Market Overview: EURUSD Forex

The bears want a reversal down from a EURUSD Wedge Top and a failed breakout above the April high. They need to continue creating consecutive bear bars, breaking far below the 20-week exponential moving average to increase the odds of a reversal down. The bulls want the 20-week exponential moving average to act as support and form a higher low followed by a retest of the prior leg extreme high (Jul 18)

EURUSD Forex market

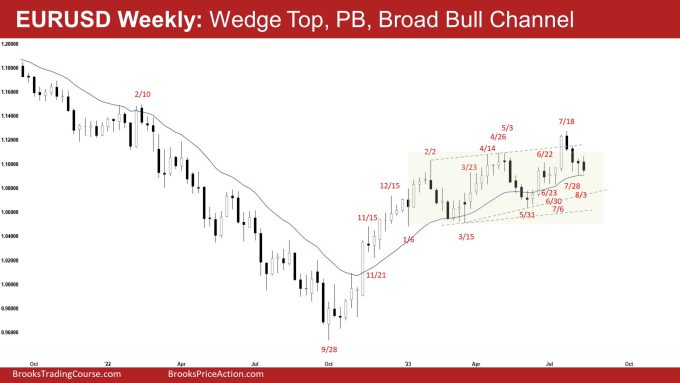

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear bar closing near its low.

- Last week, we said that traders will see if the bulls can create follow-through buying or will the market continue to trade sideways to down around the 20-week exponential moving average area.

- This week traded above last week’s high, but the bulls were not able to create sustained follow-through buying and the market reversed to close as a bear bar.

- The bulls previously got the third leg up forming a wedge pattern (Feb 2, Apr 26, and Jul 18).

- They want a strong leg-up lasting many weeks like the one which started in November 2022 but did not get follow-through buying above the April high.

- The targets for the bulls are the Jan/Feb 2022 highs and a measured move up using the height of the prior 6 month’s trading range which will take them to around the October 2021 high.

- They hope that the last four weeks were simply a pullback and want at least a small leg to retest the July 18 high. They see the market as still being in a broad bull channel.

- The bulls want the 20-week exponential moving average to act as support and form a higher low.

- They then want another leg up completing the smaller wedge pattern (in the current leg) with the first two legs being June 22 and July 18.

- The bears hope to get a reversal from a failed breakout above the April high, a wedge top (Feb 2, Apr 26, and Jul 18) and a trend channel line overshoot.

- They manage to create a pullback testing the 20-week exponential moving average.

- They need to continue creating consecutive bear bars, breaking far below the 20-week exponential moving average to increase the odds of a reversal down.

- Since this week was a bear bar closing near its low, it is a sell signal bar for next week.

- For now, the EURUSD may still trade sideways to down in the coming week(s).

- Traders will see the bears can create a close below the 20-week exponential moving average area or will the market trade slightly lower but continue to stall around the 20-week EMA area.

- The odds slightly favor the market to still be in the broad bull channel phase and favor at least a small retest of the July 18 high after the current pullback.

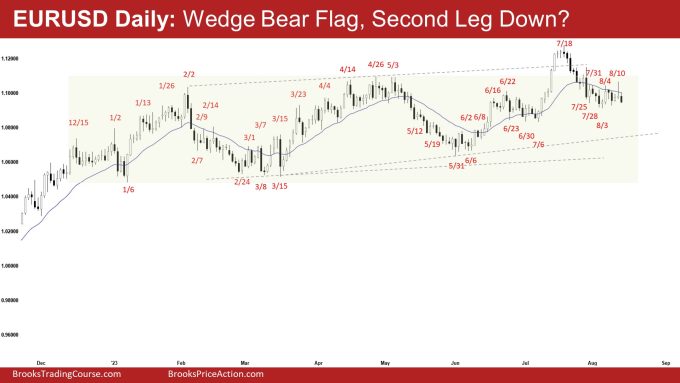

The Daily EURUSD chart

- The EURUSD traded sideways to down for the week. Thursday traded higher but there was no sustained follow-through buying. The bears got follow-through selling on Friday.

- Previously, we said that the EURUSD may still be in the sideways to down pullback phase and traders will see if the bears can continue to create strong bear bars or will the pullback phase be weak (with overlapping bars, doji(s) and bull bars).

- The EURUSD traded sideways to down below the 20-day exponential moving average in the last 2 weeks.

- The bulls recently got the third leg up, completing the large wedge pattern (Feb 2, Apr 26, and Jul 18).

- They want the breakout above April to be the start of a new leg lasting many weeks but were not able to get sustained follow-through buying.

- They hope that the recent move down is simply a pullback and wants another leg up completing the smaller wedge pattern (since May low) with the first two legs being June 22 and July 18.

- At the very least, they want a small retest of the prior leg extreme (July 18).

- The bears hope to get a failed breakout above the April high.

- They want a reversal down from a trend channel line overshoot and a wedge top (Feb 2, Apr 26, and Jul 18).

- They got a strong leg down followed by 2 weeks of sideways trading below the 20-day exponential moving average.

- They see the sideways trading as forming a double top bear flag (Aug 4 and Aug 10) or a wedge bear flag (Jul 31, Aug 4, and Aug 10) and want another strong leg down.

- They want a test of the bull trend line below.

- The move down since July 18 is in a tight bear channel. The bull bars in the last 2 weeks also lack sustained follow-through buying.

- For now, the EURUSD may still be in the sideways to down pullback phase.

- Traders will see if the bears can create another leg down testing the bull trend line or will the pullback continue to trade sideways (with overlapping bars, doji(s) and bull bars).

- Odds slightly favor the EURUSD to form at least a small retest of the prior leg extreme (Jul 18) after the pullback.

- The retest can simply be a few bars and may not reach the prior leg extreme high, in which case, it will then form a lower high major trend reversal pattern.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

I appreciate your help and your perfect analysis.

I would be grateful if you could put your analysis for 5-min EURUSD chart.

thaks a lot

Dear Anoush,

Thanks for your continuous support..

At the moment I don’t think there is a plan for an analysis for 5-mins EURUSD chart..

It may be in the pipeline in the future?

Take care and wishing a blessed week ahead.

Best Regards,

Andrew