Market Overview: DAX 40 Futures

DAX futures moved lower last week with a give-up bar, and so are going for a measured move down. The bulls tried to get a wedge bottom reversal or a High 2, but both failed, and no one wanted to buy the weak signal. It is close to support and some bulls are waiting to fade breakouts here for a test-up after 15000 Big Round Number. Most traders should be short or flat.

DAX 40 Futures

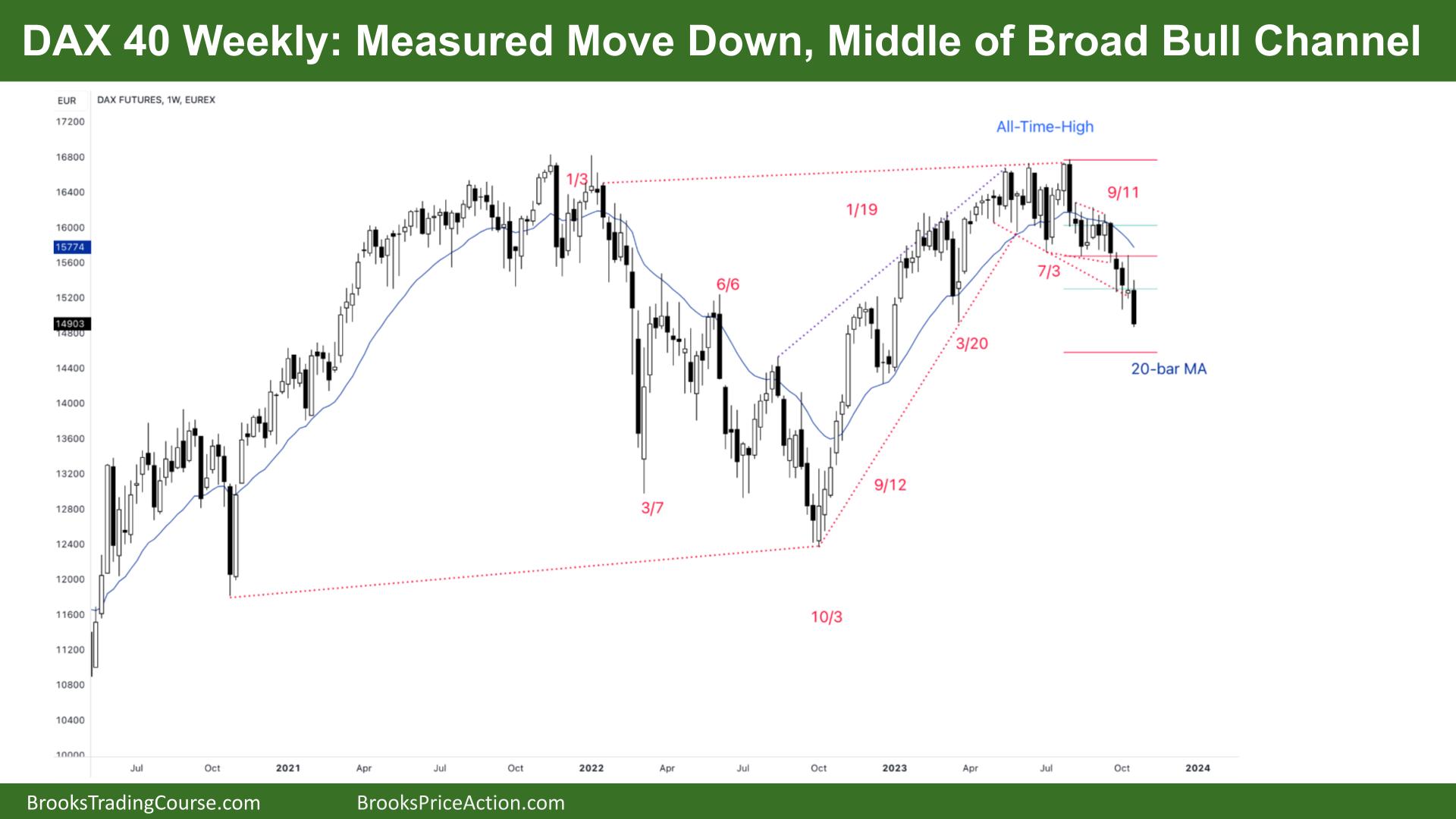

The Weekly DAX chart

- The DAX 40 futures last week was a big bear bar closing on its low so that we might gap down on Monday. It is on the way for a measured move down.

- 15000 has been an important price for a long time, and we said we would come back here repeatedly to test.

- The bulls see a wedge top and expected 2 legs sideways to down, testing the swing low and the start of the third leg we just reached.

- They will look for a second entry buy signal, expecting a trading range.

- The bears see an expanding triangle, a break below a wedge, a BO of the range, a test last week and then move down. Their target is a MM of the ET.

- The prior week was a weak sell signal – a bull doji. Some traders bought below it and will look to scale in lower.

- It was a failed High 2, and many bulls exited when it closed. They were hoping for a move back up into the range.

- Some bears see this as a bigger wedge and a break below. Considering the HTF, it is more likely a larger expanding triangle, and this is the first part of a trading range.

- The bears want a vacuum test of support as the bulls give up. We could get that next week as we quickly move to the target and go sideways.

- Most traders should be short or flat. Limit order bulls will wait to see front running or a bull doji at support.

- The first reversal back up, should be minor.

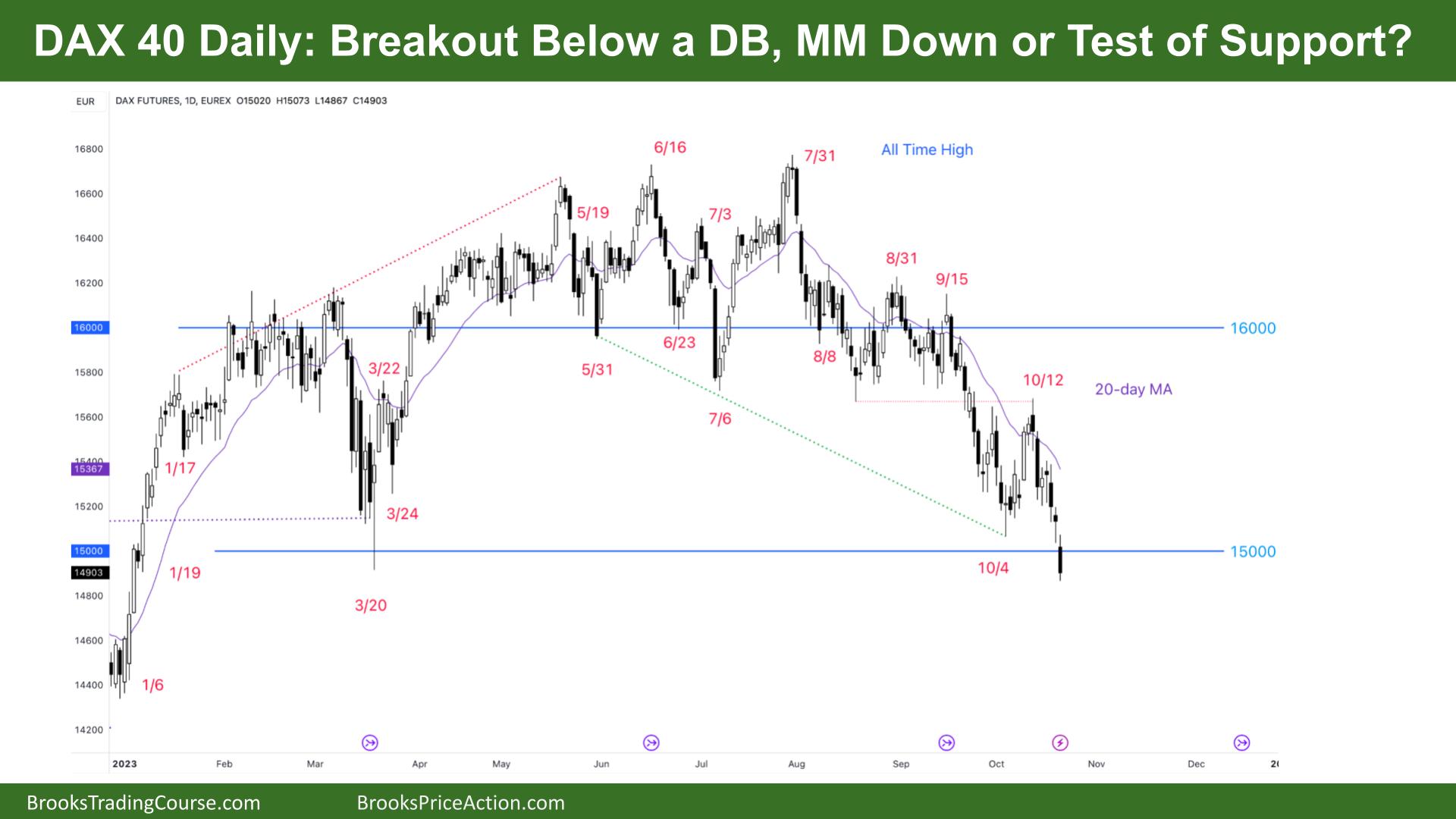

The Daily DAX chart

- The DAX 40 futures on Friday was a big bear bar closing near its low so we might gap down on Monday.

- It is a 4-bar bear microchannel, so we are always in short, and traders will sell the first pullback to go above the high of a prior bar.

- The bulls wanted a DB at support, the 15000 Big Round Number, but the signal was weak on Thursday.

- It is not a great sell signal either, so some bulls are scaling in below to set up a longer-term trade. But in the shorter term, it is a strong bear spike, and traders should expect a second leg sideways to down.

- Traders expected a test of the triangle to the left, the TTR and the swing low. In TRs, the price often goes above or below swing points before reversing.

- The bears want a break below the DB and then a MM down. The only issue is the strong bull spike from October. Buyers below will be looking to break even on their first entry and make money on the scale in.

- Some bears will sell and use a wide stop, sitting through the pullback. The issue is selling at support. Some bulls will count it as leg 3 or 4. Other bulls see this as a new leg and will wait for another leg before looking to buy.

- Most traders should be short or flat.

- For a few months now, everything bullish has been failing. The bulls are looking for a wedge-bottom reversal signal. They see this as a nested wedge and want a decent signal to buy above.

- We should test the BO point above on Monday or Tuesday.

- Some bulls will look to buy because if you look left, how often do you get 5 bear days in a row?

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.