Trading Update: Thursday April 28, 2022

Emini pre-open market analysis

Emini daily chart

- Emini likely to bounce and will probably get back to the April 25 close. This is because some bulls who bought before the April 25 signal bar triggered (or during the Globex session, which it did trigger) would be willing to buy more below April 25, betting worse case they can exit breakeven on the entire trade. More likely, they will be able to exit at the original entry price around the April 25 close.

- Yesterday closed as a bull doji bar. This is a micro double bottom with April 25. However, the channel down is tight, so the first reversal up will probably be minor.

- The bulls still have a reasonable chance at testing the April 18 low, which is the breakout point of the wedge bottom.

- The market will likely bounce for a day or two; however, the bounce will probably be minor. The odds favor a test of the February low, and the bears still have a reasonable chance at getting down there.

- As stated in the prior blog post, the daily chart is in a trading range, so traders should expect disappointment. While the bears have done a great job with the selloff of the past four trading days, the bears are likely to be disappointed soon. The disappointment could be a deeper pullback than what the bears wanted.

Emini 5-minute chart and what to expect today

- Emini is up 39 points in the overnight Globex session.

- The Globex has been in a bull trend since yesterday and had a strong rally during the overnight session that broke above yesterday’s U.S. session high.

- The bulls want today to close on or near its high, setting up a strong entry bar for yesterday’s weak buy signal bar (micro double bottom with April 25).

- Traders should be open to the possibility of the market closing as a bull trend today; however, as Al says, price is truth, and one must trade the chart in front of them.

- Yesterday’s (April 27) was a good reminder that 50% of opening rallies/selloffs fail and reverse.

- In general, traders should consider waiting for 6-12 bars, a credible stop entry, or a strong breakout with follow-through.

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD closed below the 2020 Lows (green line) yesterday, and they want another bear close today.

- More likely, today will have a close above the open (1.0560) and try and test the 20202 low (1.0636) either today or tomorrow.

- It was reasonable to buy the 2020 low and scale in lower, which means the market could rally back to it quickly.

- Overall, the breakout below the March – April trading range has been strong, which means the first reversal up will likely be minor, and the best the bulls can expect is sideways until they get a micro double bottom.

- One thing to point out is that the current selloff (April 21 – 28) on the daily chart is the strongest-looking selloff since April 2021. The market may go sideways and form a bottom around this price level over the next couple of weeks and rally back to the March – April trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

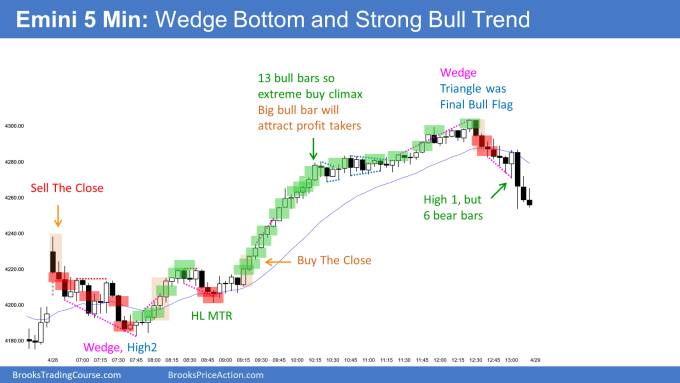

- The market sold off on the open of bar 1 and formed a wedge bottom around 7:45 PT which was also around yesterday’s close.

- The bulls rallied from the wedge bottom and ultimately formed a higher low major trend reversal around 10:45 PT.

- The bulls ended up getting a strong breakout above the initial opening trading range and testing the April 25 bull close on the daily chart. This was a logical magnet since some bulls were willing to buy the April 25 bull close and scale in lower, betting the market would test back to their original entry.

- Overall, today was a strong bull trend day with a very strong buy the close rally. The rally was unsustainable and climactic, which caused the market to have a deep pullback into the close.

- The selloff late in the day created a big tail on top of the daily chart bar, which is a further reminder that the daily chart is in a trading range.

- The bulls want follow-through from today’s bull bar. They hope that the micro double bottom (April 25 and Today) nested within a larger double bottom with March 14 is enough of a bottom to rally back to the April 18 low possibility of the April 21 high. This would cause the April 21 selloff to be a 2nd leg trap, which would tap bears into selling too low.

- The bears want a test of test of the February low.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Why is bar 7 not a sell signal?

While bar 7 did close at its low, it is at the previous day’s close (support). Also, there was bad follow-through. Also, bar 4-6 was a possible final flag which means bar 7 had the risk of being an exhaustion bar.

Hi, Brad

I sell below bar 53 and bar 57, target is bar 41close, both are losing trading.

I have a question about how to trade from bar “46” to bar “60” to avoid placing trade in tight TR and wrong direction?

although at the end of day, these bars is not worth trading, but at that time I really want to find a bar to sell.

thanks,

After the bar 9:15 PT(Bar 33) – 10:15 PT (bar 45) rally, it is common to think that the market must pullback, and while that is true, the pullback could be sideways. Typically, when the market is clearly Always in long, it is better to wait for a strong trendline break (major reversal) and a retest of the highs.

Lastly, I would ask yourself why you were so eager to sell here? Was it because you felt that the risk was too significant to be long? I bring this up because it is common to look for reversal because the risk is small (such as selling below bar 57 stop above 57). However, that also means the probability is low.

Remember, any time you have a great risk/reward, it has to be a lower probability.

Yes, I need ask myself why I wanted to sell here. after taking profit, and AIL, It is better just waiting. consider sell until bar like 71, 72.

thank you very much.

April 25 close was 4292.75.

The opening range (first 18 bars–4182.50 to 4238) pointed to a measured move to 4293.50 (55.50 plus 4238)

Interesting confluence. Interesting pre-market analysis.

Great observation Glen.

That just goes to further show that every tick is math-based and there is a logical reason for everything.

The institutions knew how big the opening range would have to be to cause a measured move up that would project to the April 25 close.