Trading Update: Tuesday July 26, 2022

Emini pre-open market analysis

Emini daily chart

- Emini bears want close below breakout point of June 28, damaging the bull case.

- The market formed an inside bar yesterday, closing near the open of the bar.

- Bulls hope that yesterday will lead to a successful pullback (high 1) buy setup and second leg up from the 7-bar bull micro channel up.

- The bears hope that the buy the close bulls who bought on July 21 will be disappointed enough to want to exit breakeven, which would drive the market lower.

- The bulls have a breakout above the neckline (June 28) double bottom and want a measured move up to the June 2 high, which is a major lower high.

- The bears want the breakout of the double bottom to fail and lead to a failed breakout which would be a type of wedge top (all failed breakouts of double bottoms are a type of wedge).

- Bears hope yesterday’s inside bar will lead to a final flag. If the market gets above the July 22 high, the bears will want the market to fail and form a sell signal, which would be a possible parabolic wedge (July 15, July 21, and a new high above July 22), but the channel is too tight, that the best the bears can get is sideways.

- The bulls still have a micro channel, so the first reversal down will likely fail. Traders will pay attention to yesterday’s low because it will probably be a magnet today since the micro channel should end soon.

- Overall, traders should expect more sideways to up and the first reversal down not being successful.

Emini 5-minute chart and what to expect today

- Emini is down 15 points in the overnight Globex session.

- The market has been in a trading range for most of the overnight Globex session.

- Traders should pay attention to yesterday’s low at 3,946 as it will likely be an important price level today. This is because the market may have to fall below it during the day session, and if we do, the market may test it several times.

- Traders should also pay attention to the open of the day as it can get tested several times if the day is going to be a trading range.

- Traders should expect a trading range open until they see a strong breakout with follow through.

- If the day is going to be a strong trend day, traders will have plenty of time to enter in the direction of the trend.

- It is essential to avoid getting too excited on the open, and avoid taking bad trades (buying too high or selling too low in a trading range). Since the open often goes sideways, it is easy to take a lot of quick losses betting on a breakout, and the trader will not be able to get back to breakeven before the end of the day.

- Most opens have at least one good swing trade beginning within the first 2 hours, so a trader should try the best to be patient and wait for a credible stop entry such as a double bottom/top, wedge bottom/top, or a strong breakout with follow-through.

- Also, one should realize that most traders who are aggressive on the open and scalping, can exit very quickly on disappointment. Exiting quickly gives traders the edge they need to be profitable in trading the open aggressively.

- Most traders starting out cannot exit quickly if disappointed, which is why I often say most traders should wait for 6-12 bars before trading on the open. Take yesterday, for example; if a trader just waited for 12 bars before trading, they could have entered a double bottom setup and targeted the open of the day.

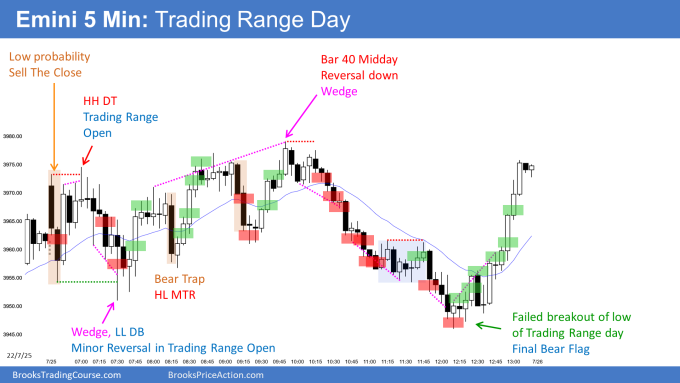

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- After 5 bars stalling at the moving average (blue line) the bulls might be giving up this morning. More likely, today’s selloff will be a pullback leading to higher prices.

- Today is a good example of when you get a rally that begins to stall at resistance; traders will only give the market a few bars to breakout before they will give up and look to buy lower, which is happening here. The bears know this, and they will sell aggressively for at least a scalp anticipating the bulls giving up.

- It is possible that the market has to reach the 1.0000 big round number before testing back up to the 2017 low and the bottom of the two-month trading range (May – June).

- The bears need today to close on its low, and tomorrow to form a strong follow-through bar that is unlikely to happen. The market is in a trading range, so traders should expect disappointment.

- Traders will pay attention today to see what the bears will do. Will they buy back shorts before the close, which would paint a tail on the bottom of the bar (a sign of weakness) or are the bears willing to sell into the close of the bar, which would increase the probability of follow-through tomorrow.

- The bears have only had one bear bar close below its midpoint in the past 10 bars, which is another reason why I think the current reversal down (today) will fail and lead to a second leg up.

- Overall, the odds still favor the market to reach the 2017 low and the bottom of the two-month trading range (May – June) regardless of if the market test the 1.0000 big round number first.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

- The bears got a bear trend from the open, leading to a trading range day.

- The market tried to reverse up several times during the first 12 bars. However, the market was unable to reach the moving average.

- The bulls tied to from a wedge bottom, but the 6:50 PT close and 8:05 close for a measuring gap which increased the odds of a possible small pullback bear trend and a successful bear breakout below the wedge bottom around 8:00 AM.

- The bulls had a great-looking bull bar closing on high at 8:00. Still, it was the first test of the moving average all day, and the bulls needed a decent close above the moving average before traders would be convinced to buy higher than the above average price (moving average).

- The 8:00 bull trap led to a strong breakout and measured move down from the high of the day to the 8:00 low. The buy the close bulls (8:00) were trapped and forced to sell out with a loss. Note, some buy the close bulls bought lower and avoided a loss, but they used a very wide stop.

- The rally up to 10:00 was enough to increase the odds of a trading range day, and the market went sideways for the rest of the day.

- One last note, when the market has a lot of buying pressure on the open, it will often try and test major breakout points, such as the 8:00 low, which was tested during the 10:15 rally.

- Overall, today was a test of the June 28 high. While the bears got a decent close, they need more bear bars closing near their lows before traders are convinced of a successful reversal.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

As usual great job Brad! One point that could be useful when you fill in the end of day summary also post the link to your youtube video- review of the day