Market Overview: DAX 40 Futures

DAX failed bull breakout and a possible double bottom. Traders sold the market for the last 2 weeks so we should get a another leg down but it’s at key support so profit taking will take us sideways. If bulls can get a good reversal that might set the trading range boundaries for the next few months. If the bears can close strongly below the long-term averages we might keep heading lower to the measured move target from the January leg.

DAX 40 Futures

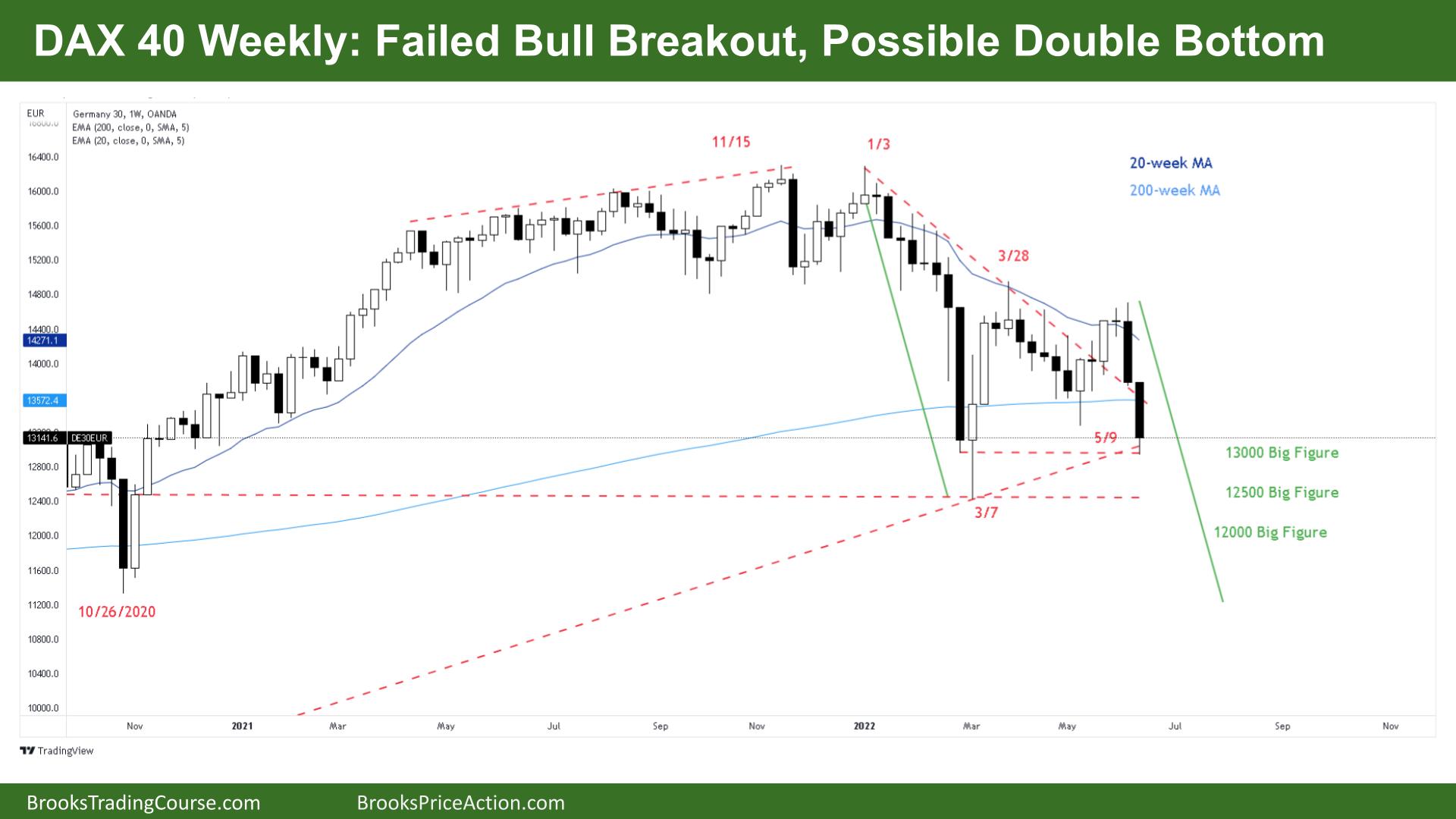

The Weekly DAX chart

- The Dax 40 futures was a big bear bar closing near its lows so market should trade lower next week.

- It was a failed bull breakout and also the second consecutive big bear bar so traders should expect at least a small second leg.

- For the bulls, it’s a deep pullback for a double bottom with March 7th at the 13000 big round number.

- Bulls have successfully traded long from here expecting the larger trend to continue, but perhaps the context is different now?

- They expect lower prices next week but will scale into longs below this week looking to at least create a wedge reversal possibly lower than March.

- They know the best the bears will get in the medium-term is a trading range and it looks like we are at the bottom, so the math is better for buying.

- Bulls know that no matter how bearish something looks in a trading range, traders should expect disappointment and reversals. They want an inside bar for a High 1 buy signal.

- Ensuring the disappointment is equally shared after a failed breakout long, it might be a failed breakout short!

- For the bears, they see it as the 2nd leg of the lower high major trend reversal in January and are looking for a harmonic move of the same length. Though that puts it into 11000 territory or Oct 2020 which is a pandemic zone and probably too low.

- Bears see the failed bull breakout of a higher low, double bottom attempt at a major trend reversal. You can see every bull exited in a hurry and bears sold the market.

- The bears want a weekly bar closing completely below the 200-week moving average (MA) which hasn’t happened in 2 years so it makes you wonder just how bearish can it be yet.

- The bears look left and see both times we have a strong bear bar into that long-term average, it was a sell climax and was the start of an aggressive bull trend. If you are short, you’re looking to take profits. The small tail on the end of the bar shows this.

- Two weeks ago bears held into the weekend, but this Friday they did not.

- If bears are scalping and selling above bars, bulls will be buying below bars so we might go sideways. This is bad for the bears at support. They need a strong break and close below the 13000 big round number to convince traders we will move down.

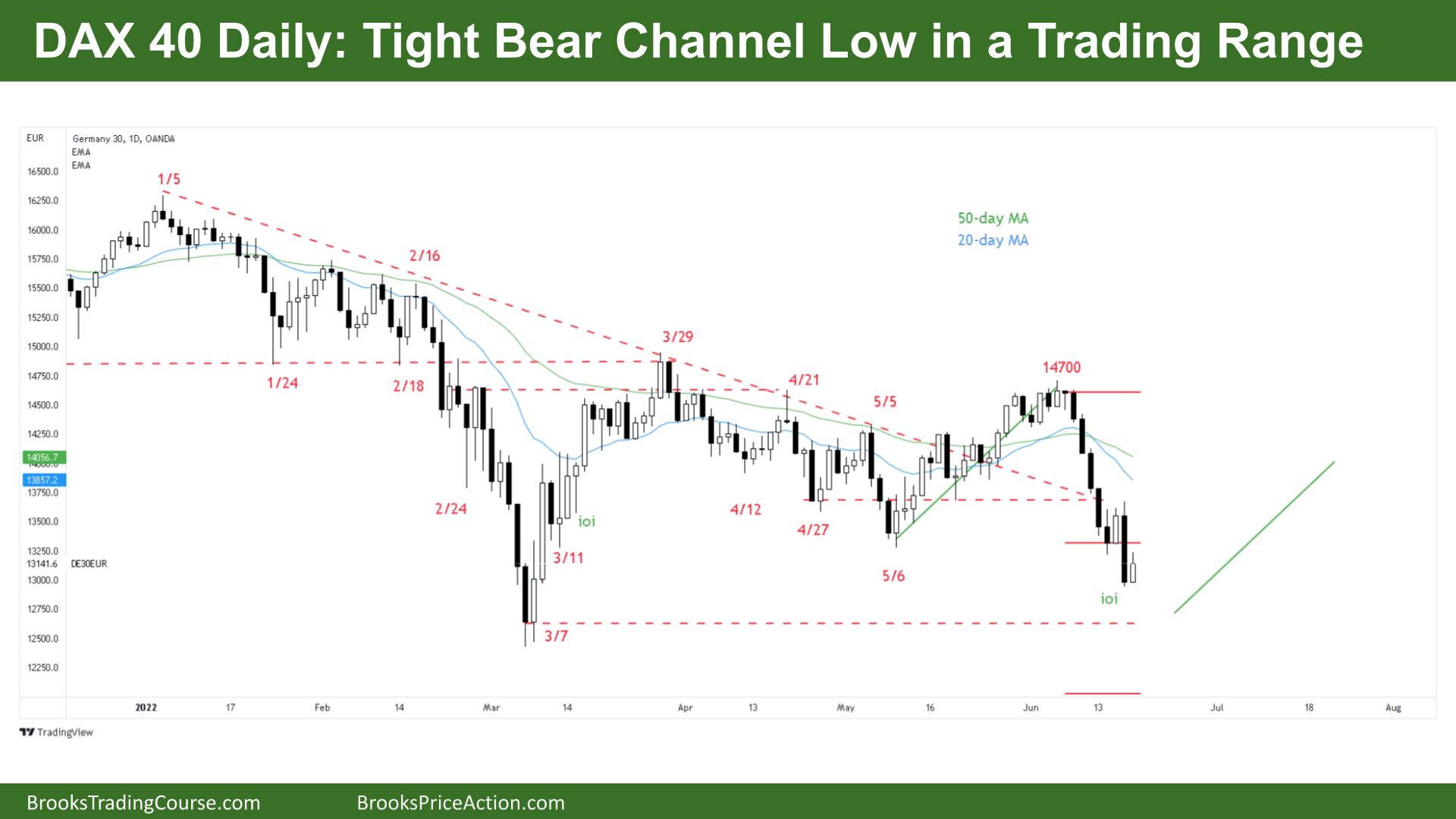

The Daily DAX chart

- The Dax 40 futures was a small bull inside bar with a tail on top. It followed a down week and a sell climax on Thursday.

- It was a failed bull breakout and the bulls see an area for a double bottom at the bottom of a trading range. They made money buying here last time so will start to scale in to do it again here.

- They see a failed breakout and now are trying for a double bottom, lower low major trend reversal.

- The bulls want a High 1 buy but after such a large streak who wants to buy here? Waiting for a second entry buy at the bottom of the range would be a higher probability long.

- Some traders look at averages crossing and recently saw them do so for the first time in 5 months. Bulls are able to rally strongly so it is more likely we are in a trading range.

- Trading ranges are full of disappointment and the bears might have to handle a failed breakout instead. Other commodity, metal and Forex charts are doing similar right now as traders wonder how much inflation is priced in already.

- The bears see an 8-bar tight bear channel and expect a second leg lower. They see the larger weekly move from January to March as the first leg and want this to be the start of an equidistant harmonic move.

- They see the lack of follow-through after Thursday and suspect we might be transitioning into a trading range so will look to sell above bars instead of below which will mean sideways to down next week.

- Even so, a reasonable measured move target would be the 5 bear bars before the pullback which would put us in new lows for the year. Once again, Monday is the day to watch, if the US session continues a down Euro session it could be another move down.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.