Trading Update: Thursday July 7, 2022

Emini pre-open market analysis

Emini daily chart

- Emini more sideways trading likely going into tomorrow’s 5:30am PT unemployment report.

- The bulls had a weak bull close yesterday following the three consecutive bear bars.

- Bears see yesterday as a signal bar for a Low 2 short from the June 28 bear breakout; however, the signal bar is a bull bar in a tight trading range, lowering the bears’ probability.

- At the moment, the odds may slightly favor the bulls getting a test of the June 28 high and a test of the June 2 major lower high. However, the probability is not 60% for the bulls.

- If the bulls had a high probability, the market would be in a strong bull breakout and not going sideways. Again, I think the bulls have better than a 50% probability, but it is certainly not 60% at the moment for a test higher.

- The bears hope that the market will continue to make lower highs and lows in the bear channel; however, the problem the bears have is that the bulls are beginning to develop a lot of buying pressure which will increase the odds of a trading range more than a bear trend.

- Also, the higher time frames are in bull trends, making the 2022 selloff on the daily chart more likely a leg in a trading range than a bear trend.

- Bulls want a higher low major trend reversal. Major trend reversals that are successful usually go sideways for several bars before it is clearly a successful reversal, so the market may continue sideways for several bars before the bulls are successful. Also, it is essential to remember that most major trend reversals are minor and lead to trading ranges.

Emini 5-minute chart and what to expect today

- Emini is up 12 points in the overnight Globex session.

- The Globex market has been in a trading range since yesterday’s day session close.

- Traders should expect today to be a trading range open (80% of opens are). This means traders should expect lots of reversals and failed breakouts.

- In general, there is a 50% chance that the initial breakout will fail and completely reverse.

- Since the open is likely to be a trading range, most traders are better off waiting for 6-12 bars before placing a trade, giving a trader more clarity on the day.

- If the day is a trading range day, it is essential to pay attention to the open of the day, especially if the open of day is in the middle of the range.

- If today is a trend from the open, traders will be able to buy when they see strong consecutive breakout bars. So if the market begins to form strong breakout bars on the open, traders will begin to buy and swing a position.

- If today is a trend from the open, it is important to remember that 60% of the time, the trend from the open will convert into a trading range.

- As always, traders can consider waiting for a credible stop entry such as a double bottom/top, wedge bottom/top, or a strong breakout with follow-through (and good context).

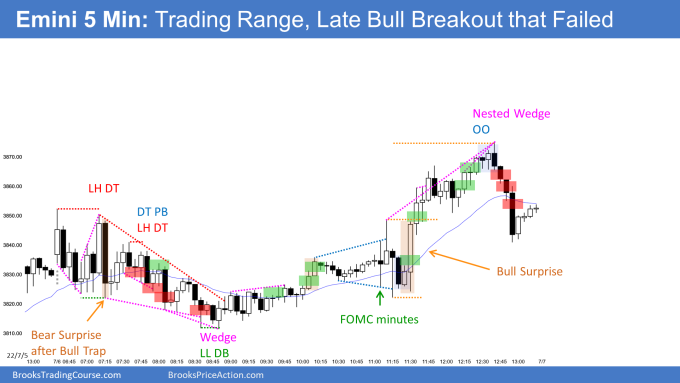

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The bears have had a strong bear breakout with follow-through over the past two trading days.

- This is a strong move below the 2017 low and the two-month trading range.

- At the moment, the odds favor a second leg down from the two-bar breakout. However, this may be exhaustion from the year-long bear trend on the daily chart.

- The market will probably have to get back to the 2017 low soon. Some bulls bought the low of 2017 and will likely scale in lower, so it is possible today is a big bull bar.

- Most traders are better off waiting for more buying pressure before looking to buy.

- The bears want a selloff down to 1.0000; however, that is 200 pips away, and at the moment, the odds favor a pullback to the 2017 low.

- Overall, the two-bar breakout is strong enough to expect a second leg down, so traders will expect the first reversal up to fail.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

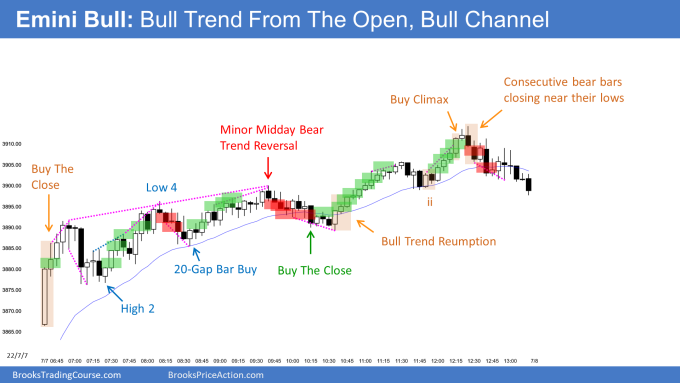

- Today was a bull trend from the open that remained a bull channel for the entire day.

- The bulls had a buy the close rally that started on bar 2 and followed a deep pullback forming a H2 deal around 7:20 PT. The H2 (second entry) rallied to a new high of the day where the market formed a L4 around 8:15 PT which is a type of complex top.

- The bulls continued the rally to around 9:45, where the market formed a minor midday reversal down to under the moving average.

- The odds were the market was going to have at leastthree3 closes under the moving average (blue line), so most traders would not be willing to buy the 10:00 AM bull reversal at the moving average for this reason (also, the signal bar followed four consecutive bear bars which lowered the probability of the buy).

- The bulls got bull trend resumption around 10:45 that leg to two large legs up.

- The bulls got a buy the close finish in the final hour of the day, however it started before 12:30 which increased the odds of profit-taking into the close.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.