Market Overview: DAX 40 Futures

DAX futures moved sideways last month with a nearly outside up bar. I’m writing this with one trading day to go. And that makes it more interesting for next month’s price action. If we go outside up, there is more chance of follow-through buying above this month. If we fail to get a new high, or close above last month’s high, and we broke below last month’s low, then more likely limit-order sellers scale in above. However, its been quite challenging being a bear for the past 10 months or so!

DAX 40 Futures

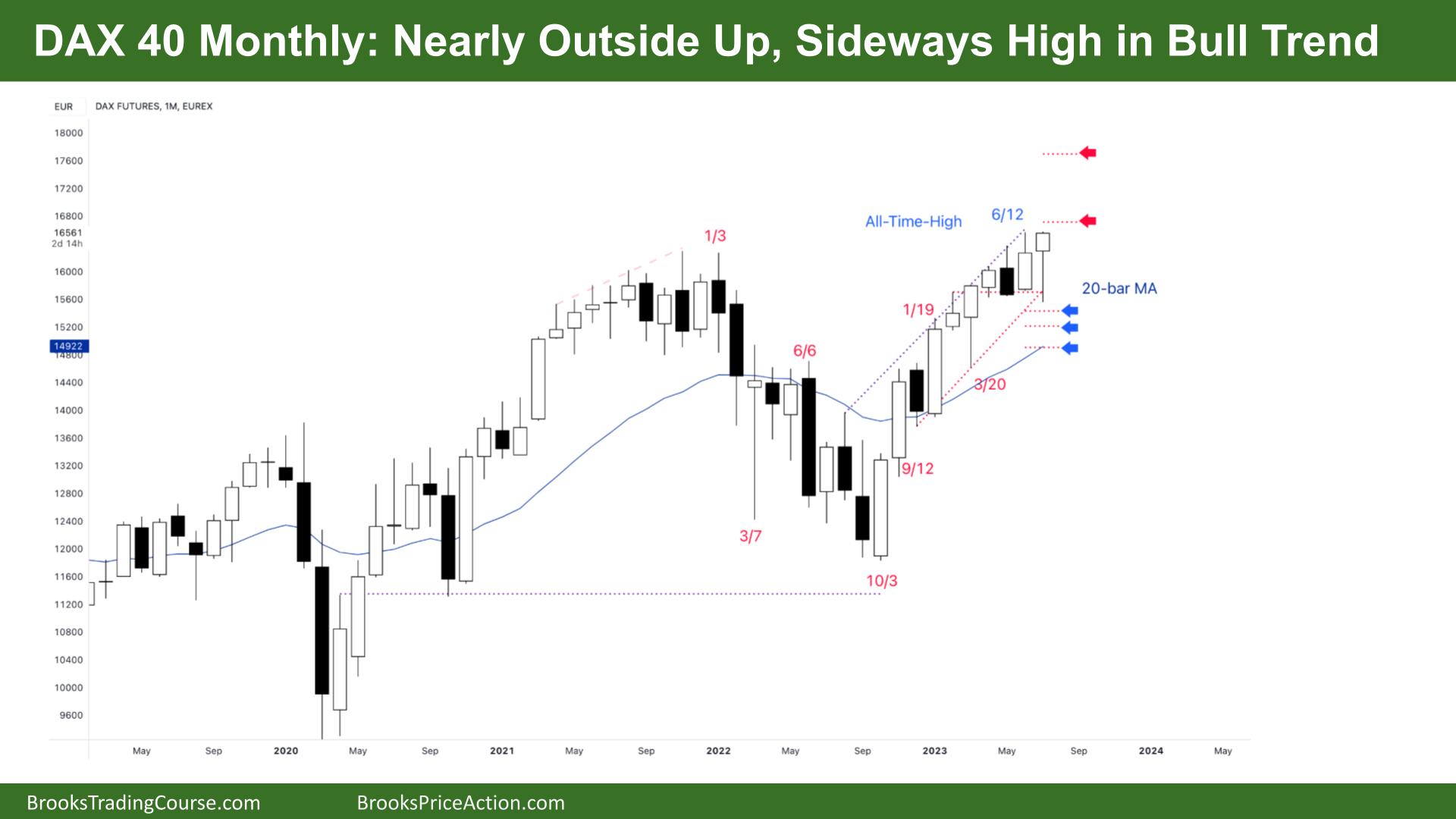

The Monthly DAX chart

- The DAX 40 futures went sideways last month with a nearly outside up bar.

- The bulls see a tight bull channel, a spike with a channel forming in March. We are high in the channel, and so most bulls buying here expect to be able to buy lower and make money.

- Bears see a trading range and are looking for a double top, but they need a good sell signal.

- An outside bar is confusing, an expanding triangle. Most expanding triangles in trends are continuation patterns.

- The bulls need a BO and FT above the prior highs for a measured-move up. This month’s bar might scare some bulls into buying pullbacks instead of BTC and BTM (Buy the close and Buy the market.)

- Bears that got triggered below last month are now short at the bottom of a bull bar.

- They need to scale in above the high of this bar – or if it’s strong (and hence low probability to sell) they will look to sell again above a weak buy signal.

- Some traders use harmonics – and the two bull legs are about the same size – that could encourage bulls to take profits here.

- Bears were hoping to get a move to the MA, but now it looks like one more leg – which was more likely given the tight channel.

- Look left; there were not many buyers above here a year ago – so are traders/investors willing to buy the highs? Let’s see next month.

- Expect sideways to up next month.

- Most traders should be long or flat.

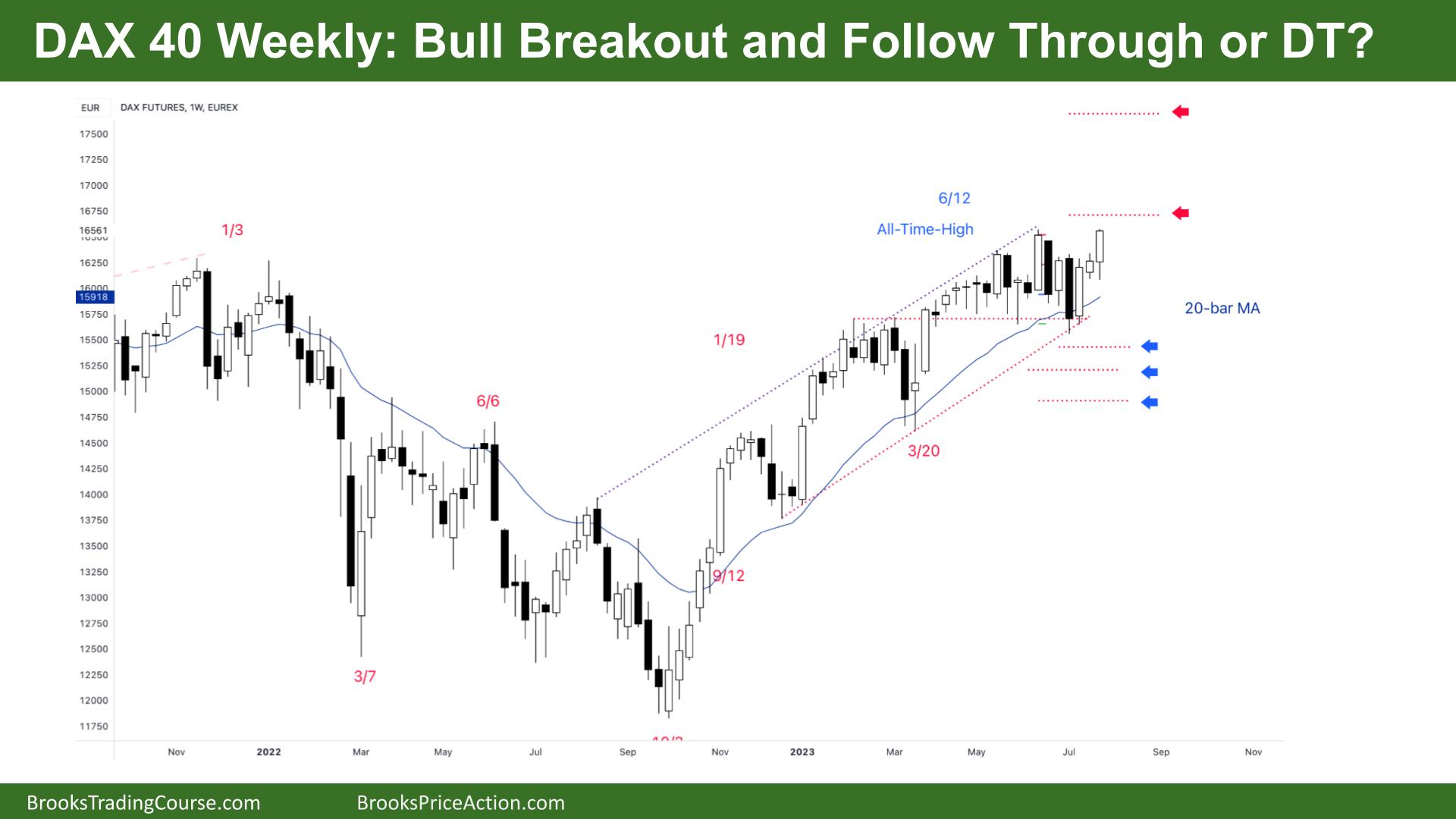

The Weekly DAX chart

- The DAX 40 futures went higher last week with a bull outside up bar.

- The bulls see a micro DB and a bull microchannel recently, with a tight bull channel with at least 3 pushes.

- They see strong bull follow-through above the MA in a bull channel, so we are always in long.

- The bears see a trading range high in a channel, and because they closed the gap below, they will look to short above the highs around here.

- They also see a big-small-big pattern – 2 legs on a LTF, so we might get a pullback here next week.

- The bears wanted to sell above the strong bear bar, but they did not once they saw the small bull follow through. They might look to sell a weak bull bar but it’s so strong for the bulls again.

- Most of the selling is bull profit-taking here, and bulls have new targets off of the buy signals at the MA.

- The bulls need a follow-through bar closing above the high for a measured move to set up. It is still an expanding triangle, so that it might set a new high and a new trading range low.

- If the bears fail here, expect a measured-move up. If the bulls get a follow-through that is not strong, then sideways to down could be the next few weeks.

- Next week, expect sideways to up after the outside up, as we are always in long. Most traders should be long or flat.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.