- Market Overview: Weekend Market Analysis

- 30-year Treasury Bond futures

- Bond futures weekly chart at apex of triangle and bottom of trading range

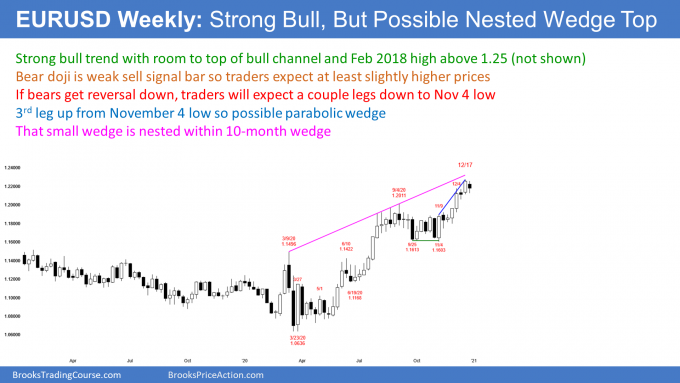

- EURUSD Forex market

- EURUSD weekly chart has nested wedge top but no reversal down yet

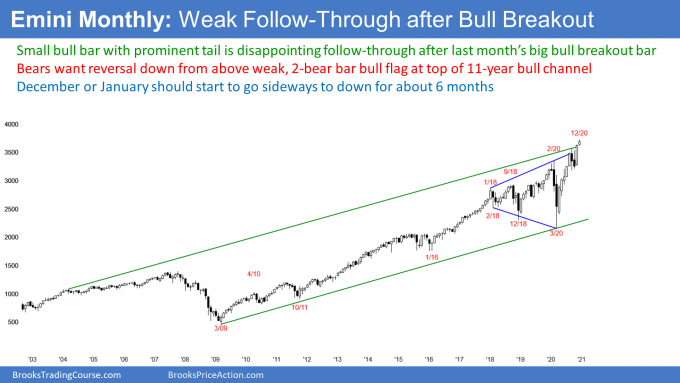

- S&P500 Emini futures

- Monthly Emini chart so far has disappointing follow-through after strong November

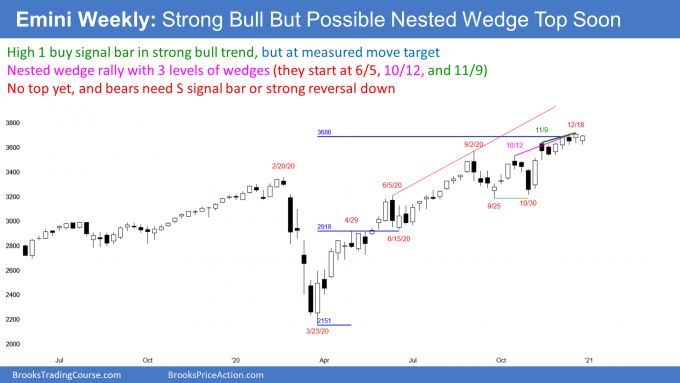

- Weekly S&P500 Emini futures chart has High 1 bull flag, but might form nested wedge top soon

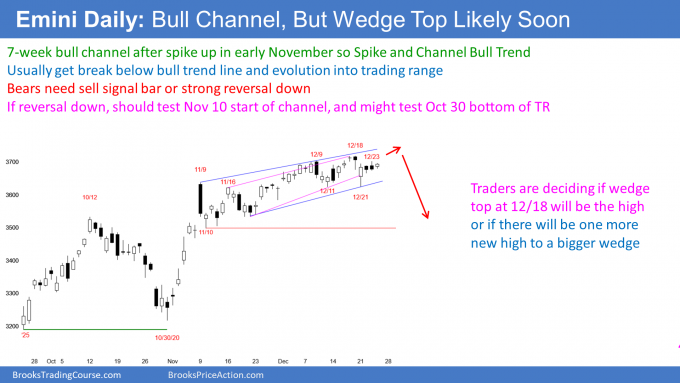

- Daily S&P500 Emini futures chart is late in bull channel so reversal down to 3500 likely soon

Market Overview: Weekend Market Analysis

The SP500 Emini futures are at a measured move target, and there is a nested wedge top on the weekly chart. Also, the 5-week rally on the daily chart has not been very strong. Traders should expect a pullback to below 3500 to begin by early January after a possible 2020 new all-time high.

Bond futures on the weekly chart are at the apex of a 10-month triangle, and just above a 2-year bull trend line. They should break up or down by the end of January.

The EURUSD Forex market on the weekly chart has rallied strongly from the March low. However, the rally is in a nested wedge bull channel. That typically results in a bear breakout, and a couple legs down. While the bull trend is still intact, traders should be ready for a possible reversal down in January.

30-year Treasury Bond futures

Bond futures weekly chart at apex of triangle and bottom of trading range

The weekly bond futures bond chart has been sideways since the biggest buy climax in history in March. Until September, all you would hear on TV was that interest rates would go to zero, and gold would reach infinity. Clearly, the pundits were exaggerating, but I have said many times for 14 months that anyone claiming that we would have negative interest rates is out of touch with the American people. They would never accept it, and it therefore would not happen.

March looks like a credible top. If it is not, the final top will not be much above the March high.

Finally, since March, I have said that bonds would be sideways in a tight range for the remainder of the year. Why? Because after a strong reversal from an extreme buy climax, a market typically goes sideways for 10 or more bars. It is important to understand that a pattern is often clear on several time frames. Corrections are based on the highest time frame that shows the pattern. That is the monthly chart (not shown). Ten bars on the monthly chart meant the rest of 2020.

Is a bear breakout imminent?

Now the experts have reversed their opinions. They are saying that the dollar will get crushed and it will cause inflation, which will make bonds fall.

This conclusion is right, but their timing might not be. I have said many times this year that interest rates will be higher (bonds lower) 5 and 10 years from now. But I keep making the point that the selloff will not be in a straight line. There will be rallies along the way, and the rallies can be strong, and last two to three months.

With bonds repeatedly trying to break below the June low and failing, you will get an increasing number of disappointed bears. What will they do? They will buy back their shorts and look to sell again higher. If the market repeatedly tries to do something and fails, it then usually tries the opposite. That means an imminent bear breakout is not nearly as certain as everyone on TV believes.

The significance of the triangle

While the bond market has sold off since the March high, it has also been sideways in a triangle. It is now at the apex of that triangle, and it has additionally been in a tight trading range for 8 weeks. This is a neutral market. It might continue sideways for another few weeks until it pokes below the 2-year bull trend line, before deciding on the direction of the breakout. But bonds will probably break out up or down, before the end of January.

A Breakout Mode market has a 50% chance of a successful bull breakout and a 50% chance of a successful bear breakout. Furthermore, the 1st breakout up or down has a 50% chance of reversing. It is a neutral pattern, but one that is likely to break out soon.

Weak buy signal

This week has a bull body after breaking below an ii pattern (consecutive inside bars). Should you buy next week for a reversal up? The bond futures are still in a tight range and that is a Limit Order Market. There typically are more traders selling above bars, and buying below, than traders entering with stops hoping for a trend. So, no, buying above this week’s high is not a high probability bet.

This is particularly true since this week’s candlestick had a small body with prominent tails above and below. That is a neutral bar and not the clear start of a trend.

It is better to wait for a stronger buy or sell signal. That can be a strong signal bar after a failed breakout below or above, or it can be from a strong breakout. A strong breakout usually means a couple bars closing far above the bear trend line and closing near theirs highs, or a couple bars closing far below the range and closing near their lows.

What should traders expect next week?

More sideways trading. Markets have inertia, and they tend to continue doing what they have been doing. But with the bond market at the apex of a triangle and just above a 2-year bull trend line, traders are expecting a breakout soon. However, until there is a breakout, there is no breakout.

EURUSD Forex market

EURUSD weekly chart has nested wedge top but no reversal down yet

The EURUSD Forex market on the weekly chart has been in a bull trend since the March low. However, the rally over the past 8 weeks has had 3 legs up. If there is a reversal down within the next few weeks, traders will see this rally as a wedge top.

This 8-week rally is the 3rd leg up in a rally that began in March. Therefore, if there is a reversal down in January, the pattern will be a nested wedge. That has a higher probability of leading to a couple legs down. Traders would look for a test of the bottom of the most recent leg up, which is the November low at around 1.16.

Breakout points are magnets, which means that if a reversal down gets near a breakout point, it usually will test it. A test means that the selloff gets very close or even dips below it. The most important breakout point is the March 9 high, just below 1.15. Therefore, if the EURUSD weekly chart reverses down in January, traders should expect the selloff to reach around 1.15. While it could fall further, that will be the focus for most traders.

That is far below the current price. If there is a reversal that gets there, the selloff will probably take a least a couple months and have at least a couple legs.

Now, why talk about a big reversal when the chart is clearly in a bull trend? Because a bull channel usually has a bear breakout. A bear breakout would also be a reversal down from a nested wedge buy climax.

Channels usually evolve into a trading range

What happens after a test of the November low? When there is a reversal down from a bull channel, the chart usually evolves into a trading range. Therefore, traders would expect the EURUSD to trade between 1.15 and 1.22 for many months. At some point, the EURUSD would then either resume up to above 1.25 or continue down to the March low at around 1.05.

How long can the bull trend last?

Trends constantly create tops and then ignore them. They can last much longer and go much further than what appears reasonable.

I said that bull channels typically have bear breakouts. Well, about 25% of the time, there is a successful bull breakout and an acceleration up above a bull channel. But that means it is more likely that there will be a bear breakout.

If there is an acceleration up, the next target is the February 2018 high just above 1.25. The EURUSD should get there. The question is when. At the moment, it is more likely that there will be a pullback for a few months first.

If instead the EURUSD continues strongly up to far above that 1.25 level, the next target is the 2014 high at around 1.40. The February 2018 1.25 high is the neckline of a double bottom created by the January 2017 and March 2020 lows. A measured move up is 1.4770. If this bull trend continues to that target, it will probably take at least a couple years to get there.

S&P500 Emini futures

Monthly Emini chart so far has disappointing follow-through after strong November

The monthly S&P500 Emini futures chart is in a strong bull trend, which makes higher prices likely over the coming year. A new all-time-high is likely for 2020. This month so far is a small bull bar. This is modest follow-through buying after November’s big bar. Traders see a bull follow-through bar as a sign that the market will continue at least a little higher.

I think what is going on now is fascinating. JP Morgan says that the S&P will reach 4,600 in 2021. But that does not mean in January. The question is when, and a year is a long time. Remember, this year sold off 35% and it is now closing on the high. With the Emini in a strong bull trend on all time frames, it certainly is possible.

The bulls want the monthly chart to close near its high. December closes next Thursday. There are only 4 trading days remaining in 2021. What they do can affect what traders will expect for the 1st many months of 2021.

The bulls want the month to close within 20 points of the high. If it does, then they will have a reasonable chance of a gap up to another new all-time high when 2021 trading begins on January 4.

But think about this. If there is a gap up on the daily chart to a new high on Monday January 4, 2021, there would also be a gap up to a new high on the weekly, monthly, and yearly charts as well. Gaps on the monthly chart are rare. Although I have not checked, I do not know if there has ever been a gap up to a new all-time high on the monthly S&P or Emini futures charts.

What happens if there is a yearly gap up on January 4, 2021?

Let’s say that there is a big gap up on January 4 on the daily chart. A big gap on the daily chart would be a small gap on the monthly chart, and a tiny gap on the yearly chart. This is important because small gaps usually close before the end of the bar. Therefore, the yearly gap should close before the end of 2021 when the yearly candlestick closes. But since the gap will be small on the monthly chart, it should close before the monthly bar closes at the end of January. If it stays open, it should close within a month or two afterwards.

If the gap is small on the weekly chart, it will probably close by the end of the week, or shortly thereafter. Therefore as dramatic as it would be if there is a gap up to a new all-time high, on January 4, the euphoria should be short-lived because the monthly and yearly gaps would likely soon close.

Don’t forget the bad bull flag

The Emini pulled back in October and November. Both months were bear bars. But the pullback was in a bull trend and it was therefore a High 1 bull flag.

A bull flag that is composed of 2 bear bars is less likely to lead to a sustained rally. When December traded above the November high, it triggered the High 1 buy signal. However, I have been saying that the resumption of a bull trend, after a bad bull flag and late in a buy climax, typically only lasts a couple bars. December is the 2nd bar. That increases the chance of a pullback in January, whether or not January breaks above the December high.

Furthermore, there is an increased chance that the pullback will last longer than the 2 bars in the bull flag. It typically will have at least a couple small legs down. Therefore, if there is a reversal down starting in January, it could take about 5 bars to complete 2 legs down. That means that a reversal down in January could lead to a trading range for the 1st half of 2021.

And don’t forget politics

There is unusual acrimony in Washington, and President Trump has done many unexpected things during his 4 years. Traders should be prepared for the possibility of other surprises after January 5. That is the date of the Georgia senate races. If Biden wins both, that could quickly lead to a selloff.

Also, President Trump has done many surprising things during his 4 years, and he might do something unexpected after the January 5 election. For example, he and his supporters in Congress might do something disruptive when Congress meets to accept the electoral college votes on January 6.

Also, other countries might try to do something in Trump’s final 2 weeks, that they might not be willing to do once Biden becomes president, hoping that Trump will give them political cover. And then there are all of the unimaginable Black Swan events that can happen at any time.

Weekly S&P500 Emini futures chart has High 1 bull flag, but might form nested wedge top soon

The weekly S&P500 Emini futures chart has rallied strongly since the October low. This week pulled back, but it was a bull bar closing near its high. It is a High 1 bull flag for next week. As I wrote above, the Emini will probably trade at least a little higher next week. The bulls want it to trade a lot higher, and it might to a new all-time high.

Traders should note that, while the weekly chart is rallying, the bars since the September 2 high are also consistent with the market being in a trading range since that high. Therefore, if there is a reversal down in January, traders will begin to wonder if the selloff will reach the October low in the first quarter. That would then be a bear leg in the trading range.

Testing a measured move target

Note that the Emini is at a measured move target. The June 15 low tested the April 29 high, but did not dip below it. The Emini tested that breakout point again 2 week later and reversed up strongly. That tells us that traders consider the April 29 high is very important.

The pandemic low is also very important. Two very important prices often generate a 3rd important price at a measured move away. The measured move target is 3686. While the all-time high is now about 1% above the target, if there is a reversal down from this area, it will in part be due to the measured move.

Many computers will probably take profits around here. If enough do, the Emini will pull back. If instead the Emini just keeps working higher, then traders will conclude that the target turned out to be insignificant.

Daily S&P500 Emini futures chart is late in bull channel so reversal down to 3500 likely soon

The daily S&P500 Emini futures chart has been rallying in a Small Pullback Bull Trend since the November 10 pullback. A Small Pullback Bull Trend can continue to 50 or more bars if it is strong. One sign of strength is at least a couple sets of two or three big bull bars closing near their highs. This 2-month rally does not have even one. When a Small Pullback Bull Trend lacks those strong breakouts, it usually begins to turn sideways to down before 50 bars. The rally in the Emini is getting close to that duration.

Also, look at the bars since late October. About 75% of them closed either near the open, or in the middle of the bar. This lack of strong bull bars is more common when a rally is a leg in a trading range. A bull leg in a trading range usually leads to a bear leg, and a test of the bottom of the range. The bottom of the range is usually the start of the bull channel, which is the November 10 low just below 3500. However, it could be all of the way down to the October low, if that is the bottom of the range.

A bull channel usually begins to turn down after 3 legs up. This rally had minor reversals on November 16, December 9, and December 17. It therefore has met the minimum objective.

This week’s strong reversal up will probably result in one more new all-time high. If there is a reversal at that point, there will be a bigger wedge pattern where the 1st leg ended on November 9 and the 2nd leg ended on either December 9 or December 17.

The Emini is still in a bull trend

It is important to see that the Emini is still in a bull trend. A bull trend can continue much longer that what appears reasonable. However, because of the factors that I discussed, I think that the Emini will probably not go much higher before it tests down to 3500. There is a 60% chance of a pullback to 3500 before the Emini reaches 4000, and probably by the end of January.

But, it is important to see that there is no clear top yet. That is why I say that the odds are that the Emini will go at least a little higher before reversing down. And because it is in a bull trend on all time frames, it could just keep going up rather than having the likely pullback.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

The reason I track and trade according to Price Action, is in fact due to the market no longer reflecting supply and demand equilibrium. It’s simply no longer possible with High-Frequency Trading and the Federal Reserve piggybank.

There is no clear and accurate information regarding the market, only a “probability of the direction of the market” based on market physics. (Pressure=Force/Area or Price = Price Change/Time)

The price to sales ratio of the S&P 500 is currently paying $2.72 for every dollar in sales, compared to a historical average of $1.50. Fundamentally, the market is based on the profitability of publically traded companies. No sales, no profit, lower stock price. Therefore, the realistic value of the S&P is 2,053, not 3,724. If there is uncertainty in the market, the value should return to the mean, not the fringe.

Therefore, common sense indicates this is a hyper-manipulated market with no basis in reality, as it may have always been in the past. The alternative will be setting prices the day after quarterly earnings are posted…but what’s the fun in that!

The Fed won’t change course just because we we point out the manipulation. And, remember, the market knows covid has significantly dampened current year sales.

It has also damped rent, mortgage payments and increased personal and corporate bankruptcies.

30% of renters have not paid since last April and will owe $16,800 on average…I would assume the same is true for mortgages as well.

610 public companies and thousands of small businesses have declared bankruptcy in 2020 (2nd only to 2010)…so many there is a shortfall of Bankruptcy judges and has overwhelmed the court system.

States and Municipalities are underfunded due to reduced income taxes. The Senate (Mitch McConnell) basically just said ‘screw the poor, no more handouts’, so no spending there either.

So, in common sense terms…the markets make no sense. Given that profits drive the stock market, there is certainly no justification for reaching new all-time highs, unless we have finally reached the point of a fictional economic system in the United States.

I should probably add that the US$ has lost 18% against the Euro since March, giving foreign investors an additional 18% discount on equities. So in their terms, they are waiting for the market and the US$ to rebound and pull off a massive gain. This would also indicate a significant decline in the US equities markets in US$ terms facing pressure from both a sell-off and an appreciating US$. All it will take is US infrastructure investment and the Fed increasing rates to start pulling US$ out of the system.

Hi Al, thank you for the insights as usual, and happy holidays! This might be a little bit off-topic, but I wonder if you have any insights about a relative new thing called “SPAC” (Special Purpose Acquisition Company). Based on what I have heard it seems individual investors can just buy a SPAC for around $10 and just wait for the acquisition/merge to happen within 2 years, and at certain time during the period people can take 50% or even more profit, and the down side is relative quite small (like -10% or so).. Somewhat sounds too good to be true to me. My hunch tells me that if there is something doesn’t align with traders equation, there is probably something I am missing.. Appreciate if you can throw some lights (especially where are the risks) on this!

SPAC’s have gotten some coverage, and it is a get-rich-quick type of deal. If a person is a trader, he is not going to participate. While the reward is good, the risk is not good relative to the reward, and the probability is not particularly high.

I view things like that as distractions, even though they are fun to think about. I think a trader will make more money by focusing on trading and not getting distracted by shiny objects.

Thanks Al!

Al, as always, I appreciate your input and market analysis. I have one big question since back in March you said the drop was so large that we would have a second leg down and there wouldn’t be any V bottom recovery. The March crash was cause by the repo market and the feds jumped in to save it. They are pumping in tons of cash to keep this market climbing. Because of their interference, can it be that reading the market today the same way you read it in the past will not really work anymore? There is so much manipulations going on and massive computer trading, the market is no longer a representation of the masses but only of what the most powerful money players want us to see. It’s so disappointing and I really don’t see how to play the market with any certainty. The old analysis paralysis syndrome. I would certainly love to hear your discourse concerning all this. Maybe there is no real direction.

Thank you for all you do. You are greatly appreciated.

Thanks and Merry Christmas

Interesting discussion and definitely want to hear what is Al’s take on this, my thoughts is that the fact “feds are pumping in tons of cash to keep this market climbing” is “a kind of surprise” on the chart, though in “real life” probably everyone knows that is what feds might do, but back to the chart we just react and treat it as a surprise. Just my thoughts. Love to know what Al will say.

At the March bottom, there was a 60% chance of a 2nd leg sideways to down, like after the 1987 crash and after any strong breakout. That means there was a 40% chance of a Small Pullback Bull Trend, which has been the case on the weekly chart.

There is currently a 40% chance that the 1st reversal down will be minor. That means a 60% chance of at least a 2nd leg sideways to up. But 40% is big enough to not ignore, like at the March low.

All of the fundamentals are factored into the price. Everyone knows what you are saying about the Fed. It does not matter. The chart looks the way it does because hundreds of institutions have been placing bets on the outcome, based in their perception of all of the variables .

The Fed is a very important variable, but there are countless more. I bet you could only come up with a couple. But there are far more. The chart reflects the current vote on every imaginable variable.

At the moment, the chart indicates that it will probably go at least a little higher. However, it also looks like it will test 3500 before going much higher.

As for a lack of clarity, that is the perpetual goal of all markets. When things are not clear, then the bulls and bear are balanced. That means they both think the price is fair.

All markets spend most of their time in some state of being fair. Only about 5% of the bars on any chart clearly indicate that the price is wrong. You can tell because the chart is then in a strong breakout, racing to another zone of fairness.

First, consider whether or not the premise that institutions having enough financial clout to influence the direction of the market is a new phenomenon. It isn’t at all and so the manner in which market-generated activity is read can’t be different on that basis. The techniques that are discussed are still very useful and relevant. The reasons really don’t matter and every participant will have different reasons. For instance, even at the institutional level, a market making firm has very different criteria for trading than a pension fund in terms of their objectives, time frame, directional commitment, and so on.

You may have certain ideas of why the market is doing what it is based on fundamental factors and that is okay if you like having some ideas about potential “big picture” cause and effect relationships, however it’s important to always be nimble enough to change your opinion if the market isn’t doing what you think it “should.” Plus, keep in mind the idea that there’s a bullish and bearish interpretation of everything and how the information is viewed in relation to what was expected can impact whether price will go up or down (If I recall correctly, it’s in the lecture on News that Dr. Brooks addresses this in a logical and coherent manner). Additionally, even if you are trading purely from a fundamental standpoint, consider the availability heuristic – just because you’ve read a “positive” article doesn’t mean that there isn’t “negative” news that you’re unaware of that supersedes the former in the eyes of the market. The data plus institutional interpretation and level of conviction is what influences price direction. A surfer doesn’t ask why the waves form (granted, this is more knowable than reasons in the financial markets), he just rides them. As independent traders we are never really going to know the reasons (though that doesn’t stop us from guessing) and we don’t have to worry about forming the waves (in the way that institutions do), so we can just focus on being great at riding them.

Second, there are different outcomes that can follow each event and some are more likely than others. That is the nature of a probabilistic environment. However, having an idea of what is likely to occur and seeing that it is not happening is valuable information as well.

Third, it’s actually a wonderful thing that people “can’t play the market with any certainty” because if there was certainty then markets would cease functioning. If there are only two outcomes in outright trading – up or down – and one side is positive that they’ll win, then who would take the other side if they know with an equal amount of certainty that they’ll lose? A trader can become more confident in his skillset over time with correct practice, but the market itself is effective largely due to the uncertainty that is inherent to its nature.

Additionally, it is worth considering how price-sensitive and directionally committed the majority of market participants actually are. Looking at CME group data, open interest is only a small percentage of the overall daily volume, so that tells us that most participants are likely trading intraday. As such, it’s more important to be able to take and manage trades based on market-generated information. Some traders do use news and geopolitical events as potential catalysts to aid in their decision making, but (of the ones I know of) they still place a heavy emphasis on technical factors.

Lastly, with regards to the idea that the market is no longer a reflection of the masses: it is true that we don’t all get an equal vote on the direction of the market, but that has always been the case and will always be. There are some advantages and disadvantages with being a large institution and the same can be said of being an individual trader, so it’s mainly about playing to one’s own strengths and not worrying about the competition. And remember, every single transaction is recorded and reflected in the activity that we see unfolding. Nothing is hidden. There is more than enough market-generated information to make consistently good decisions.