Market Overview: DAX 40 Futures

DAX futures moved sideways last week, with a DAX 40 inside bar closing above its midpoint. The bull trend has been strong, and without bears closing consecutive bear bars, it’s hard for bears to swing short. There are open gaps below, and it looks like the bulls will get to the all-time high. Often price can get close to a magnet before reversing – but the expectation is that we will get there and form a double top at least before going down.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bearish inside bar following consecutive outside bars.

- We are at the top of an expanding triangle which in a trend is often a continuation pattern with a lower probability of a reversal (down.)

- The bulls see a strong and tight bull channel, many bars above the MA.

- The bears see a wider trading range that we are at the top of. They know the math favours selling at the top of a trading range and are looking to get a good entry for a larger profit target below.

- But where are the sell signal bars?

- Bears need a move that closes the gaps above bull breakouts – and then they can start to sell.

- Until then, expect bear moves to fail and become with-trend buy setups.

- Both limit-order bulls and stop-order bulls are making money.

- Stop-order bears are not making money, and neither are limit-order bears. The small gap above February’s bars indicates that the limit-order bears did not get out breakeven.

- This is a strong bull trend still, even though it is sideways.

- Consecutive outside bars and then an inside bar – a volatility contraction. This is often followed by a volatility expansion – a breakout in either direction.

- With two outside bars, there is a layer of support and resistance above and below the bars.

- Shrinking bodies mean the trend is weakening. Bulls are not buying closes but pullbacks and bad opposite signals.

- Six bars with a bull BO above them is a sign of strong bulls, so a type of small pullback bull trend on a lower timeframe.

- We are so close to the all-time high that we might need to go and test it. That could be the failed breakout above and reversal to start off the next move.

- Traders should expect sideways to up next week.

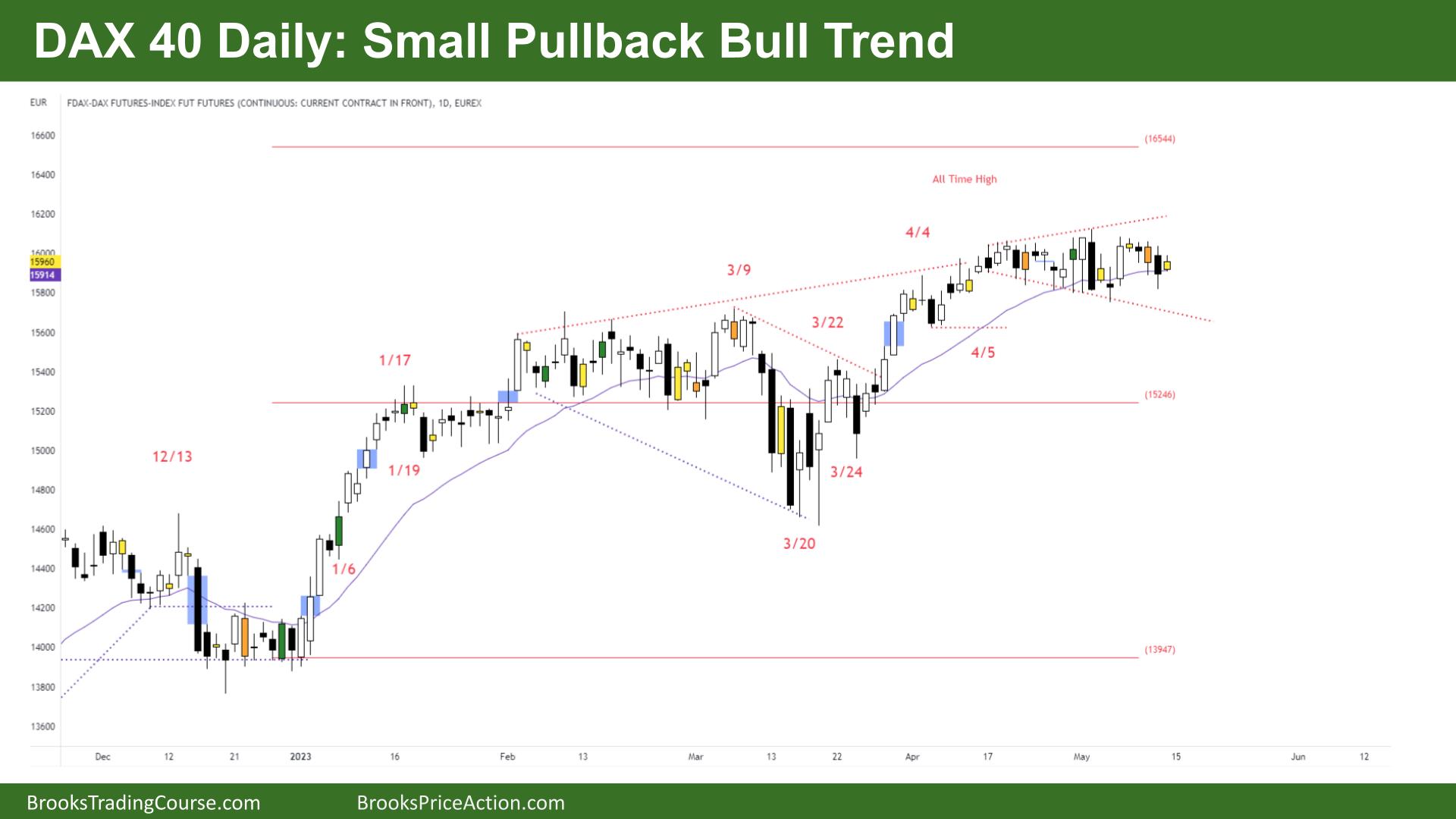

The Daily DAX chart

- The DAX 40 futures was a small bull inside bar, closing below its midpoint. Indecision.

- The bulls see an expanding triangle, a tight trading range sitting at the moving average, which has been support for many weeks.

- The bears see a small head and shoulders top, looking for a strong break below and a measured move down.

- Wednesday was an outside down bar, so sellers above. They got some follow-through, but tails mean the bears are still scalping, and bulls are buying below bars.

- There is still a small gap below the bull breakout point, so until the bears close that gap, it has a higher probability of going up, even if the pullbacks get stronger.

- The moving average has been resistance for the last few weeks and broadly for much longer, so expect buyers there. Bears need a strong break below and a low 2 short closing on its low to convince bears to swing sell.

- The bears see four consecutive bear bars, which is strong enough for a second leg of its own. Perhaps they get down to the channel line before reversing.

- Wednesday and Thursday were a strong bear reversal. Wednesday went above Tuesday, picking up the bull stop orders above the bar and then going outside-down, trapping them in. Now there are sell orders up there.

- Thursday was a climax bar, but it had follow-through. Some traders will see that as a surprise and expect a second leg sideways to down.

- Traders should expect sideways to up until the bears get a strong pair of closes.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.