Trading Update: Wednesday August 2, 2023

S&P Emini pre-open market analysis

Emini daily chart

- The Emini continues to go sideways following last Thursdays outside down bar. On the Globex Market, the Bears are testing the July 28th Low.

- I have been saying for the past couple of blogs that the odds favor a test of the moving average (blue line). While the bulls have done a good job of forming a tight channel, the momentum to the upside is losing energy.

- Traders are happy to buy far above the moving average if the momentum justifies paying a higher premium. However, the bulls have lost momentum, so traders will be less willing to buy far above the moving average.

- The bears are hopeful that they can get a strong downside breakout; however, more likely, the best the bears will be able to achieve is a trading range.

- Overall, traders should expect the market to reach the moving average today or in the next few days.

Emini 5-minute chart and what to expect today

- Emini is down 33 points in the overnight Globex session.

- The Globex market recently sold off below last Thursday’s low (July 27th), the minimum expectation for the bears.

- The market will probably form a trading range around last Thursday’s low, and buyers will probably be around the low.

- Today will probably have a lot of trading range price action. This means most traders should assume that the open will be a limit order market until proven otherwise.

- Most traders should wait for 6-12 bars before placing a trade. By being patient on the open, a trader will gain certainty about the day’s structure and have higher confidence in what type of day is forming.

- There is at least an 80% chance that the market will form an opening swing before the end of the second hour. It is common for the opening swing to begin after the formation of a double top/bottom or a wedge top/bottom.

Emini intraday market update

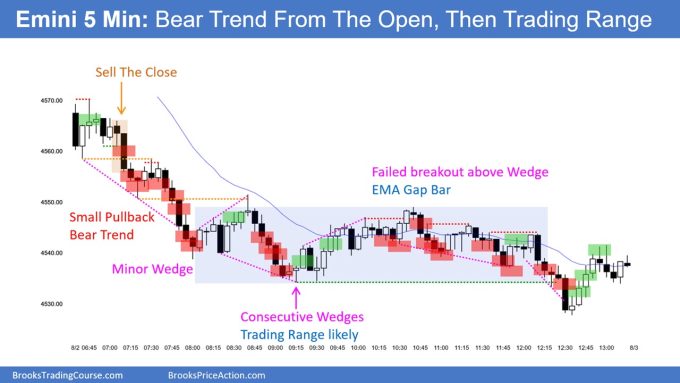

- The Emini gapped down and formed a bear trend from the open. The bears have done an excellent job; however, as of bar 36, the market is beginning to develop more buying pressure. This increases the odds that the market is transitioning into a trading range.

- The bears hope the selloff will continue for the rest of the day.

- There is a 60% chance that the bear trend will transition into a trading range before the end of the day.

- Traders should expect a trading range to develop soon, which will probably last at least a few hours.

Yesterday’s Emini setups

Richard created the SP500 Emini chart (Al travelling).

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current daily charts added to Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD is trying to get a downside breakout below the July 28th low. Next, the bears want a test of the July 6th low.

- While the channel down is tight, it looks like a bear leg in what will become a trading range. The bears will probably be disappointed soon, and the market will bounce.

- Overall, the market will probably begin to go sideways soon and attempt to rally for a couple of weeks.

Summary of today’s S&P Emini price action

Al created the SP500 Emini chart.

End of day video review

Here is YouTube link if video popup blocked:

Emini End of Day Review – Wednesday August 2, 2023 – Brad Wolff

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Upon further review of your responses, one suggests buying above the close of the signal bar and the other seems to suggest buying above the signal bar high. Which is it?

Sorry for confusion George but yes, Al does recommend buying above high of signal bar (as Andrew suggests). My charts are marked more aggressively so not strictly in accordance with Al’s standard advice. I trade off a tick chart and use non-standard order flow tools so should perhaps not be marking up these charts in Al’s absence, right? 🙂

Thank you for additional clarification, Richard. I appreciate that we each have slightly different approaches to trading the market. It is good that you share yours. And please keep marking up those charts any way you want. We all learn from it.

In your Emini chart setups, are you buying and selling the “close” of a signal bar rather than waiting for a break above the high or low of the bar? It certainly reduces slippage at the expense of sometimes taking a trade that subsequently never broke out. I would prefer to just buy the close of a signal bar if it is a push one way or the other. Thanks.

Al’s standard swing trade entry is 1 tick above or below the high/low of a signal bar. That should be clear from chart markups, but my charts (when Al traveling) do show entries 1 tick above/below close which is more aggressive. See course video 32B for Al’s recommended stop order entries.

Thank you for the clarification.

The charts here are marked for stop entries which Al recommends for beginners. Yes you want to see the market go beyond the signal bar to avoid those situations where the trade doesn’t trigger.

Thanks Andrew.