Market Overview: EURUSD Forex

The EURUSD Forex formed a EURUSD tight bear channel closing below the 20-week exponential moving average (EMA). The bears want follow-through selling next week. If they get that, it increases the odds of a deeper pullback beginning. The bulls want the 20-week EMA to act as support and hope the market will reverse back above the 20-week EMA.

EURUSD Forex market

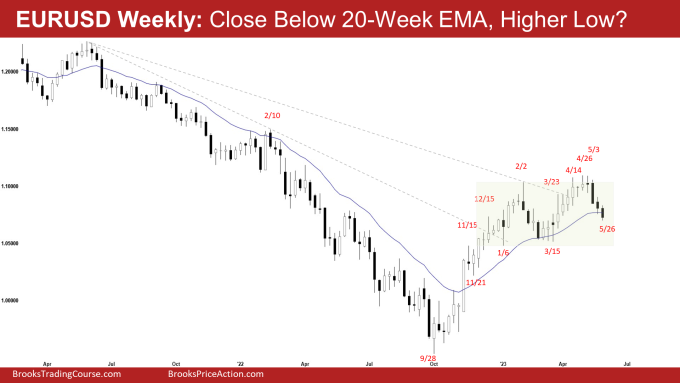

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear bar with a small tail below.

- Last week, we said that the odds slightly favor a small second leg sideways to down after a pullback.

- This week closed below the 20-week EMA (exponential moving average).

- The bears got a reversal down from a higher high major trend reversal and failed breakout above the February 2 high.

- They got the third consecutive bear bar, and they now have a 4-bar bear micro channel. They want a retest of the March 15 low.

- The bears will need to create follow-through selling breaking far below the 20-week EMA to convince traders that a reversal down could be underway.

- If there is a pullback, the bears want at least a small second leg sideways to down testing the current leg low (May 26).

- The bulls got breakouts above the February 2 high in April and May; 3 times (a wedge – Apr 14, Apr 26, and May 3) but did not get sustained follow-through buying.

- When the market does something a few times and fails, it will often then do the opposite. The EURUSD stalled and has started the pullback phase.

- The bulls hope to get at least a retest of the April high after the current pullback.

- They want the 20-week EMA to act as support. They hope the EURUSD will reverse back above the 20-week EMA next week.

- If the EURUSD trades much lower, they want a reversal up from a double bottom bull flag with the March low.

- The current selloff is in a tight bear channel. The bulls will need a strong reversal bar or a micro double bottom before they would be willing to buy aggressively.

- Since this week was a bear bar closing near the low, it is a sell signal bar for next week.

- Traders want to see if the bears can get a follow-through bear bar following this week’s close below the 20-week EMA.

- Or will the EURUSD form a minor pullback (bounce) and reverse back above the 20-week EMA?

- For now, odds slightly favor a small second leg sideways to down after a small pullback.

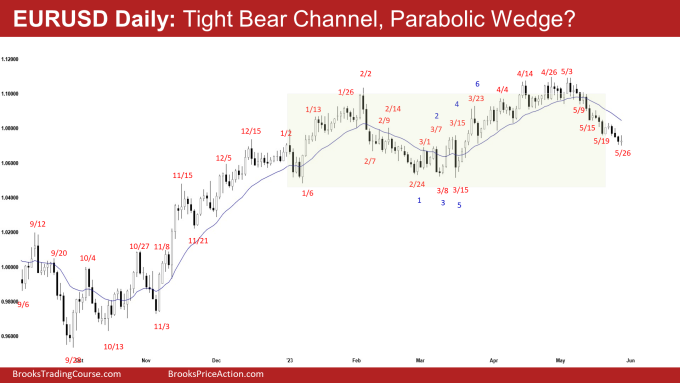

The Daily EURUSD chart

- The EURUSD pulled back slightly earlier in the week and then formed another leg lower for the rest of the week. Friday was an outside bull doji.

- Last week, we said that odds slightly favor at least a small second leg sideways to down after a slightly larger pullback.

- This week continued the tight bear channel down in a parabolic wedge (May 15, May 19, and May 26).

- The bears got a reversal down from a higher high major trend reversal (with Feb high), a wedge (Mar 23, April 4, and April 14) and a micro wedge (April 14, April 26, and May 3).

- The move down is in a tight bear channel. That means persistent bears.

- Traders expect at least a small second leg sideways to down after a larger pullback.

- They expect at least TBTL (Ten Bars, Two Legs) in the pullback phase. The pullback currently consists of 15 bars (candlesticks).

- The bulls hope the pullback will form a higher low.

- They want another strong leg up completing the wedge pattern with the first two legs being February 2 and April 26.

- At the very least, they want a small leg retesting the prior leg extreme high (April 26) after the pullback.

- They want a reversal up from a parabolic wedge (May 15, May 19, and May 26).

- If the EURUSD trades much lower, they want a reversal up from a larger double bottom bull flag with the March low.

- While the tight channel down means strong bears, the selloff is also slightly climactic.

- There may be a minor pullback followed by a second leg sideways to down retesting the current leg low (May 26).

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thank you, Andrew!

Dear TP,

You’re most welcome.. have a blessed week ahead..

Best Regards,

Andrew