Market Overview: DAX 40 Futures

DAX futures dipped lower last month back to the moving average with a DAX 40 strong bear bar. The bulls got a wedge bottom, and strong follow through so most traders will expect a second leg sideways to up. Bears will look to scale in higher above last month and some will wait for a second consecutive bear bar below this month. Most traders should be trading with stop orders so it is okay to get out below this month.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a strong bear bar closing near its low.

- It follows two large consecutive bull bars, which was a surprise. Some traders will expect a second leg sideways to up.

- The bulls see a wedge bottom, three pushes down and a bull surprise. Last month, they saw a pullback and might buy below the bar or at a 50% pullback.

- The bears see a possible double top bear flag from a strong bear leg.

- Look left. It is a tight trading range so we might find buyers below this week and sellers above. Tight trading ranges are magnets.

- The bulls want another buy signal next week, a High 1 buy setup. They know some bears are trapped below, so they are willing to scale in lower.

- Bears want a follow-through bar. They saw we were always in short from all-time highs and wanted another leg down.

- Bulls will get out below the bear bar, or some will scale in lower. They are betting we won’t go much below the two strong bull bars.

- It’s okay to scalp short below, but most traders should wait for a higher probability short, two consecutive bear bars closing near their lows.

- Bears might also see a failed breakout above the prior highs – so they will trade it like a trading range, selling above last week, betting they can go back to breakeven on their first entry and make money selling higher.

- The probability is to the long side, protective stop below the 2 bull bars. Probably closer to 50%, as we are in the middle of the range.

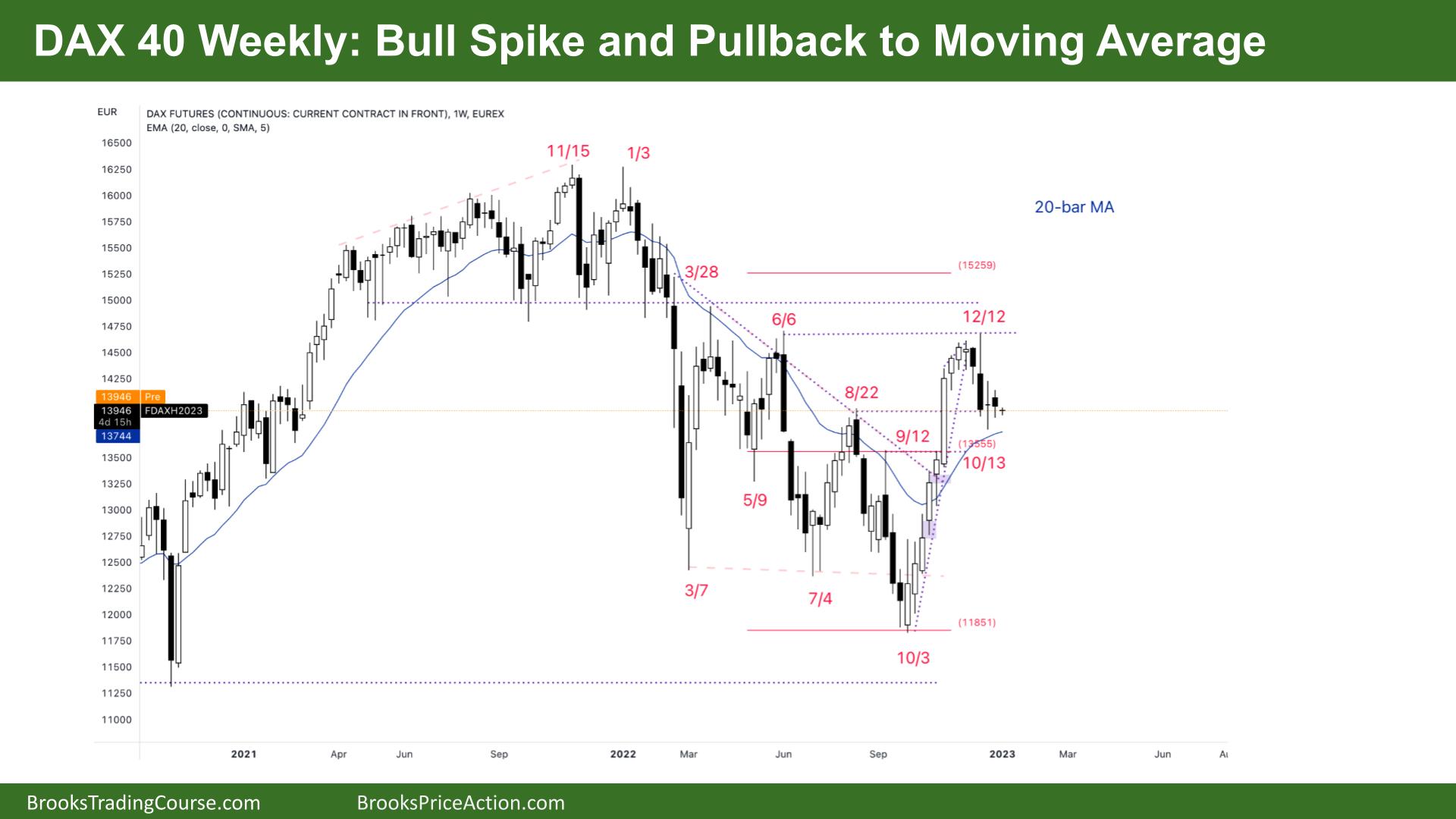

The Weekly DAX chart

- The DAX 40 futures was a small bear inside bar, just above the moving average.

- The bulls see a bull spike and are looking for the pullback to end for the start of the channel.

- They expect a second leg after such a strong bull micro channel.

- Bulls will look to buy at the moving average, above a decent bull bar or at 50% from the start of the spike.

- The bears see a lower high in a bear channel or the top of a trading range. They want a double top or a reasonable sell signal.

- The bears see consecutive weekly bear bars with follow-through, so perhaps there will be a little more sideways to down before the bulls commence buying.

- If you are confused, it is more likely a trading range. Prices tend to overlap breakout points in a trading range as everything gets tested.

- Before continuing higher, we might have a deeper pullback to the prior breakout point.

- Bulls want to stay above the September 12th high to trap bears short and get a stronger second leg. But the bulls have struggled all year to break out of this range.

- It’s a series of small bear bars, so it is a weak sell and a weak buy. A tight trading range is breakout mode, and most traders should wait for a clear resumption of the trend, or a reasonable stop order short.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thanks for your continuous weekly and monthly updates, really solid work! DAX is one of my favorite instrument to trade and 2023 will not be boring.