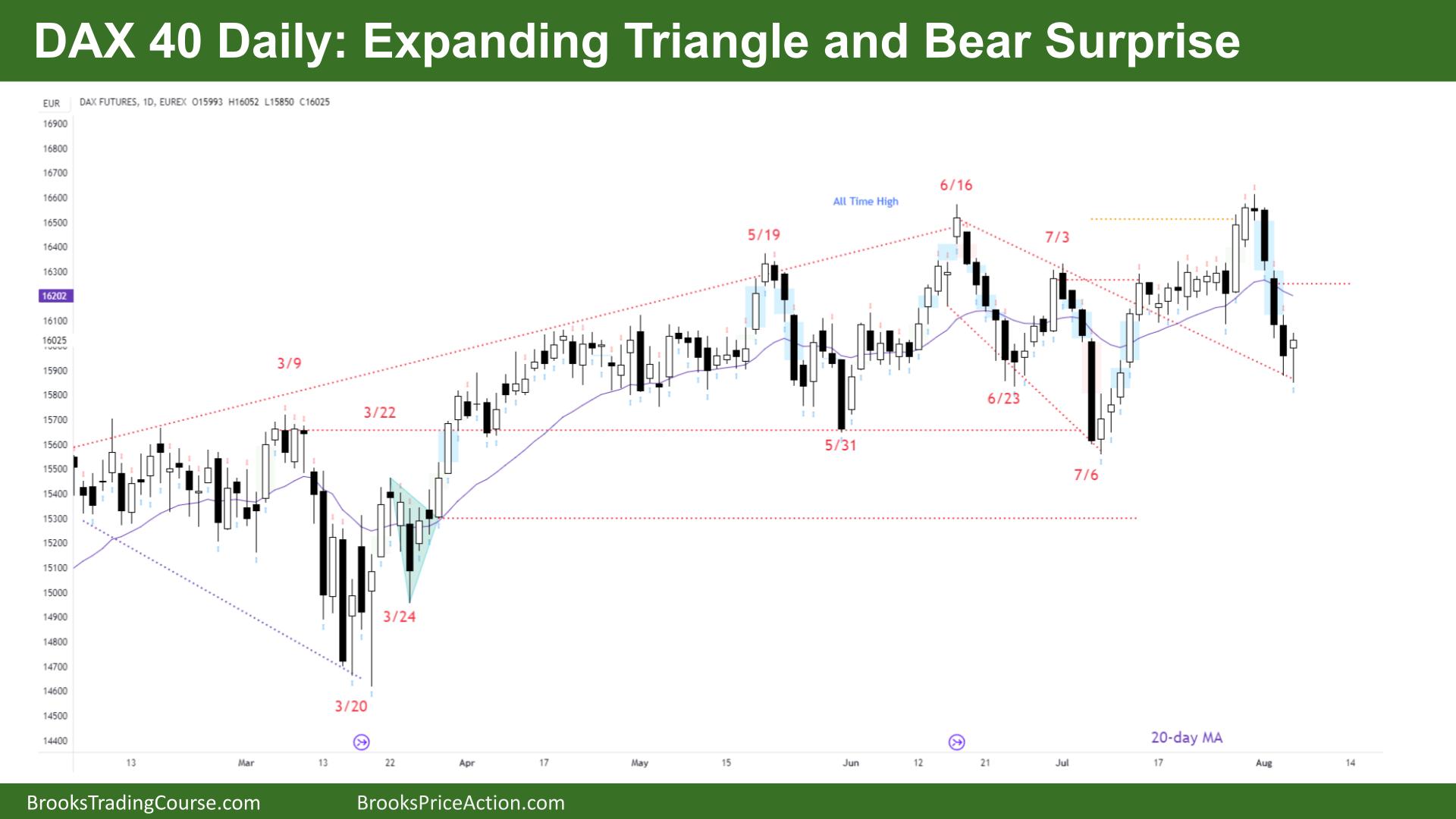

The Daily DAX chart

- The DAX 40 futures on Friday was a small bull bar with a small tail above.

- Bulls see a Micro DB and will look for a second entry to get long.

- After the bear surprise BO and FT, the bears expect a second leg sideways to down.

- Bears will likely sell above the high of the last two bears bars expecting another leg down.

- Last week was interesting because we let out the trapped bulls on the highest close above. Then we let out the trapped bears from July 6th.

- It is more likely we head back to the TTR above to enter BOM.

- Bulls see another HH in a bull channel, so buyers are below. They want to trap the bears again with a failed BO and get a new high.

- The bears want a second leg sideways to down – but the pullbacks have been very strong. They have not had many sellers down here since April.

- The bulls are stuck above at the MA and will probably get out.

- The bears need a LH DT and a a LL below July to convince traders we can move down further.

- The risk for traders is a broader expanding triangle – HHs and LLs. An even stronger bear leg down to July’s low would catch the bulls off-guard.

- Next week is important to see whether buyers are above the bull bar or more sellers.

- Most traders should be short or flat.

- Expect sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Do you run a daily commentary on the 5-minute chart?

Hi George thanks for your message – I trade FTSE and DAX but I don’t give live commentary at the moment. We might be getting a Euro session live happening at some point – however Tim Stout covers DAX in great detail very often in the Euro Futures channel on Discord – have you got access to that?