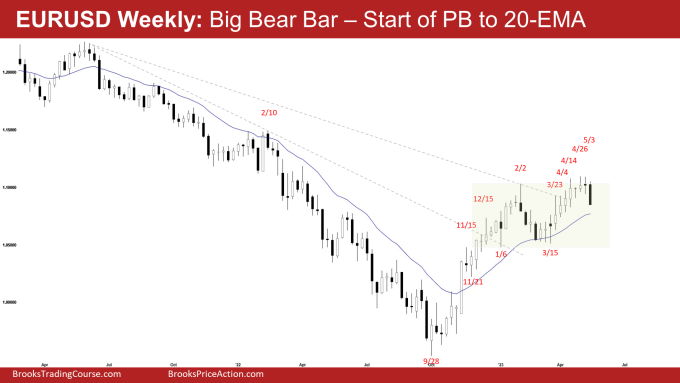

The EURUSD Forex formed a EURUSD big bear bar on the weekly chart. It is likely the start of the pullback phase following the bull’s repeated failed breakout above the February 2 high. The next targets for the bears are the 20-week exponential moving average and the March low. The bulls hope the 20-week exponential moving average will act as support.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a EURUSD big bear bar closing at its low.

- Previously, we said that the wedge and micro double top increase the odds that we may see a minor pullback begin at any moment. Odds will continue to slightly favor sideways to up until the bears can create credible selling pressure.

- This week was a strong bear bar and likely is the start of the pullback phase.

- The move up from March 15 was in a tight bull channel which means strong bulls.

- The bulls got breakouts above February 2 high in April and May 3 times (a wedge – Apr 14, Apr 26, and May 3) but did not get sustained follow-through buying.

- When the market does something a few times and fails, it will then do the opposite. The EURUSD stalled and is pulling back this week.

- The bulls hope to get at least a retest of the April high after the current pullback.

- They want the 20-week exponential moving average to act as support.

- If the EURUSD trades much lower, they want a reversal up from a double-bottom bull flag with the March low.

- They want another big leg up completing the wedge pattern with the first two legs being February 2 and April 26.

- The bears want a reversal down from a higher high major trend reversal.

- This week, they got a strong move down from a wedge (Mar 23, Apr 14, and Apr 26) and a micro double top (Apr 14, Apr 26, and May 3).

- They want a failed breakout above the February 2 high and a retest of the March 15 low.

- The bears hope that the prior strong move up is simply a buy vacuum retest of the February 2 high.

- Since this week was a big bear bar closing near its low, it is a good sell signal bar for next week.

- The bears will need to create follow-through selling breaking far below the 20-week exponential moving average to increase the odds of a deeper pullback.

- The next target for the bears is the 20-week exponential moving average.

- For now, odds slightly favor the EURUSD to trade at least a little lower, possibly testing the 20-week exponential moving average.

The Daily EURUSD chart

- The EURUSD traded lower for the week.

- Previously, we said that the wedge top near the trading range high increases the odds of a pullback which can begin at any moment.

- This week was likely the start of the pullback phase, and the bears got a strong first leg down this week.

- The bears want a reversal down from a higher high major trend reversal (with Feb high), a wedge (Mar 23, April 4, and April 14) and a micro wedge (April 14, April 26, and May 3).

- The bears got a tight channel down breaking far below the 20-day exponential moving average.

- The move down is strong enough for traders to expect at least a small second leg sideways to down.

- Traders expect at least TBTL (Ten Bars, Two Legs) in the pullback phase.

- The bulls hope the pullback will form a higher low.

- They want another leg up completing the wedge pattern with the first two legs being February 2 and April 26.

- At the very least, they want a small leg retesting the current extreme high (April 26) after the pullback.

- If the EURUSD trades much lower, they want a reversal up from a larger double-bottom bull flag with the March low.

- Since Friday was a bear bar closing near the low, it is a sell signal bar for Monday.

- For now, odds slightly favor the EURUSD to be in the pullback phase, and for a second leg sideways to down after a small pullback.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.