Market Overview: DAX 40 Futures

DAX futures moved sideways to down last week with a bear bar in what looks like a wedge bull flag. But it is confusing, for some traders it is always in short. Because we broke below the swing low, tested and now are moving down below the MA. For other traders, the pattern is not large enough or strong enough to reverse it yet. So it will likely become a bear leg in a trading range.

DAX 40 Futures

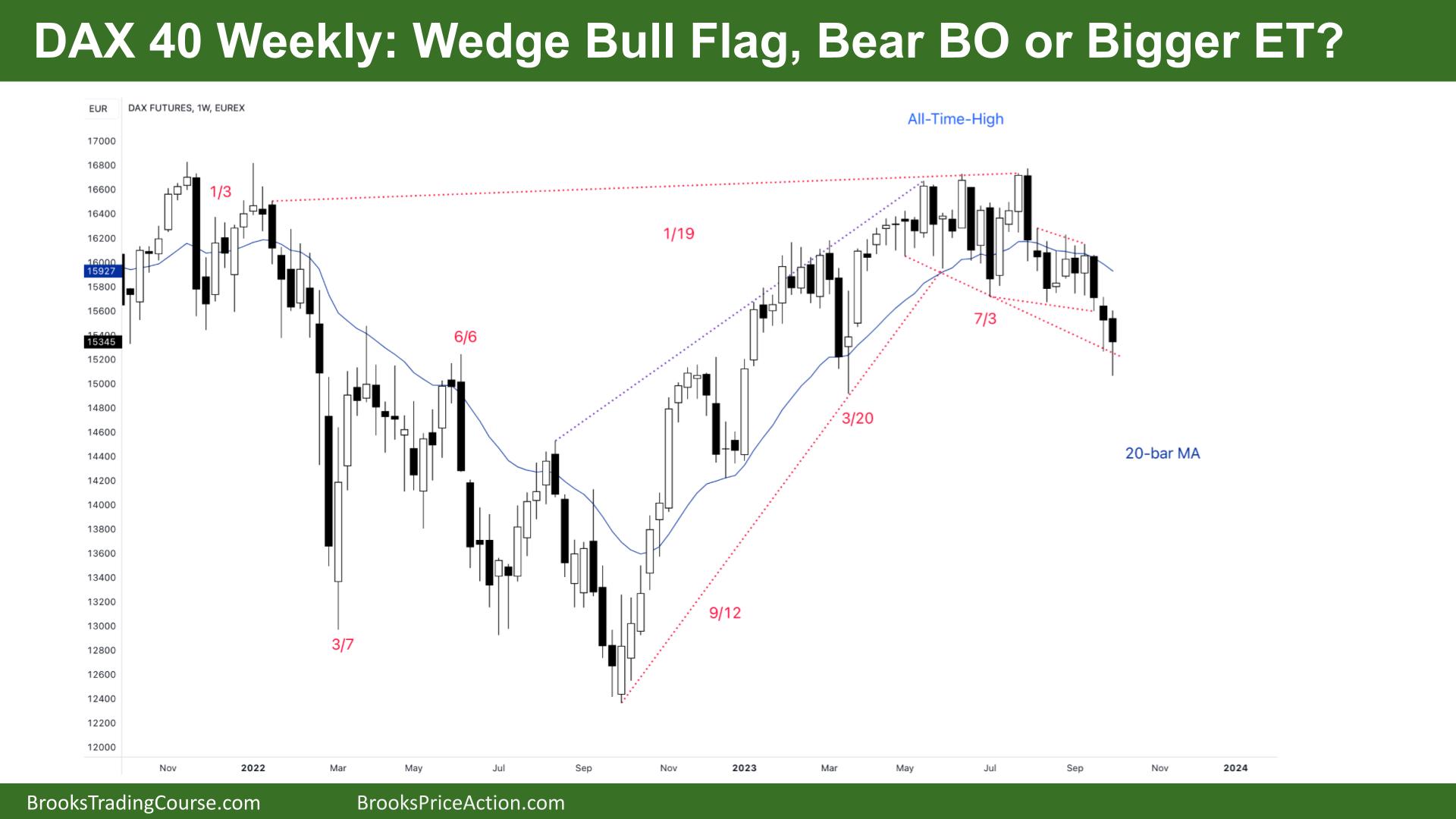

The Weekly DAX chart

- The DAX 40 futures on the weekly chart was a larger bear bar with a big tail below, closing above its midpoint.

- So some computers will see it as a bull bar.

- So that means it is a High 1 buy above next week. But it’s a bear bar, in a bear spike below the MA, so probably a better limit entry sell.

- Some bears see it as a failed breakout above the ATH and a bear spike and channel, and we are likely in the second leg.

- Other bears might see the wedge bull flag that failed in July, August and September.

- But if it is difficult to read, it is a trading range.

- We have consecutive bear bars closing below the MA but not closing on their lows. So I think it is more of a bear channel – a few ways to draw the lines – but importantly, the sells will be above the highs and near the MA.

- Day traders can look at it as a breakout and pullback and look for a second leg. We might get more sideways for the next few weeks as this leg is strong, so they might try for a larger second leg closer to the MA.

- Nothing to buy here for stop entry bulls. Limit bulls below the bar and lower third.

- The bulls see we are at the bottom of a trading range with March. Bears had a sell climax bar, which triggered and reversed. So, anyone who sold early got a chance to exit last week.

- Could we break strongly below next week? Three consecutive bars is a microchannel, and value bulls will look to buy at support at or under a good bull bar. So if it doesn’t pause on Monday, then Tuesday could be a big down day.

- Sometimes, the market will get vacuumed into the support or resistance zone.

- Depending on where you draw the wedge, a trader might need a reversal bar with a big tail overshooting the line. Either way, BLSHS.

- Expect sideways to down next week as traders decide what is below this week.

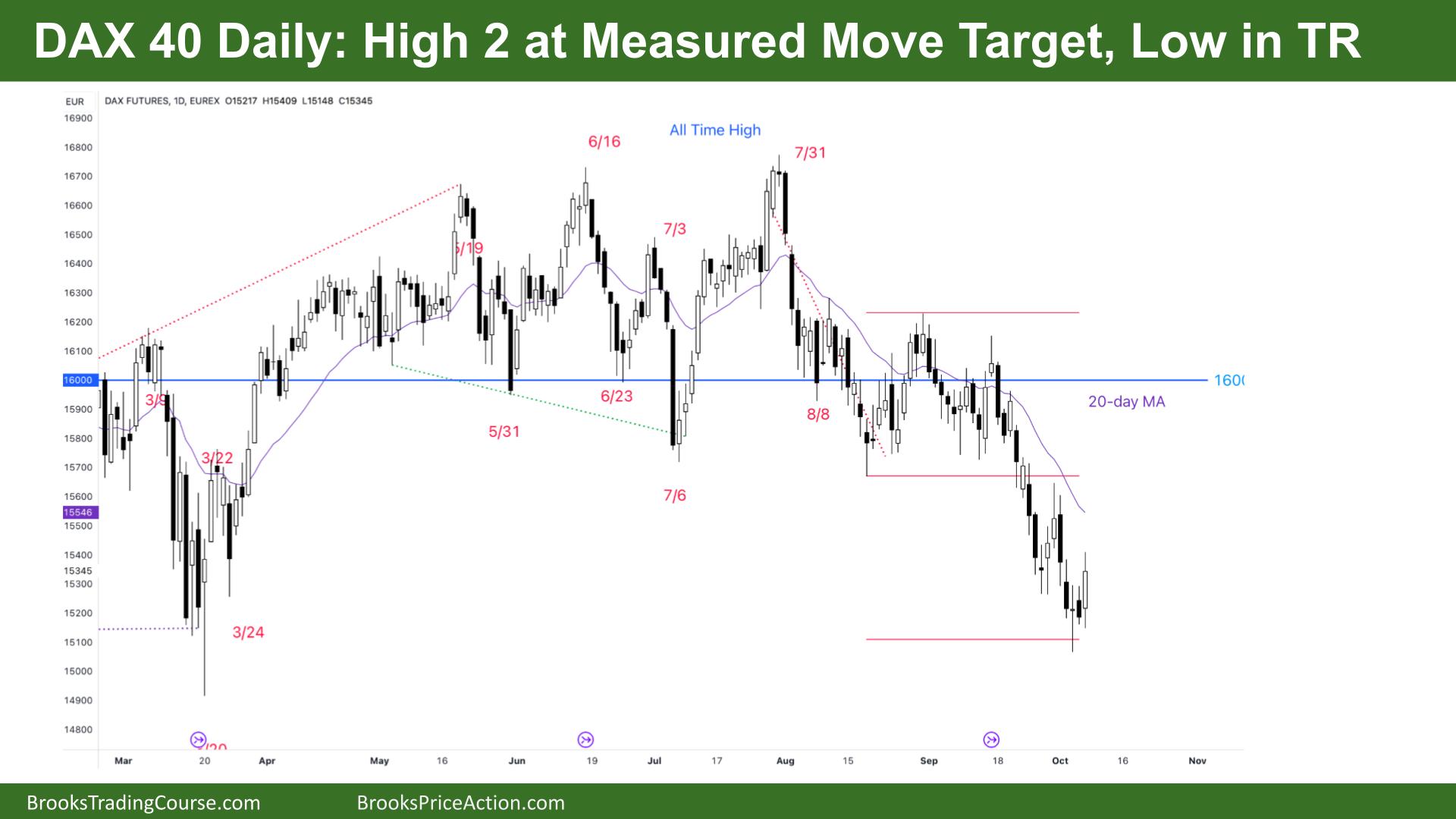

The Daily DAX chart

- The DAX 40 futures on Friday was a was a bull outside bar closing near its high with a small tail above.

- The bulls see a High 2 buy, far from the MA average, so a possible swing setup.

- The bears saw a spike and channel, which broke below the double bottom and tested the BO point. They expected a measured move down. We just hit it last week.

- We are a bar range from the MA so the bulls might get that bar up where bears will sell a DT bear flag and likely a low 2 at the MA which is a high probability sell signal.

- A second entry long low in a TR is a high probability signal.

- On the RTH chart there is an open body gap, so bulls need to close that early next week or the bears will more likely get more bars down.

- The sell off has been strong but did not trap bulls above. But when the bulls got the BO and FT above bear doji that might have scared bears off from selling too low. Buyers stepped in below the lows and scaled in lower and mode money.

- If bulls are making money here then the bear trend is not strong and most bears will then sell higher.

- Monday is important to see if we get FT. Outside bars are expanding triangles on LTF to attract limit order traders above and below. If the bulls can get a FT bull bar, closing above the high of Friday, they might get a second leg to the MA.

- If Monday is a bear bar with a tail above the high of Friday then expect a move back to the lowest close. The bears would like an OO, consecutive outside bars and get a FT below that to continue the spike.

- If you look left, or on the HTF, we are at the March TR, and that means we are likely to go past its low before reversing.

- Bulls need to get the pullback as far above 50% as possible to create some kind of a bottom on this timeframe.

- It is a wedge bull flag on the higher time frame but a bear channel, so the upside is limited.

- Still always in short so expect sideways to down until bulls trigger the High 2.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.