Al added a few comments to report

Market Overview: Weekend Market Analysis

The SP500 Emini bulls got bull follow-through buying on the weekly chart. Odds favor a test of the February 2 high. The bulls will need to close far above the February 2 high to convince traders that a re-test of the trend extreme is underway. The bears want the Emini to stall around the February 2 high and reverse lower from a double top bear flag. The rally in the last 2 weeks was in a tight bear channel. Odds slightly favor a second leg sideways to up after a pullback.

S&P500 Emini futures

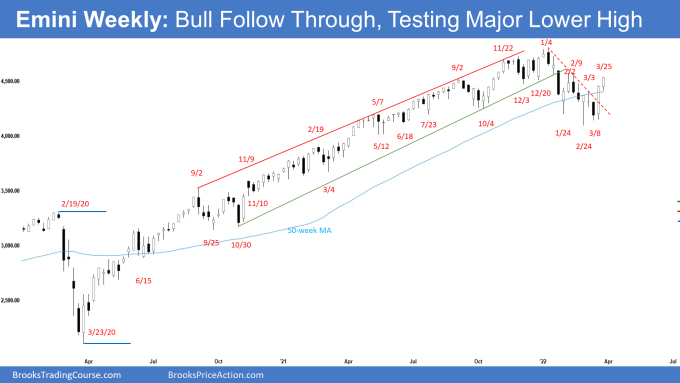

The Weekly S&P500 Emini chart

- This week’s Emini weekly candlestick was a bull bar closing near the high. It was a bull follow-through bar following last week’s big bull reversal bar from a higher low major trend reversal and a wedge bull flag.

- Last week, we said that odds slightly favor sideways to up and that the bulls will need to close next week as another bull bar to confirm the reversal higher. The stronger the bull bar and the higher the close, the higher the odds that the correction is over.

- Al said that the market may continue in its eight-month trading range indefinitely. The next target for the bulls is the February 2nd lower high, which is a major lower high. This remains true.

- Since this week closed near the high and followed a big bull bar closing near the high from last week, odds are good that we will test the February 2 high next week.

- The bulls hope that this is the start of the reversal to re-test the trend extreme followed by a new high. They want consecutive bull bars closing near their highs, like the one from October 4 low.

- This week’s bull bar closing near the high is a strong buy signal bar for next week. It increases the odds of a gap up on Monday. If the gap is small, it usually closes early.

- Al has been saying since March 15 that the Emini should test the February 2 high before breaking below the February 24 low. But it might pull back to the March 3 high first.

- The bears hope that this is simply a pullback (bounce) from the 2-month correction. They want the Emini to stall around February 2 high and reverse lower from a double top bear flag. They want next week to have a bear body, even though the Emini may trade higher first.

- The bears want a strong break below the February 24 low which is the neckline of the double top bear flag and a measured move down. There is only a 30% chance of a break below that low before a strong break above the Feb 2 high.

- Al said that if the bears get the breakout below February 24 low (only 30% chance currently), it would follow 3 strong reversals up (wedge bull flag). There would be a lot of trapped bulls because everyone expected higher prices. It would likely lead to a 50% chance of a fast sell-off for about a 500-point measured move down to 3600 based on the height of the 7-month trading range.

- Since this week’s candlestick was a strong bull follow-through bar closing near its high, odds slightly favor sideways to up for next week. Since the February 2 high is less than 50 points above Friday’s close, we may even reach it early next week.

- The bulls will need to close far above the February 2 high to convince traders that a re-test of the prior high and a subsequent breakout to a new high is underway.

- If next week trades higher but reverses and close as a bear bar near the low, traders will start wondering if this will lead to a reversal from a double top bear flag.

- The Emini is in an 8-month trading range. The trading range is more likely to continue rather than a strong breakout from either direction.

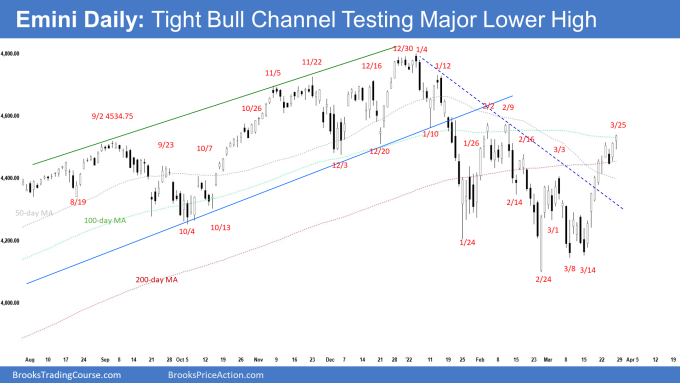

The Daily S&P500 Emini chart

- The Emini had a small pullback on Wednesday followed by a second leg sideways to up into Friday’s close, closing around the 100-day moving average.

- Last week, we said that odds slightly favor sideways to up, and for a second leg sideways to up to form after a pullback.

- The rally in the last 2 weeks was in a tight bull channel and strong enough for traders to expect at least a 2nd leg sideways to up after a slightly larger pullback. If there is a pullback, it may test the March 3 high.

- The bulls want this to be the reversal higher to re-test the trend extreme, followed by a breakout to a new all-time high. They want a strong leg up like the one which started from October 13 low.

- Al said that the February 2 high is a major lower high. If the bulls get two closes above that high, the rally will probably continue up to a new all-time high.

- Alternatively, if the bulls fail to get two closes above that high, the bears will try to get a reversal down from a double top with that high. But even if they do, a continuation of the trading range would still be more likely than a break below the February 24 neckline of the double top bear flag.

- Traders should expect the market to be sideways to up for several more months. This remains true.

- The bears want the Emini to stall around the February 2 high. They then want a reversal lower from a double top bear flag with February 2 high followed by a strong break below February 24 low and a measured move down to around 3600 based on the height of the 7-month trading range.

- Al said that there is only a 30% chance for the Emini breaking below the February 24 low before a strong break above February 2 high.

- If there is a bear breakout, it would follow 3 strong reversals up (wedge bull flag). There would be a lot of trapped bulls because everyone expected higher prices. It would be a Surprise Bear Breakout and has a 50% chance of a fast sell-off for about a 500-point measured move (to around 3600).

- The market has been in a trading range for 8 months. Traders are deciding if the bull trend is resuming or if the rally is a bull leg in the trading range. The trading range is more likely to continue than a resumption of the bull trend.

- For now, odds slightly favor sideways to up for next week, and for a second leg sideways to up to form after a slightly larger pullback.

- Traders will be monitoring whether the bulls can test the February 2 high and close far above it, or if the Emini stalls around the February 2 high and reverses lower.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all reports on the Market Analysis page.

Thanks for the amazing analysis as always! When the market bounces violently from the February 24th low, Al said it is too expensive for the bulls given how far is the entry vs stop location and they will wait for a better entry location as has happened. How valid is that case for the bears which are patiently waiting around February DT and given the attractive stop location they will aggressively short?

Dear Eli, you’re most welcome..

If the trade has a small risk, but high return, the odds will always be lower.

As for how valid, I think it is perfectly valid for them to wait and see if there is an entry.

However, blindly entering a short simply because price has reached a double top may not be ideal.

Rather, bears will wait for price to reach the double top bear flag, and again, back to what we have discussed in an earlier post..

1) How is the buying/selling pressure? Is the bull buying pressure super strong as it is now? Or weak bull bars, strong bear bars, overlapping bars, 3 pushes, dojis?

Selling a strong bounce, tight bull channel, consecutive bull bars = bad

I would want to see if prices stall around that level.. and if the channel is tight, wait for a trend line break, re-test of the leg high and get some sort of a double top with a good signal bar.

Just my 2c..

Have a blessed week ahead Eli! Keep it up!

Best Regards,

Andrew

Thanks for the post Andrew, as always, I have couple of questions: 1) when “Al said that the market may continue in its eight-month trading range indefinitely” what does he really mean by “indefinitely”? can you please elaborate? 2) on the daily chart, “Al said that the February 2 high is a major lower high. If the bulls get two closes above that high, the rally will probably continue up to a new all-time high”, here why it is “two closes” not some other numbers like three? is this a rule-of-thumb thing that if this happens it greatly increase the probability of continue to a new high or at least test prior high?

No one knows how long a trading range will last. This one has gone on for 8 months. If it reaches 20 bars (months) on the monthly chart, then the probability of a bear breakout will be about the same as for a bull breakout. At the moment, there is a 30% chance of a break below the February low before a break above the February 2 high. The odds are greater than 50% of a break to a new all-time high before there is a bear trend reversal on the monthly chart.

But, the Emini will enter a trading range for about 10 years starting within a few years. There is a 30% chance that it has already begun. Once it begins, there should be at least a couple pullbacks of at least 30% and possibly 50%, like in the 2000’s and the 1970’s.

As strong as the rally has been over the past 2 weeks, the market is in a trading range on the daily and monthly charts. One of the hallmarks is disappointment. The bulls will probably be disappointed within a couple weeks by the rally on the daily chart not breaking strongly above that February 2 high. The Emini might pull back below the March 3 breakout point on the daily chart first.

If there is a pullback below the March 3 high and the Emini then goes to a new high and fails, there would be a wedge rally to a higher high double top. That would probably lead to at least a couple legs down.

Traders like to see confirmation. It increases their confidence that a move will continue. When there is a bull breakout, traders like to see consecutive bull bars closing above the breakout point, and preferably both bars closing near their highs. That increases the chance of another leg up.

I talked about that in mid-October when the rally went above the September 2 high. By October 25, traders concluded that the probability of another leg up was about 60%.

Thank you for the elaboration Al! As always!

Thank you so much for these great analyses

Dear Mikael,

You’re most welcome..

Have a blessed week ahead! 🙂

Best Regards,

Andrew

Thanks Andrew, excellent work again! Sifting and brooding through these charts make me feel like a detective, I love it ;-)!

Dear Sybren,

You’re most welcome.. brooding over charts is the best part of my day.. (other than playing with my cats) 🙂

Have a blessed week ahead too!

Best Regards,

Andrew