Market Overview: DAX 40 Futures

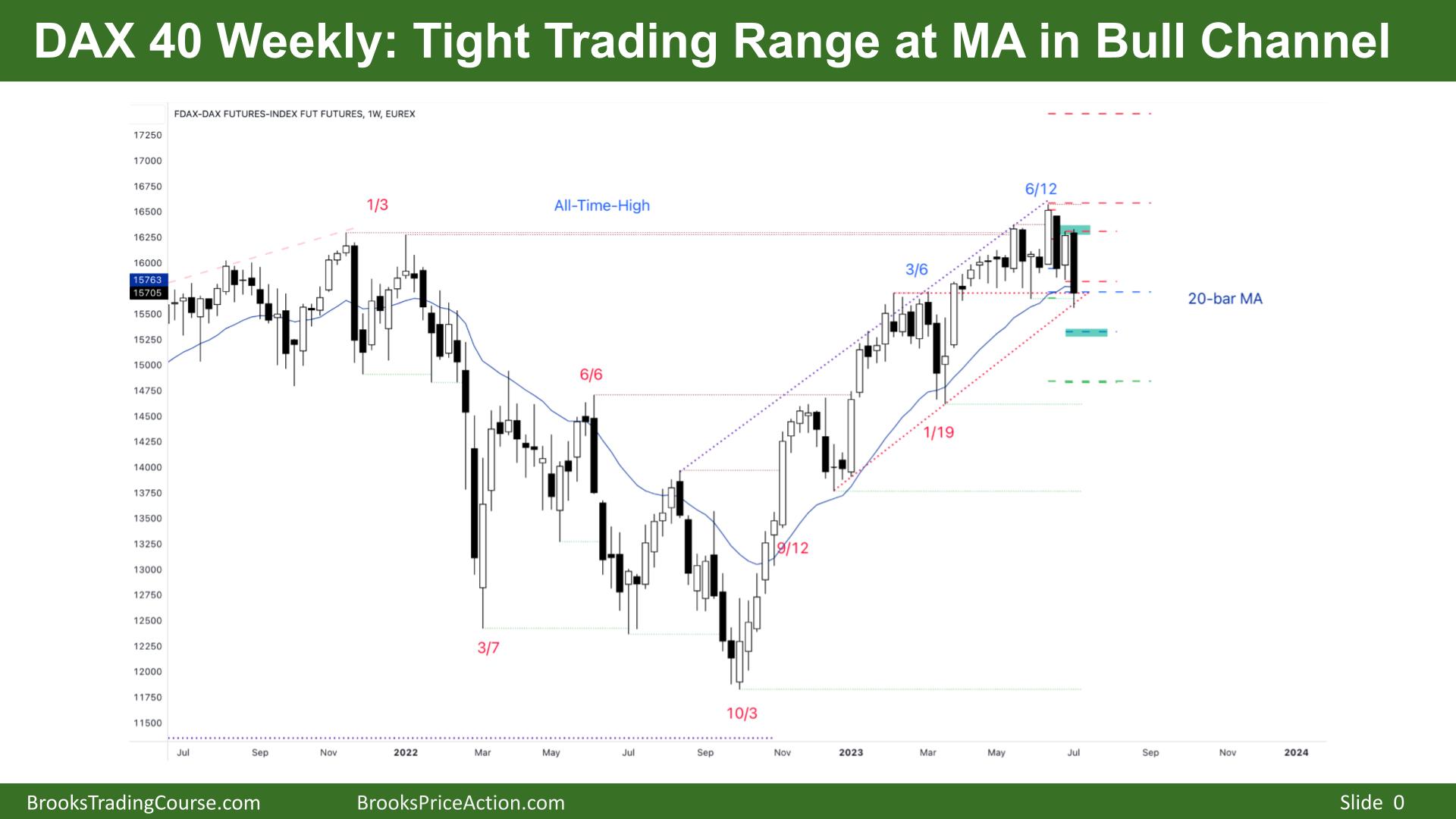

DAX futures has been stuck in a tight trading range for several weeks, and this is the first touch of the MA. The bears see a possible second entry short – but at the MA is not great. Bulls will happily buy the MA and below in such a strong bull channel. But perhaps they want to see another leg down to get a better price.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures reversed down last week in a tight trading range with a big bear bar closing on its low, so we might gap down on Monday.

- It might be transitioning out of a tight trading range and could be the bottom of an expanding triangle.

- This strong trendline will probably attract buyers who might also scale in lower if it does not work.

- It was a bear surprise bar, and if there is follow-through next week, we will probably see a second leg sideways to down.

- Selling at the MA in a bull channel is a low-probability trade. But it might set up a wedge top swing sell.

- The trading range is tight, and TTRs resist breakouts. Next week can also reverse strongly as scale-in bulls buy more to scale out.

- The bull bar two weeks ago was expected – traders that BTC of the strong bull bar got a chance to buy the low and get out breakeven.

- We then triggered the sell above that bar – good for bulls. They are trapped but should get a chance to get out without a loss.

- The problem for them is where is the buy signal. It is better to buy above a bull bar closing above its midpoint.

- The bulls see a bull channel that is strong and open gaps. Although the bears closed the gap this week, high probability shorts are at the highs and in the top thirds.

- If it has converted into a TR, then a Low 1 and Low 2 here is not a good sell signal. So if selling, it can only be for a swing as the probability is not great.

- The bears want a breakout of the tight trading range and MM down. That would be back to the swing low. Scale in bulls are probably waiting there.

- The first bear bar completely below the MA is also a high-probability buy signal. So the bears have more work to do.

- Expect sideways to down next week to see if there can be follow-through selling.

The Daily DAX chart

- The DAX 40 futures was a bull doji on Friday.

- It was a pause bar after a bear surprise in a strong bear microchannel, so traders will expect the first reversal up to be minor.

- But we broke below a major swing point, a higher low, so the bears will probably get a measured move down.

- The bulls see three legs down, a possible wedge bottom testing the prior breakout point. But there is no buy signal yet.

- Bulls will probably need a second consecutive bull bar to get them interested in buying.

- It is a tight trading range on a HTF so traders should be careful of strong pullbacks.

- The bears see a possible head and shoulders top, lower high, MTR, and strong second leg down. They count only two legs and expect a third leg, perhaps symmetrical to the last leg.

- There is a triangle lower that we might need to test from March. Bears were shorting a lower high and got stuck there, so they might be trapped.

- Big bars in TRs attract profit-taking, and we are far below the MA, so we might need to test back before moving down further.

- We are always in short, so traders should be short or flat.

- Bears want a measured move from the lower high above.

- The bears broke a swing low, so now it is the bottom of a trading range – but they want to get to the lower part of this larger trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.