Market Overview: DAX 40 Futures

DAX futures went higher last week with a bull doji – weak follow-through after a strong reversal up. The bulls want a move back to the MA, which is likely with such a bull trend bar. Some bears will sell the MA, while others are trapped trying to sell above a bear bar to return to their lower entries. Expect sideways to up next week.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a weak bull doji, following a strong reversal bar last week.

- On the monthly chart, it is 3 bear bars, so we need to get back to the high of the last one – around 15700, above the MA where sellers will be waiting.

- The bulls see a BO and bad follow-through, but the minimum they wanted was a bull bar – so we will probably get to the MA in the next 2 weeks.

- The bulls see a late leg in a bear spike and wedge channel at a measured move target. They didn’t get a buy signal low, and some traders will enter here and scale in. Others will wait for a slight pullback, maybe to the high of the bad buy signal the week before.

- The bears see three legs down and a strong pullback.

- It is not clear. The leg was sideways and looked like a leg in a trading range. There was a bad sell signal that worked and trapped bulls. Those bulls got a chance to exit breakeven on their higher buys and profit on their lower buys.

- If you buy it, then it is for a swing. You will probably scalp out at the MA because it is a trading range that will disappoint.

- Nothing for bears to sell until the MA, which makes me think we will get there fast next week.

- We are just above 15000, so we might need to go and test there again. That’s a reasonable buy zone and near the 200-day MA.

- We don’t need to go back there because the bears had a sell signal that triggered, and they could have got out.

- Some bulls will wait for the bears to scale in and exit until they buy for a swing long.

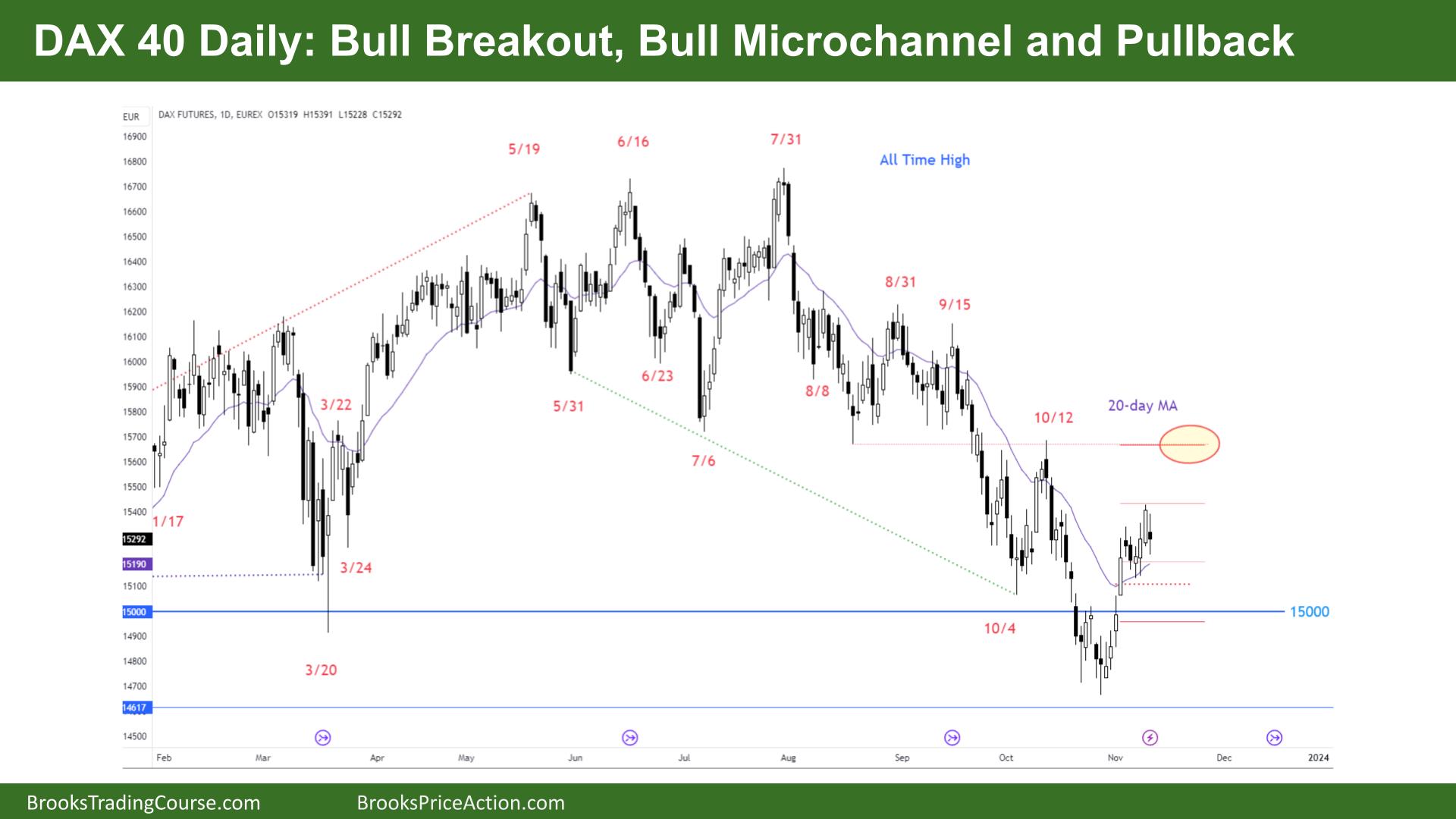

The Daily DAX chart

- The DAX 40 futures was a bear doji on Friday, a pause in a strong bull spike.

- Bulls saw 3 pushes down a wedge channel to a lower low double bottom. 15000 was the target, and we breached through and launched back-up. We might pullback to create an inverse head and shoulders or keep going higher.

- The bears see a bear channel and a trendline break, but they never went back to test it.

- Bears at the MA might have avoided a loss, but it launched straight past, trapping them below, or they exited in the bull spike.

- Bull spike and bull breakout, we are always in long. Traders will get long above a good bull bar or wait for the MA to get in.

- It is a weak sell signal, so they might even buy the open on Monday.

- The expectation is for 2 legs sideways to up with about half as many bars as the wedge pattern. That’s probably a few more weeks sideways to up.

- Bears need to get back below the MA, they will sell above strong bear bars to the left, but most traders should look to get long and hold.

- Is it a second entry short? The bears did get a bear close below a bar, but the odds favour more upside with open gaps and strong bull closes.

- Expect sideways to up next week; most traders should be long or flat.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.