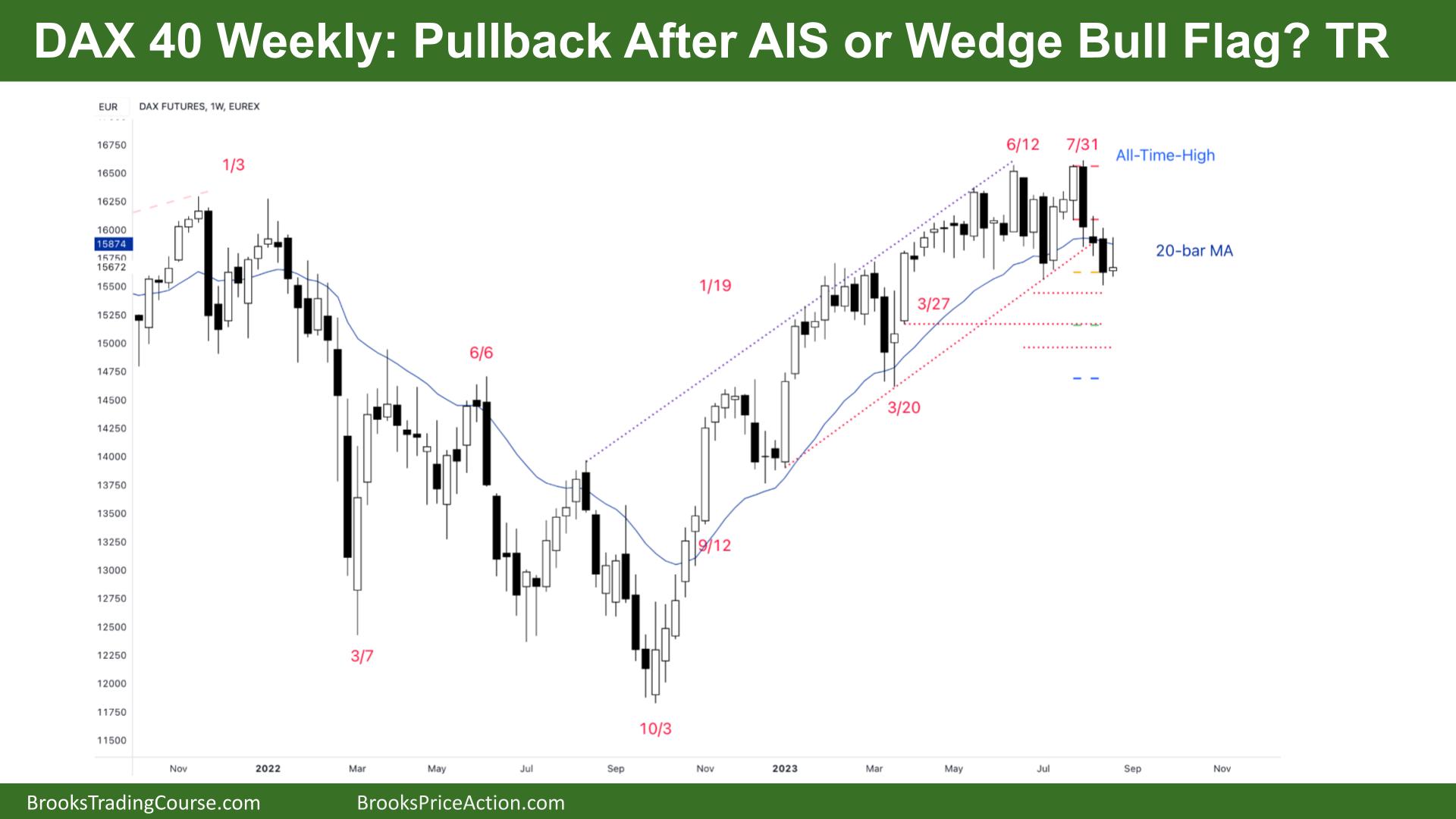

Market Overview: DAX 40 Futures

DAX futures moved sideways last week with a pullback after potentially going always in short. Most traders will wait to see if there is a second leg they can participate in or wait for a buy signal low in a TR. Bulls will still get a MA Gap bar buy setup but it might only be for a scalp on this timeframe. Bears closed the gap so now sellers above which will limit the upside.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures last week was a pullback, a small inside bar after a strong bear leg down.

- It is an inside bar which is a weak signal in either direction.

- It is the 2nd consecutive bear bar, which is larger and the 2nd close below the MA. But the context is not great for a sell swing here.

- Most bears will wait for the bull pullback to fail and sell above or sell on the momentum if we break strongly below 2 weeks ago.

- The bulls see a tight channel and at least 3 legs up, so it was expected to go sideways.

- The bulls also see the expanding triangle, which often becomes continuation patterns in trends. So, there are likely buyers below.

- The week prior was a sell climax – it rapidly accelerated below the small bear channel. Bulls who bought there made money.

- Bulls that faded that bear doji made money – so limit order trading is another reason against taking short trend entries.

- Last week was a weak buy signal, so sellers above is more likely.

- Bears wanted a better close below – a BO and FT, but they didn’t get it. The risk now is if bears don’t sell strongly here, then a TR is more likely, and we will probably go back up.

- Bulls are concerned about the large gaps below as vacuums for price. So they will need to trade small and scale-in if it moves strongly down.

- We are probably always in short – even though the context for buying is still reasonable. Better to be short or flat.

- When you have good reasons to be short and long – it’s better to trade it as a TR and fade stop entries.

- Most traders should wait for a reasonable stop entry in either direction. Consecutive bear bars closing below the MA. Or a second entry long for a test of the high.

The Daily DAX chart

- The DAX 40 futures chart was a bull inside bar on Friday. So, likely buyers below and sellers above.

- If you extend a few trendlines across it looks like we need to go and test 15500.

- In comparison to the weekly chart – this is a bit more interesting!

- The bears see at least 2 legs down and might get a third. This would form a possible wedge reversal long setup.

- We broke strongly below the MA and git follow-through. This trapped-in bulls trying to scale in and created resistance above for bears to sell.

- It is an expanding triangle on this timeframe and we already got another LL. So it is 5 legs. Will we break below the low and get a move down? Or is this the test and reverse up?

- Thursday was a bearish outside bar, so likely sellers above.

- Look left – how many bull bars close above other bull bars? None? The bull bars don’t have good follow-through buying. This says to me we need to go lower.

- So if you do feel like getting long, it has to be at the lows and scaling in lower if at all.

- Bulls see a final flag, a TTR, and maybe this was the third leg. We tested the range, but they need a DB to get a good move back up. At the moment it looks more like a wedge that can fail and go lower.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.