Market Overview: EURUSD Forex

EURUSD Forex failed breakout pulled back after testing the 2017 low. The 10-day tight trading range from the end of April potentially is the final flag of the trend. Bulls want at least a 2-legged sideways to up pullback following a parabolic wedge (August 20, November 24, May 13) and a trend channel line overshoot.

The sell-off has been in a tight bear channel. Odds are any pullback (bounce) would likely be minor and traders expect at least a small second leg sideways to down after the pullback.

EURUSD Forex market

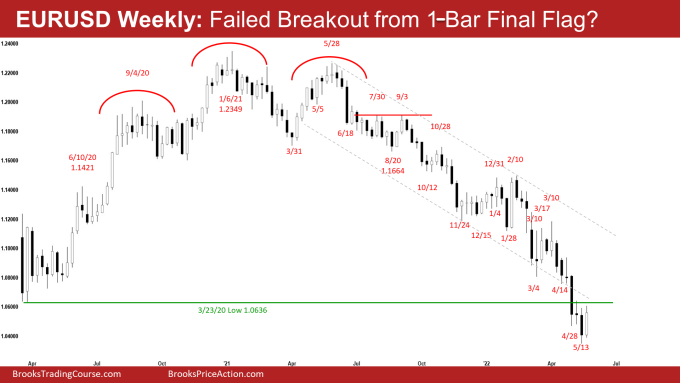

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bull bar with a prominent tail above. It traded above last week’s high but closed below it.

- Last week, we said that the trend down is strong, and odds continue to favor sideways to down. However, because of the market context (selloff is climactic, parabolic wedge, trend channel line overshoot), traders should be prepared for a 2-legged pullback (bounce) which can begin at any moment.

- This week closed as a bull bar near the upper half of the week’s range. It is a buy signal bar for next week.

- The bulls want a reversal higher from a parabolic wedge (August 20, November 24, May 13) and a trend channel line overshoot.

- The bulls hope that the selloff since March was a sell vacuum test of the 7-year trading range low. They want at least a 2-legged sideways to up pullback.

- The bears want a strong break below 2017 low and a measured move down based on the height of the 7-year trading range.

- If the bears get a few closes below the 2017 low, odds will swing in favor of a bear breakout.

- Al has said that the market has been in a trading range for seven years. It is now near the bottom of the range. Reversals are more likely than breakouts.

- Therefore, as strong as the sell-off has been, it is still more likely a bear leg in the seven-year trading range than a resumption of the 15-year bear trend.

- The sell-off is in a tight bear channel which means strong bears. Odds continue to favor sideways to down and any pullback would likely only be minor

- However, the current selloff is climactic. Because of the market context (parabolic wedge, trend channel line overshoot), traders should be prepared for a 2-legged pullback (bounce) which may have begun this week.

- The bulls will need to create a follow-through bar next week to convince traders that a 2-legged sideways to up pullback may be underway.

- The sell-off is strong enough for traders to expect at least a small second leg sideways to down after a pullback.

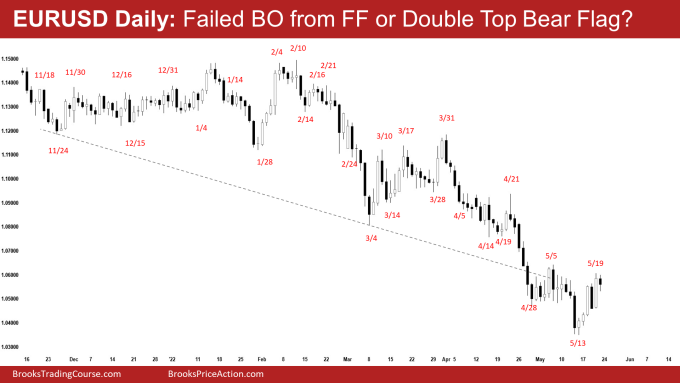

The Daily EURUSD chart

- The EURUSD pulled back higher from a failed breakout below the 10-bar final flag from the 2017 low.

- Last week, we said that the selling since March has been climactic. The parabolic wedge and trend channel overshoot increase the odds of a minor pullback before a strong break below the 2017 low. It may begin after a failed breakout below the final flag around the 2017 low.

- This week was the reversal higher from the 2017 low after a failed breakout below the 10-day final flag.

- The bulls hope that the sell-off since March was simply a sell vacuum test of the 2017 low. They want a reversal higher from a trend channel line overshoot and a parabolic wedge (April 14, April 28, and May 13) around the 2017 low.

- They hope that the tight trading range from the end of April was the final flag of the move. They want a reversal higher after a failed breakout below. So far, they have the first leg sideways to up.

- The bears want a strong break below 2017 low and a measured move down based on the height of the 7-year trading range.

- Friday was a small bear inside bar. It is a sell signal bar for Monday. They want a reversal lower from a double top bear flag (May 5 and May 19).

- The sell-off since March 31 is in a tight bear channel. It means the bears are strong.

- However, the selling has been climactic. The parabolic wedge and trend channel overshoot increase the odds of a minor pullback before a break below the 2017 low.

- The pullback may have already begun. The bulls will need to create consecutive bull bars closing near the high trading far above May 5 high to convince traders that a deeper pullback may be underway.

- If the pullback is more sideways with weak bull bars, odds are the bears will return to sell the double top bear flag (May 5 and May 19).

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.