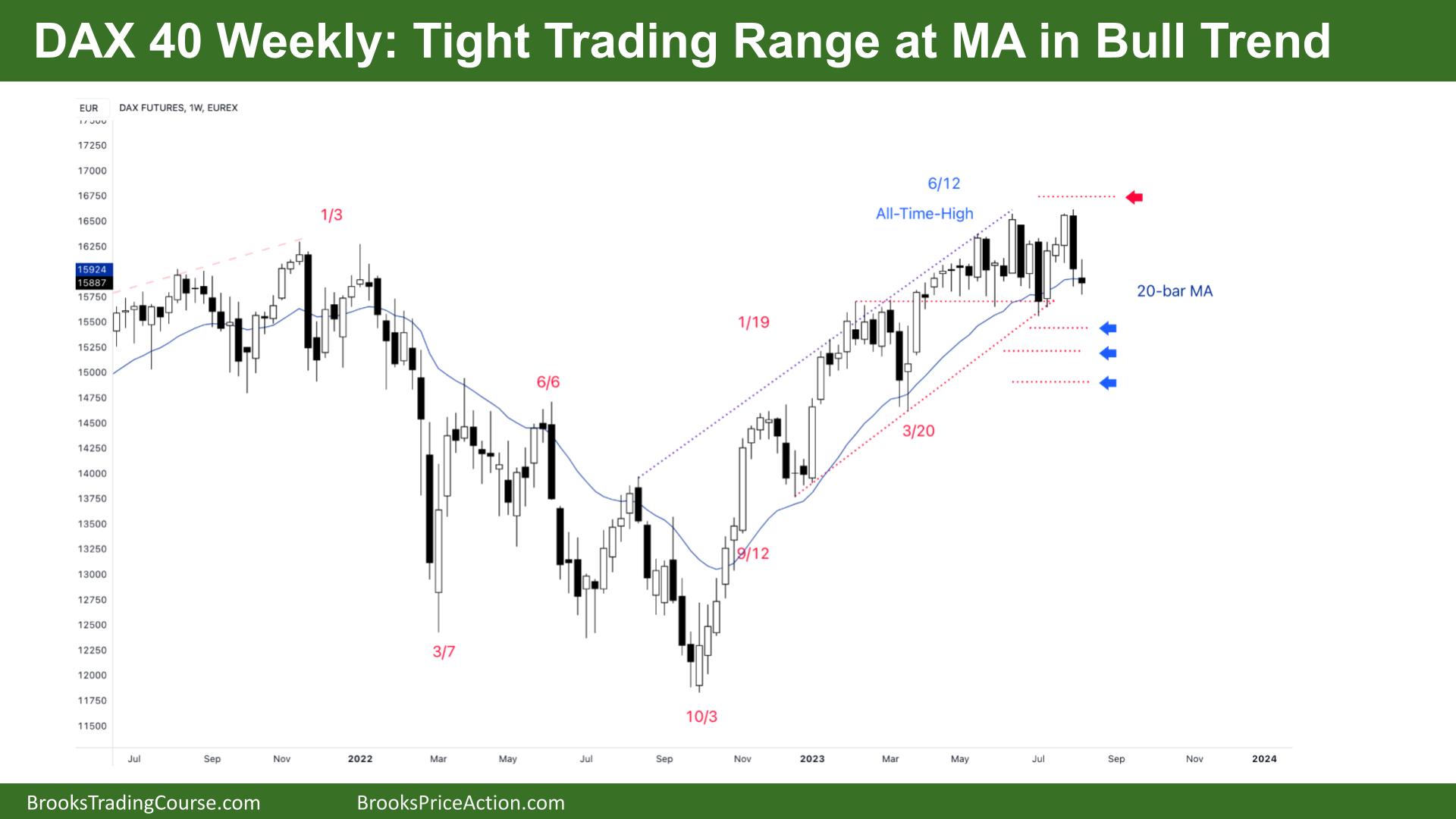

Market Overview: DAX 40 Futures

DAX futures moved lower last week with follow-through selling in a tight trading range, but it was not able to close below the bar from the week before. So it’s not as bearish as it could be. Bulls have finally got a chance to buy the moving average, and in a tight bull channel, it is reasonable to do that. The bears see a possible wedge top and want two legs sideways to down. But a total lack of bear stop entries that worked will prevent the selling from starting yet.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures last week continued in a tight trading range, with a bear doji closing just below the MA.

- The bulls see a bull trend, a final flag that keeps going, and we are heading sideways at the MA.

- The bears see that this TTR has gone on for about 20 bars, so the upward momentum has probably gone.

- The bears want a follow-through bear bar next week, preferably closing completely below the MA.

- Some bulls see three consecutive bull bars as a continuation pattern. But the problem is no gaps between them.

- The bull breakout did not get follow-through above the high of this leg. That’s a problem.

- The bears saw a failed breakout and got the minimum level of follow-through. But disappointing because it did not close below the prior week’s low.

- Best to be flat here in the middle of the tight trading range.

- If the bears get a bear bar and a pullback – it could be a reasonable short below – taking a chance that any buyers would have already appeared.

- Some bulls will probably scalp the first bar below the MA in so long. But I suspect it would be a scalp only.

- Other bulls see a test of the trend line and expect a test of the high before reversing.

- The biggest issue is the tight trading range which makes potential stop-entries, reliable limit-order fades, instead.

- It has an expanding triangle shape, so we could get a move down and a stronger move back to the highs. Confusion should keep traders BLSHS and taking quick profits.

- One bull argument is the open body gap currently below. Technically, the trend is still on and still 55% likely for bulls.

- Disappointing for both sides, so expect sideways to up next week.

The Daily DAX chart

- The DAX 40 futures was a bear bar on Friday, closing near its low, so we might gap down on Monday.

- The bulls had a strong leg in a trading range but failed to get buyers at the MA. Some bulls might be stuck above.

- The bears got follow-through and a bear microchannel down. There are usually sellers above the high of the last strong bar in a bear microchannel.

- But it didn’t even reach there. That is a sign of strong selling.

- The spike down is strong, so traders will expect two more legs – in a trading range, which is disappointing for traders, you mostly get only two legs.

- It’s a bear bar, so a sell signal for Monday. It is reasonable to get short, but it might only be a quick move with the inside bar.

- Bears want the leg to get down to the July low. The middle of the big expanding triangle is a magnet.

- Bears see a HH DT, a reversal pattern, and two down weeks so we might get follow-through selling.

- The bears want to put in a lower high before anything major happens. The bulls get getting new ATH, and that’s a problem for the bear case.

- Next week we might get below the Aug 8th low to see what’s down there.

- We are back in a tight trading range here. Expect limit-order traders, to sell here and sell more higher.

- Bulls will likely buy below and scale in lower.

- It’s okay to be short or flat here. We are still in breakout mode on the HTF, so the price action can whipsaw here, trapping traders.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.