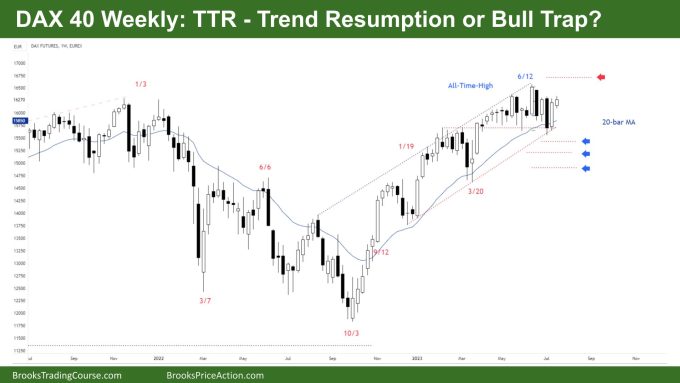

Market Overview: DAX 40 Futures

DAX futures was a small bull follow-through bar but it did not close above the high of last week, so its a possible bull trap. Bulls want the stop-order to work and get back to the high close of the bull channel. Bears want tot rap them here and get a bar back at the moving average. Buyers weer always going to be at the MA in such a tight channel, so probably more buyers below as well.

DAX 40 Futures

The Weekly DAX chart – Trend resumption of Bull trap?

- The DAX 40 futures weekly candlestick was a small bull bar with a tail above in a tight trading range (TTR) a possible bull trap.

- At least pushes up, and most measured moved targets have been hit – so how can bulls attract more buyers? Consecutive bull bars are good, but overlap is bad.

- It isn’t very clear. It’s a stop-order bull buy above a decent bull bar at the moving average (MA.) But that bar was an inside-bar, and we are slightly above an outside bar.

- Probably sellers above the bear outside bar here – but why? It is a possible bull trap.

- 3 weeks ago the bulls had a buy signal that failed. Now they have a second buy signal at the same price but with less risk. Sounds fishy!

- Bulls want the limit-order bears to get trapped and shoot up to the high again. They want the bears to get stuck and have to sell again to fix it. The sell orders driving the price higher.

- But look left – a TTR and no stop entries did that well. It was better to fade every bar in the last few months.

- Most traders should be flat waiting for a good stop order outside of this trading range.

- It is 3 trending lows now so probably buyers below. They want a small second leg sideways to up.

- Bears want outside down and follow through – to get bulls stuck in the middle of the range. They are selling high, which means the bull signal bars are high in the range where the math is bad.

- Last week was a reversal bar – the outside down bar was a bear breakout. The last weeks are bull breakouts, which traps bears.

- A bull trap is also a trap for the bears – one side gets trapped in, one gets trapped out.

- Bulls want one more followthrough bar to get the bears to give up so they can get to the highs again.

The Daily DAX chart

- The DAX 40 futures was a small bull inside bar at a measured move target.

- Bulls see a strong bull microchannel, a breakout of a bear channel and buyers below . They want a symmetrical second leg up.

- They bought the Low 2 hoping it would fail so they should get more up.

- Bears see three pushes up (including the doji on Wednesday) so a possible DT wedge bear flag.

- But its a higher high after a strong bull BO so the next leg might need to be higher.

- The bulls want followthrough or another failed sell signal to reach the 3:1 above. It was a low-probability buy that worked, so they need a good reward.

- But trading ranges punish traders who don’t take quick profits, so they can become sellers very fast.

- The sell climax might flip up as those bears took a reasonable sell and need to sell again higher, around 16470.

- Bulls that buy in a strong bull channel and at new highs usually get out breakeven so we might need to let them out at the high close.

- Expect more sideways to up next week as the inside bars confuse traders.

- Bears will sell above their strong bear microchannel from July 3rd so don’t expect the bull day to race through that resistance zone on the first try.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.