Market Overview: Weekend Market Update

The June bar on the Emini’s monthly candlestick chart has created an oo bull flag with May. However, if July does not go above the June high to trigger the buy signal, July will be both a buy and sell signal bar for August.

The month-long rally in the crude oil futures market is testing resistance. It will probably stall over the coming week. The chart will probably remain in a trading range for the rest of the year.

The EURUSD weekly Forex chart has rallied for 6 weeks and is now above the 20 week EMA. The lack of consecutive strong bull trend bars make the rally more likely a leg in a trading range than the start of a bull trend.

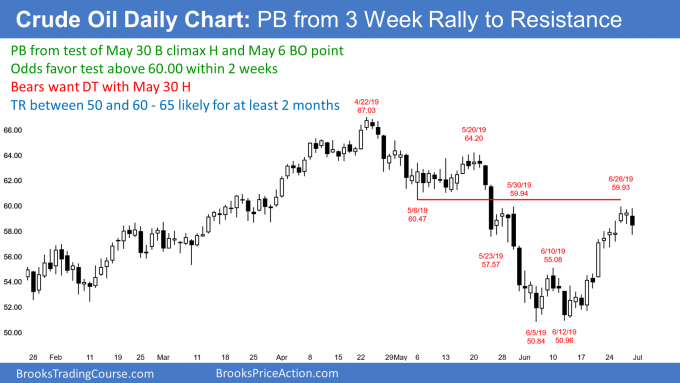

Crude oil Futures market:

Bull leg in trading range is now testing resistance

The crude oil futures market has rallied for several weeks. It is now testing the May 30 high, which is the top of the final sell climax on the daily chart. That is the 1st target when there is a reversal up. It is also testing the May 6 low, which is the neck line of the April/May double top.

Because the rally is now testing resistance, the rally has slowed over the past 6 trading days. The bodies and ranges are becoming smaller and the tails are getting bigger. This is 2 sided price action and it will probably lead to a tight trading range next week.

I have been writing for the past month that this rally will probably evolve into a trading range between 50 and 60 over the next month. It should remain in a trading range for the rest of the year.

The top of the range could be around the May 20 high of 64.20 because that is the top of the sell climax on the weekly chart. Even if it continues up to the May high at around 67, the several big legs up and down over the past year are a sign of a trading range price action.

There is nothing to indicate that this is about to change. Traders will continue to sell rallies to resistance, buy selloffs to support, and take profits every 2 – 3 weeks.

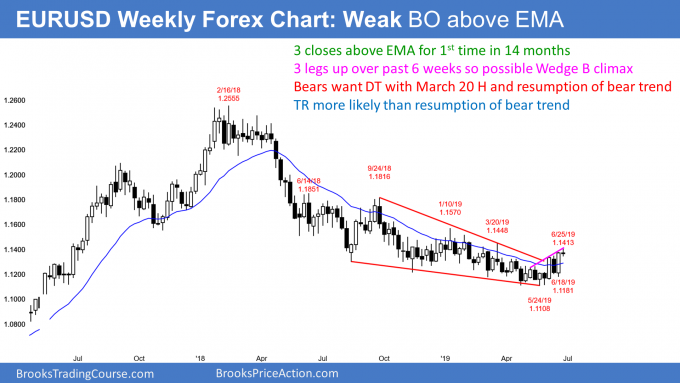

EURUSD weekly Forex chart:

Alternating bull and bear bars

The EURUSD weekly Forex chart has had 2 big bull trend bars in the past 4 weeks. Both closed above the 20 week EMA, and they are the 1st closes above the EMA since September. However, there is no follow-through. Where are consecutive big bull trend bars?

If this rally is the start of a bull trend, the bulls should be able to control the market for more than one week at a time. Because they have not, this rally is more likely a bull leg in a trading range.

End of bear trend does not mean start of bull trend

Yes, the rally might have ended the yearlong bear channel. That does not mean that there is now a bull trend. Instead, this rally is behaving like a leg in a trading range.

Trading ranges have legs that go up and they alternate with legs that go down. If the bulls are unable to get a strong bull bar within the next 2 weeks, the weekly chart will likely go sideways to down for a few weeks.

If so, the bulls will want the pullback to hold above the 20 week EMA. That was resistance for a year. The bulls hope it is now support. If so, the rally will resume up to test the major lower highs of the past year.

The bulls want the rally to continue up to the start of the bear channel. That is the September 24 high at around 1.18. It took 8 months to fall from there to the April low. If it gets back there, it will probably take several months. This is especially true given the lack of consecutive big bull trend bars on the weekly chart.

Possible small wedge rally

The month-long rally began with a small bull bar that closed on May 24. The 2nd leg up was 2 weeks later. Last week might be the start of a small 3rd leg up. Three legs up is often a wedge rally, which is a buy climax. If so, it often leads to a couple legs sideways to down.

This week might be the end of a 3rd week up. The March 20 major lower high of 1.1448 is just above. The rally might have to get there before the bulls will take profits.

But will the bears sell aggressively enough to resume the bear trend? At the moment, a sideways to down leg in a trading range and then a resumption of the rally is more likely. At a minimum, the rally will probably reach the January 10 lower high at 1.1570. That was the start of the most recent leg down and its high is therefore an important magnet above.

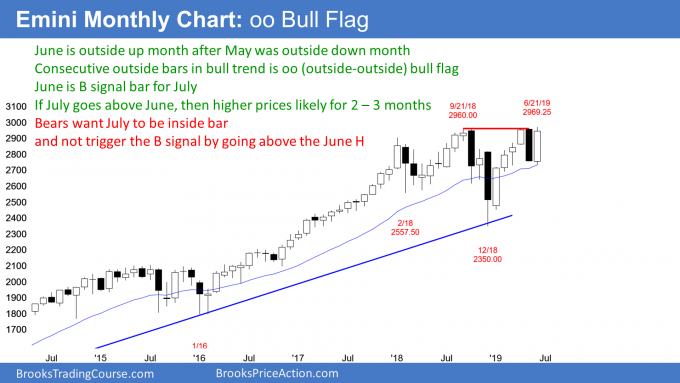

Monthly S&P500 Emini futures chart:

Emini’s June oo buy signal and expanding triangle top

The monthly S&P500 Emini futures chart is currently the most interesting because it has 2 fairly unusual patterns. There is both an oo buy setup (consecutive outside bars) and an expanding triangle top.

oo bull flag

When the market is in bull trend and forms an outside down bar and then an outside up bar, that is a set of consecutive outside bars. I call that an oo bull flag. May traded above the April high and then below its low. May was therefore an outside down month and a sell signal bar for a top in a bull trend.

June traded below May to trigger the monthly sell signal, but then rallied to go above the May high. It therefore hit the protective stops of the bears who sold below May’s low.

June is now a buy signal bar. If July goes above the June high, it will trigger the oo bull flag buy signal. There would then be a 60% chance of higher prices over the next few months.

ioi top

If July does not go above the June high, July will probably be an inside bar. This is because the June low is so far below that the odds are against July falling that far. An inside bar after an outside bar in an ioi setup (inside-outside-inside). The bar before an outside bar is inside of the outside bar. That is why I call it an ioi pattern.

An inside bar in a bull trend is a buy signal bar. Consequently, if July does not trigger the buy signal above the June high, July will be a buy signal bar for August.

Remember, when June traded below May, it triggered a sell signal, even though it failed. If August trades below July, it would be a 2nd reversal down from the top of the 18 month trading range. That is a higher probability sell signal than a 1st reversal down. Therefore, an ioi is also a sell signal as well as a buy signal.

When a bar is both a buy and sell signal bar, there is a Breakout Mode pattern. In general, traders assume that a Breakout Mode pattern has a 50% chance of a successful bull breakout and a 50% chance of a successful bear breakout. Furthermore, there is a 50% chance that the 1st breakout up or down will fail.

Expanding Triangle Top

When many traders think of a triangle, they see a pattern that is constricting, getting ever tighter, with a series of lower highs and higher lows. The theory is that the tension is building up and that there will be a breakout that will go about the same distance as the height of the triangle. This contracting triangle is the most common type of triangle.

But the mirror image of that is a triangle as well. If a market makes a sideways series of higher highs and lower lows, it is a triangle that is expanding instead of contracting. This is a reversal pattern and not a breakout pattern. Traders expect each new high to reverse and then make a new low, and then reverse up to a new high. At some point, the pattern stops and market moves onto some other pattern.

The monthly chart made a high in January 2018 and then a low in February 2018. That was followed by a new high in September and a lower low in December. The June rally went above the September high (which was a double top with the May 2019 high).

If the Emini reverses down from here, that would be the 5th reversal and it would create an expanding triangle top. The goal for the bears is a new low in the pattern, which means a break below the December low. If the bears get a good sell signal bar in the next few months, they will have a 40% chance of a break below the December low.

That means that even with a good sell signal, there is a 60% chance of something else. The most likely possibility is a continuation of the 18 month trading range.

How far will the rally go?

The Emini has been in a trading range for 18 months. When there is a breakout of a trading range, traders look for a measured move that is based on the height of the trading range. Since this range is 600 points tall, the bulls want a rally to 3,500 and the bears want a selloff to 1,700.

But both are currently unrealistic. This is because this trading range is an expanding triangle. That means breakouts are more likely to reverse than to lead to a measured move.

When a market is in an expanding triangle, traders can extend the lines above and below. The rising line above is resistance and the falling line below is support. If the bulls trigger their buy signal in July, the top of the triangle is currently around 3,040 and it is rising.

Expanding triangles typically go beyond the lines before reversing. These are overshoots and 1 – 2% overshoots are common in the stock market. That means that the Emini might reach 3,100 before reversing. Therefore traders should look for a reversal down from between 3,000 and 3,100.

The 1st reversal down typically targets the most recent major higher low. That is the June 3 low of 2732.75.

Weekly S&P500 Emini futures chart:

Bear inside bar but minor sell signal

The weekly S&P500 Emini futures chart formed a bear inside bar this week. It is therefore a sell signal bar for next week for a failed breakout above the May high.

However, the 3 week rally has been strong. In addition, the 2019 bull trend has also been strong. Consequently, there probably will be more bulls looking to buy below this week’s low than bears eager to sell there. This is therefore a low probability sell setup.

If next week triggers the sell signal by going below this week’s low, it will probably form a bull flag over the next few weeks instead of beginning a bear trend. The odds continue to favor a new all-time high in July.

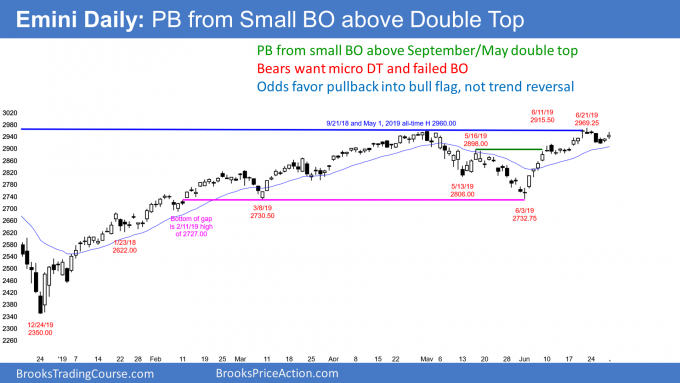

Daily S&P500 Emini futures chart:

Should test 20 day EMA and June 17 tight trading range around 2,900

The daily S&P500 Emini futures chart bounced on Thursday and Friday after 4 bear days. Since the 20 day EMA is always support, it is a magnet. Wednesday’s low got to within 20 points. It is therefore within the magnetic field. That makes it unlikely to go back to the all-time high without 1st getting down to the EMA.

The tight trading range that ended on June 17 is an area of agreement. It, too, is therefore a magnet. The selloff got halfway there.

A 50% pullback is common. The market often pauses halfway to a target as it decides between continuing down to the target or resuming up to a new high.

While traders assume that every reversal attempt will fail and form a bull flag, the EMA and tight trading range are strong magnets below. Many bulls will not want to buy until they see the Emini fall to that support and reverse up. As a result, it is likely that the Emini will test 2900 before making a new high.

The China trade talks are unusually important this weekend. Most traders correctly assume that there will be no surprise. That means the technical factors will remain in control and there will not be a big news-related move on Monday. But if there is a surprise, it could overwhelm everything that I wrote today. The Emini could make a huge move up or down on the news.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.