- Market Overview: Weekend Market Analysis

- Gold futures

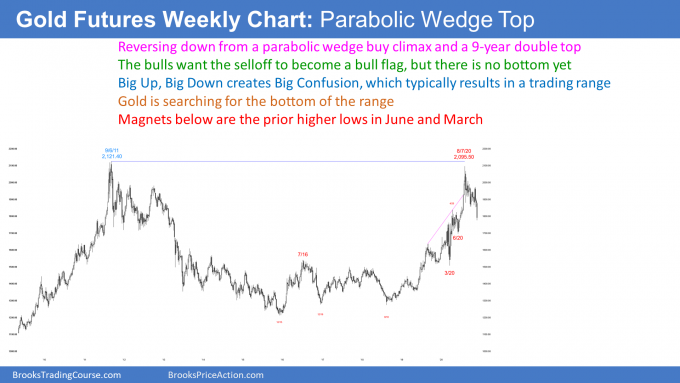

- Gold futures weekly chart turning down from wedge buy climax just below 2011 all-time high

- Bitcoin market

- Bitcoin daily chart is turning down from parabolic wedge buy climax and test of all-time high

- S&P500 Emini futures

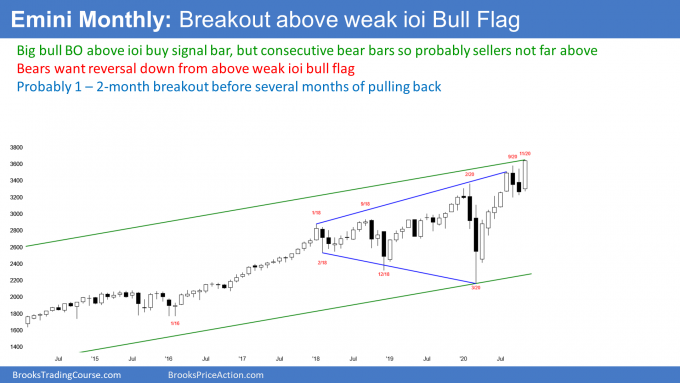

- Monthly Emini chart has huge bull bar in November, but October was a bear bar and therefore weak buy signal bar

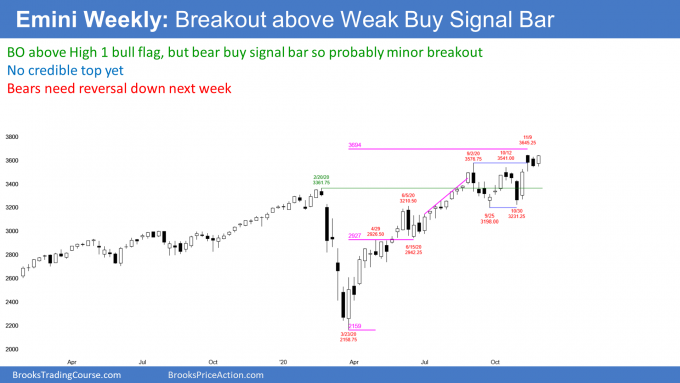

- Weekly S&P500 Emini futures chart weak breakout above High 1 bull flag buy signal bar

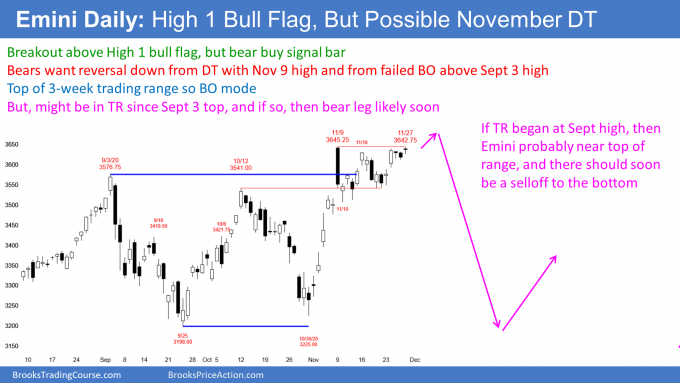

- Daily S&P500 Emini futures chart in strong rally, but next 10% move will probably be down

Market Overview: Weekend Market Analysis

The SP500 Emini futures has rallied strongly in November, but most of the bars on the daily chart have been weak. This makes the rally more likely to be a bull leg in a trading range that started in September, and the start of a measured move up. Emini futures down probably on next 10% move.

Gold futures are turning down on the weekly chart. This is probably the start of a trading range that will last many months.

Bitcoin is pulling back from a parabolic wedge buy climax on the daily chart. Traders should expect at least a few weeks of sideways trading.

Gold futures

Gold futures weekly chart turning down from wedge buy climax just below 2011 all-time high

The weekly gold futures chart has sold off since the August high. The reasons I am showing it is to remind traders that TV experts are stupid, and to explain some things that are going on in the Emini and bond futures markets.

If you watched any financial show this summer, you repeatedly heard how gold was early in a bull trend and that it was going far above the 2011 all-time high. The soundbite was “interest rates to zero and gold to infinity!” All of the experts were linking the two.

Where have the experts gone now that gold is down almost 15% from the high? No one is talking about gold now, because they don’t want to remind everyone about how bullish they were in August when gold was testing the top of a buy climax and testing the 2011 all-time high.

What next?

The bears are hoping that the gold market is forming a double top with the 2011 high. They want a bear trend reversal. The rally since the August 2019 high has had 3 legs up. The bears hope that this is a wedge rally to a double top with the 2011 high. They know that this is a reliable reversal pattern.

A reversal down from a buy climax typically has at least a couple legs sideways to down. The current selloff is now in its 3rd leg down. But since the 3-month selloff is in a tight bear channel, it is probably a complex 1st leg down. If so, traders will expect the 1st rally to fail. They then would look for a 2nd leg down.

At that point, if there is a reliable setup, they might buy for a resumption back up to the 2011 high. More likely, the weekly chart will enter a trading range. This process will take 20 or more bars, which means 6 months or more.

This selloff is now in search of an initial bottom. A reasonable target would be around the June low, which is a little more than a 50% retracement of the rally that began in March.

A wedge reversal often retraces to the start of the wedge bull channel. That is the March low. That is also at the July 2016 high, which is the top of the 2013 to 2019 trading range.

The news is always extremely bullish just before a reversal down

It is important to understand that when a market is in a buy climax, the news is always extremely bullish. It has to be, otherwise the market would not be racing up.

But the mistake is to assume that the news is right. The experts on TV are constantly giving all of the reasons why the trend is early, and it will go much higher. They are very confident, and they arrogantly look down at the fools who are not already long. They wear nice suits and have impressive titles, but they are idiots.

The church of gold

This is especially true in the gold market, which is more of a religion than a commodity. When it is up, they say you must buy because it is going higher. When it is down, they tell you that you must buy because it will soon race back up to the high.

Ask them what would make them sell. They will tell you that there is never a reason to sell, and there is always a reason to buy.

Do you think that is useful advice? If you bought gold for $2,100 in 2011 and watched it lose 40% of its value in 6 years, do you think that was the best choice for your money? Gold is not always the best choice. In fact, it rarely is the best choice. Most of the time, some other market will make more money for you.

Buy climaxes lead to profit-taking

Now, why does a market reverse down from a strong bull trend? You cannot have a buy climax unless everyone is bullish. FOMO… Fear Of Missing Out. Smart traders buy early and look for an extreme buy climax to take profits. They buy low and sell high. Also, smart bears start to short when there is an extreme rally, and they sell more higher.

The last buyers are the momentum traders. And don’t forget the dumb money traders who missed the move. They believe all of the hype and are desperate to buy at any price.

The momentum traders are buying because the market is going up. Once it stops going up, they quickly exit. Their panic selling once they sense that the bulls are starting to take profits accelerates the reversal down.

They are not investors, who are willing to use wide stops or no stop at all. Investors will buy more during a collapse because they are in it for the long haul. They are confident that gold will be higher 10 or 20 years from now, and will use selloffs to buy until they have the desired amount in their portfolio.

Golden lambs to the slaughter house

The dumb money traders, who follow the gold gurus on TV, buy at the top and hold until after the crash. They then exit with a big loss. They do not understand the risk of buying during a buy climax.

Very importantly, they do not have a plan to exit. They do not think about whether they are momentum buyers or investors. Remember, a momentum buyer exits quickly when the rally slows down. Investors buy more after a big selloff.

Dumb money does not have a plan. They expect the gold tree to grow to the sky, like the guy on TV says. When gold sells off, they are faced with a reality that is very different. They suddenly decide that they are not willing to sit through a 6-year bear trend that erases 40% if their money. And the TV guy is nowhere to be found to help them manage their bad trade.

Interest rates bottoming after 30-year bear trend

Because of that linkage between interest rates and gold, I want to summarize that I have been saying about the bond market since the March buy climax. I have talked about the bond market for years, saying that it is near the end of a 30-year bull trend and that it will fall for at least a decade. Remember, the bond market moves opposite to interest rates. As bonds fall, interest rates rise.

I said that interest rates could not hit zero in the U.S., and that they will work higher over the next decade. The bond futures market could briefly go above the March high, but at this point, it is more likely that it will not. If they rally over the next several months, the rally should fail around or below the old high. They could stay sideways for several more years, but they will be higher 5 years from now, and higher still 5 years after that.

So much for “interest rates to zero and gold to infinity.”

Bitcoin market

Bitcoin daily chart is turning down from parabolic wedge buy climax and test of all-time high

The Bitcoin cash index daily chart has rallied 5-fold since the March low. Pundits portray bitcoin as a replacement for gold as a storehouse of value. The news often describes it as “digital gold,” implying that people are selling gold and using the money to buy bitcoin. While this is true to some extent, it is impossible to know how significant it is. I suspect not very.

The 3-month selloff in gold happened as bitcoin went up 500%. Is this as cause and effect? No, because there are many reasons to own gold that are unrelated to bitcoin, and many reasons to own bitcoin that have nothing to do with gold. However, they have had a strong inverse correlation over the past several months, and the TV financial news often says that some of the money going into bitcoin is coming out of gold.

Bitcoin has reliable chart patterns

What next? When you look at the daily chart of bitcoin over the past 2 years, you can see that there are many traditional chart patterns. You should expect that with all markets that have lots of participants.

This is because a chart is simply a map of rational human behavior. That behavior is coded in our genes. Until we evolve into another species, the behavior will remain the same. It does not matter if you are trading stocks, baseball cards, or bitcoin. If you remove the labels, the charts would look the same.

Parabolic wedge buy climax

As strong as the 5-week rally has been, there are 3 legs up in a tight bull channel. The rally is therefore a parabolic wedge buy climax.

Buy climaxes typically attract profit-takers. If a bull takes profits, he is not going to buy again 1 bar later. He is concerned that the profit-taking could be strong enough to lead to a deep selloff or even a bear trend.

The bulls still want to buy, but they like to wait until after they see the bears try and fail at least twice, to create a trend reversal down. Therefore, a buy climax usually leads to at least a couple legs sideways to down.

If the bears fail to create a trend reversal down, then the bulls will buy again. They expect the bears to fail and give up, and for other bulls to buy again as well. They are looking for a resumption of the bull trend.

But if the bears create an endless pullback down, traders will conclude that the pullback has evolved into a bear trend. There is no sign of that at the moment.

More often, a big move up and the reversal down is a Big Up, Big Down pattern. That generates Big Confusion, and confusion is a hallmark of a trading range. This selloff is likely the start of a trading range that should last at least a month. The bulls will see the range as a bull flag. The bears will look for some kind of double top, in addition to the 2017/November 2020 double top. Therefore, traders expect bitcoin to go sideways for at least the next month.

S&P500 Emini futures

Monthly Emini chart has huge bull bar in November, but October was a bear bar and therefore weak buy signal bar

The monthly S&P500 Emini futures chart has a big bull bar so far in November. There is one trading day left in the month. The bulls want November to close above the September high at a new all-time monthly high. That would increase the chance of higher prices in December. However, the bears want November to close back below the October high. That would reduce the chance of a strong December.

October was a High 1 bull flag buy signal bar. When the Emini rallied above the October high, it triggered the monthly buy signal. The bulls want a resumption of the 5-month bull trend.

But the October buy signal bar was a bear candlestick. That is an unreliable buy signal bar. With it being the 2nd consecutive bear bar, it is even more unreliable. There will more likely be more sellers than buyers above the October high, even though there is no sign of them yet. The rally could last a couple months, but traders should expect a reversal down within a month or two.

The reversal down in September led to a 2-month pause in the bull trend. Since November is a big bull bar after a 5-month buy climax, it probably will be an exhaustive buy climax. If so, traders will expect at least a couple legs sideways to down once this climactic breakout ends. It should end in December. Consequently, traders should expect the Emini to be mostly sideways for the 1st half of 2021. That would increase the number of bars in the trading range than began in August.

Possible gap up on Monthly chart on Tuesday

Monday is the final day of November. The Emini has been in a strong bull trend since the March low. If Tuesday gaps up to a new all-time high, there will be a rare gap up to a new all-time high on the monthly chart.

While the gap could be big on the daily chart, it will probably be small on the monthly chart. Small gaps typically close before the bar closes. If it stayed open through December, it would likely close in January or February.

Everyone on TV is bullish

What about the uniformly bullish experts on TV? If you’ve been trading for a few years, you might have noticed a pattern. There is an annual ritual. In November and December, the financial networks trot out an endless series of experts predicting that the next year will be up 10 to 20%. You don’t get on TV unless you are eager to say bullish things about the coming year. If they did not put you on last year, you have to make an even more outrageously bullish prediction this year to make sure you will be on TV.

Since most years are up, it is a safe thing to predict an up year. However, not all years are up. I will show the yearly chart at the end of the year. It is currently a big outside up bar. But that is not bullish when it comes late in a bull trend. The current bull trend is now 10 years old. The rally is now late.

More often, a big bar late in a bull trend attracts profit-takers. Therefore, both the monthly and yearly charts look like they are predicting a lack of a rally for the next 6 – 12 months.

Could the charts or my reading of the charts be wrong and the TV experts right? Absolutely. But the monthly and yearly charts look like they will lead to a sideways market for many months.

Weekly S&P500 Emini futures chart weak breakout above High 1 bull flag buy signal bar

The weekly S&P500 Emini futures chart has a pattern that is similar to the one on the monthly chart. There is a High 1 buy signal bar, and it was the 2nd consecutive bear bar.

Traders typically expect more sellers than buyers above a weak High 1 bull flag buy signal bar. The market can sometimes rally for a couple bars (weeks), but it then usually reverses down a 2nd time. The 2nd reversal is usually more complex and lasts longer. While the pullback in September led to 2 sideways bars, if there is a pullback within the next few weeks, traders will expect at least a couple small legs sideways to down. They will look for a trading range lasting at least a month.

Can the Emini explode to the upside and begin a strong rally to the end of the year? The bulls have a 30% chance. However, with this week closing on the high and strong momentum up 3 weeks ago, next week should go above this week’s high.

Daily S&P500 Emini futures chart in strong rally, but next 10% move will probably be down

The daily S&P500 Emini futures chart had a quick move up to the November 9 high, but then went sideways. I have talked about the bars in that rally and in November a few times. In November, about 75% of the bars closed either around their open or in the middle of the bar. Those are weak bars. Yet, the month is forming a huge bull bar on the monthly chart. Something is wrong here.

Bull trends usually have lots of bull bars closing near their highs. Look back at the summer rally as an example. If the November rally is not consistent with a bull trend, it might be a big bull leg in a trading range. As a general rule, if something does not look the way you think it should, the chart is probably forming a trading range.

If I’m right and this rally to a new all-time high is simply a strong bull leg in a trading range that began after the September 3 top, where is the top of the range? It is probably not much higher. As I wrote above, December could be another bull bar on the monthly chart, but traders should expect a trading range on the monthly chart by early next year.

The next 10% move in the Emini will probably be down, not up

The bottom of the range will probably be around the September low. That is about 12% down from the current November high. Let’s say about 10% down. Since I think the November rally is part of a trading range, and not part of a successful breakout of the 400-point tall, 4-month trading range, then I am saying that the next 10% move in the Emini will probably be down and not up. We just don’t know when the move down will begin. I believe it will start in December or early January, and that it will come before the Emini rallies 10%.

Also, if the Emini gets down to near the September low, it will probably fall below. This is because traders would conclude that the Emini had entered a trading range, and legs in trading ranges tend to break beyond support and resistance before reversing. Therefore, if there is a selloff, it will probably be more like 15 to 20% instead of just 10%.

What would cause the selloff? It will be technical. The daily chart looks like it is in a trading range. It is now at the top and therefore it should go back to the bottom.

News reporters are narcissists and incorrectly assume everything is caused by the news

There is news every day. Whatever the news is on the day the selloff begins will be what TV reporters will definitively claim as the reason for the selloff. That is because they believe that they are the center of the world. To them, everything is related to the news, which means to them. They cannot imagine that something else unrelated to the news, like technical factors, might be the real cause.

The news could be the catalyst, but the price action is already telling us that a selloff is likely. There are bad bull flags on the weekly and monthly charts and too many bars on the daily chart with weak closes.

Also, remember what I wrote last week. There is an increased chance of a surprise after January 5. What is the surprise? Who, knows? That’s what makes it a surprise!

What about next week?

The momentum up in the rally from 3 weeks ago was strong enough to make a new high likely this week. As I mentioned above, November has been a very strong bar on the monthly chart. Traders should not be surprised by a gap up to a new all-time high on Tuesday when December begins. That could lead to an acceleration up for several days and even a couple weeks.

But it would probably be an exhaustive buy climax and the end of the rally from the March low. There is currently only a 30% chance that the breakout above the September high will lead to a 400-point measured move up.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Could someone clarify for me why on the futures chart in this article, gold price has not surpassed the 2011 high, but the spot price has already made new high?

I understand that futures are calculated charts, and that they will show “wrong” past prices, and that they don’t match spot price, which makes perfect sense to me – so far. But why would it not reflect something so important such as price making new all time high? Even if it’s recalculated, shouldn’t new highs / lows be reflected appropriately?

Does it have something to do with continuous charts vs. non-continuous?

Here is an example of spot price chart: https://www.kitco.com/charts/popup/au3650nyb.html

The actual 2011 high was 1900-ish and the high of this year was around 2090. The futures chart is very deceiving…

To add to the confusion, some futures charts do show a new high in 2020, for example if you display the Comex front month contract on the TradingView web platform.

After 9 years of reading price charts, this still blows my mind.

Thanks for the update on Gold and Bitcoin, always interesting.

I think Bitcoiners are similar to Gold bugs, both have a different perspective, they don’t trust the government and central banks, so it is clear to them they don’t want to hold fiat (aka shitcoin).

Bitcoin is very interesting by the way. If you think about it, it is the only asset available that is truly decentralized (no rulers) and unconfiscable (which gold is not since it is physical and not digital).

Bitcoin is the only asset that has an absolute cap on the supply where every participant knows exactly how much bitcoin will be in circulation and the issuance schedule. Everything is verifiable, you can exchange value between two unknown peers with zero trust anywhere in the world.

Bitcoin is the first engineered money and the result is the most secure existing monetary network on earth.

Within developed economies serves as a Store of Value but can serve as Medium of Exchange within precarious economies.

Bitcoin is a volatile Store of Value against FIAT currencies, meaning that its value it is meant to increase heavily over time.

Looking at that weekly gold chart, do you think it’s possible/likely it is a huge cup and handle formation?

If gold pulls back for a year or two and resumes up, many technicians will refer to the pattern as a cup and handle bottom. I usually reserve that term for a climactic selloff and a climactic reversal up. That is not the case here.

Instead, I would call it simply a bull flag. It would be a failed attempt at a double top.

So you are saying the 30 year Treasury bond will go down and yields will go up? The biggest short ever on the Dollar right now is correct?

If bonds go down, interest rates have to go up. Let’s say you bought a new 30-year bond 10 years ago for $100,000 from some country when it was paying 3%. You can hold it for 30 years and collect 3% ($3,000) each year in interest. At the end of 30 years, the government will buy it back from you for $100,000. You will have made $90,000 in interest over those 30 years.

However, let’s say you need cash today and you want to sell the bond. If interest rates for new bonds issued by that government today are 1.5%, then people are willing to get a 1.5% return on a 30-year bond. For every $100,000 they invest in the government’s bonds, they are happy to receive $1,500 a year.

If you are selling them a bond from the same government and it is paying $3,000 a year, they will buy that bond from you for $200,000. You would no longer be collecting annual interest, but you would have made a 100% return on your investment, in addition to the $3,000 each year in interest for the 10 years that you owned the bond. That is a $130,000 total profit, or 130% over 10 years.

But remember, if interest rates today were now 6% and you sold your bond, you would only receive $50,000. Traders would want a 6% return on their money. Since your bond is paying only $3,000 and that is 6% of $50,000, that is all your $100,000 bond is now worth. Yes, you would have made $30,000 in interest, but you would have had a net loss of $20,000 on your $100,000 investment.

The price of bonds is inversely related to interest rates. Investors want to know what their rate of return is on their money. They know that US Treasury bonds are the safest investment. If the government today can sell new bonds at an 1.5% interest rate, that is what people think is a fair rate of return. If you have a bond paying $3000 a year in interest, the value of that bond then is $200,000, even though the bond itself says that it is a $100,000 bond.

As to the other part of your question, Forex markets are priced based on countless variables. In addition, the price is based on a comparison of the two countries in the Forex cross. For example, the EURUSD is based on the economic conditions in both the U.S and the European countries that use the Euro.

If interest rates in the US go up, people will be more willing to buy U.S. bonds. U.S. bonds are sold in dollars. Anyone buying a U.S bond has to sell his currency and buy dollars. If a lot of people and institutions do that, the price of the dollar goes up relative to the other currency.

But if US interest rates go up, usually rates go up around the world. It is all relative. If Europe’s rates go up more (because of a strong economy, and not a collapse of Europe and a huge printing of new Euros), there will be a demand for the Euro because people would need to convert their dollars to Euros to by European bonds.

Also, if the U.S. rates are going up because investors fear that the U.S. is printing too much money, then there are too many dollars. The dollar is worth less, and it will fall against other countries.

There are many other variables as well. A coup, a war, a huge natural disaster, political turmoil, major changes in government policy, and many other things can affect the value of a currency.

Life is not simple. If it was, it would be very easy to make an incredible amount of money. Since it is not, you have to conclude that it is dangerous to assume that the price of anything is overwhelming due to a single variable.

But just look at the charts. They tell you whether to buy or sell. They show the total distillation of how all the institutions see of all the variables, known and unknowable. It does not matter if they are right. If they are aggressively buying some currency, I want to buy it, too!

Analogy lesson: gold is to religion as Bitcoin is to cult.

Dear Dr. Brooks,

Any comment about the Btc’s anual chart ii pattern that triggered recently?

It would be much appreciated.

Josep

Thanks Al for the btc update. Would you consider $13,863 a ledge on the monthly chart? Looking for a test in jan-march 2021.

The most reliable ledges are on charts that are 15 minutes or less, and on charts that do not have more than 100 – 200-tick daily ranges. The Emini is the best example.

When the bars are bigger (more ticks), the bottom of a ledge is less perfect. There is then less consensus.

However, any higher low is a rally is always a magnet once there is a reversal. The longer the market went sideways and the more perfectly sideways, the stronger the area of agreement. Markets like to go back to prior areas of agreement when they reverse.

Thanks for your weekly comments Al, always a good read. One question regarding interest rates. How can the government lift interest rates with borrowing so high? Surely the Fed is stuck with low interest rates near zero or even below zero, for decades unless there is some sort of ‘reset’ (that keeps being talked about by the banks along with the CBDC). These current debt levels can never be paid back realistically. So something must happen. Thanks.

You know a lot about what I’m going to write, but other readers might not.

The government has no control over long-term interest rates. They can only change the overnight lending rates (fed funds rate). That can indirectly lead to an increase in long-term interest rates (bonds) by creating inflation (too much unneeded easy money).

But the Fed isn’t stupid so that is not going to happen. They will keep the fed funds rates low only as long as it is not creating too much inflation. If there is too much easy money, there is too much money. When there is too much money, everyone has lots of money. People will be willing to pay outrageous amounts for things. The result is inflation.

The government wants some inflation, but not too much (about 2%). As long as the world’s economy is hurting, there is not enough money. Governments can keep the fed funds rate at or near zero until everyone feels like they have enough money. Continued easy money would create more inflation than what people want, and it will reduce spending and borrowing. That would slow the economy down again.

The world’s financial markets are in a very unusual position. This has never happened before. Countless factors are involved, and many are never discussed.

One big one is that rich countries have been staying rich by basically having poor people around the world make stuff for us at ridiculously low wages. They are so desperate for money that they will take anything we give them. We prefer to give them just enough to stay alive.

But the percentage of people willing to live on subsistence is falling as people slowing climb out of poverty. You always hear on the news how the wealth gap is increasing. But that refers to the gap between the richest and average Americans. There is another wealth gap that is decreasing, but never mentioned. That is the gap between the average and poorest people the planet. We are slowly running out of the invisible slaves who maintain our lifestyle.

These people are starting to demand things from their governments, and the governments have to respond if they are to remain in power. The response has been to try to stimulate the world’s economies to make sure these people continue to have jobs. That means low fed funds rates.

Long-term interest rates are determined by the market, and governments are at the whim of investors. If a government or company is running out of money, it sells bonds to bring in dollars. Buyers decide how risky it is to buy the bonds and tie up their capital for 10 – 30 years. If they think it is very risky and other investments are better (like stocks), the buyers will demand a high interest rate on the loan they are providing (when you buy a bond, you are giving a loan to the country or company that is selling the bond).

They need money, and creating a bond and selling it is how they get that money. If lots of countries are hurting financially, they will all be selling bonds. At some point, the buyers will feel like they have enough bonds in their portfolios. To entice buyers, the bond sellers have to offer higher rates to make the bonds more attractive to investors.

A home owner or a car buyer needs money. If he does not have enough cash, he has to borrow it. HE is competing with bond sellers.

The government is a bond seller and therefore a borrower. If it has to borrow so much that it has to raise interest rate it is willing to pay, all interest rates will go up. That includes those that other borrowers have to pay, like on a mortgage.

Nothing lasts forever. Therefore, near-zero and negative interest rates will go away. The transition will be sudden, and we will not see this again in our lifetimes. The monthly bond chart is telling us that the transition might have begun in March. We will not know for sure until there is a sudden, sustained collapse in bond prices. But is it coming.

Interest rate trends continue for decades. Tops and bottoms take years. The bond market is making a top. The March high might not be the final top. However, I have said many times that the US cannot have negative interest rates. The American people will not stand for it.

You are right that the government debt can never be repaid. That is true for all governments. The ultimate result is going to be a worldwide default. But it will not be in the traditional sense. It will be by governments printing so much money that the $27 trillion we owe will be essentially worthless. You will be able sell a loaf of bread some day for a trillion dollars. Then, the government will just remove a bunch of zeros, and a trillion dollars will be one dollar. Poof! No more debt.

This is really unimaginable and that is why no one talks about it. No one knows how it will play out, and it will take decades to unravel. A slow motion train wreck. But the one thing everyone agrees on is that the US can never repay $27 trillion… in today’s dollars. So it keeps borrowing to pay back the bonds from 30 years ago that are now coming due.

At some point, the only way to meet the interest payments is to print an incredible amount of money. The result will be huge inflation, and then $27 trillion becomes tiny.

It’s really crazy. The bond holders will get screwed. But who are the bond holders? Mostly other governments. They all buy each other’s bonds. For example, you always hear about how China holds a lot of US debt. Well, the Chinese government itself has sold about $5 trillion in bonds, and Japan is the biggest buyer of China’s bonds. Japan’s debt is $11 trillion, and other countries bought the Japanese bonds.

This is getting too long. But, yes, the debt can never be repaid. We will print so much money that the debt will always stay manageable, and we will continue to borrow forever, as will other countries. That will be the reset. Everything will take place over decades so nothing will be dramatic. The monthly bond chart looks like the transition is underway.

Thanks Al. Your perspective is always appreciated.

In your opinion, wouldn’t “huge inflation” and a devaluation of the US dollar be very bullish for GOLD and, perhaps, Bitcoin as well?

Thank you always, for your insights.

Yes, inflation is always good for things that are in limited supply. But I am a technical trader and I always assume that the fundamentals are already baked into the charts. I therefore would not buy either simply because interest rates go up. I would want to see chart patterns consistent with higher prices.

I say this because so often the smart money has already bought by the time the news comes out. That’s why I call them smart. They knew before everyone else and before the news realized what was happening.

Sometimes, however, there might not be enough buyers left to continue the rally. If so, what you might assume should be a bull market sells off as disappointed bulls exit and bears smell blood and short.

Markets can go down on good news and up and bad. I therefore trade in the direction they are going and not in the direction that the news says they should be heading.

Remember what I wrote above about gold. This summer, everyone on TV was saying buy gold, despite the buy climax, because gold was going to “infinity.” How could gold go down when the experts said it was so bullish? Smart money took profits, and there were not enough zombies following the advice from the clowns on TV to buy enough to continue the summer rally.

Thank for your answer, a lot to chew on. I wondered what your answer to this problem would be.

I do hope the ‘reset’ will be relatively undramatic over decades, but I personally seriously doubt it. In my own mind I see a lot of new challenges on the horizon which will change the playing field in both the near and long term dramatically. Excluding war and pestilence, these include new technologies such as AI and 3D printing, over population and the ultimate problem we all will face, that of global warming.

Anyway, thanks again. Lots to think about! Interesting to discuss.

I also catch me sometimes thinking about all these problems, but then I always come back to this quote which I will add at the bottom. Sometimes there are things which will happen, and we just can’t impact the outcome. They will happen regardless. like Al says, just be happy and dont overthink.

“If there is no solution to the problem then don’t waste time worrying about it. If there is a solution to the problem then don’t waste time worrying about it.”

— Dalai Lama XIV

You are right. Dalai Lama’s words are basically in tune with my thinking. However, I believe we cannot ignore the issue of global warming. This one is an existential threat to human life on earth, and needs us all to act, not ignore it. However, all this is going a bit beyond trading discussions lol. All the best. Good posts and comments today.