Market Overview: FTSE 100 Futures

The FTSE futures market went slightly lower last week with a bear inside bar. Bears have had trouble breaking below this low, but keep getting bars under the MA. The risk/reward favours the bulls who want a move up, betting that we will not get another low in the year. Bulls want a good buy signal to set up a swing, as the prior ones were too high or the bodies were too small.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures last week was a bear inside bar.

- The bears got consecutive bear bars below the moving average, so it is a pullback, and they want a second leg sideways to down. Was that the second leg?

- The bulls had a 4-bar bull microchannel, a breakout to a new high and expected a two-legged pullback.

- But that was a disappointing pullback for bulls. So likely a trading range.

- We are testing the prior inside bar, which had a breakout and good swing up, so it might be from here that the bulls want another move.

- Bears see strong bear bars and will likely short anything at the MA.

- It’s a triangle, it’s BOM, and we are at the long-term trendline – a bull trend on the monthly. That means buyers are somewhere below.

- If you’re a bull, you want a good buy signal above the MA – nothing for you.

- If you’re a bear, you have a break below and a sell signal – with a tail.

- Because it is a trading range, it’s probably a better buy below that bar – betting sell signals fail at the lows like buy signals fail in the high.

- Most traders would be short or flat – waiting for a real breakout.

- We are going to break out of here. It is likely to be to the upside but might shoot down to trap traders first.

- Expect sideways to up next week.

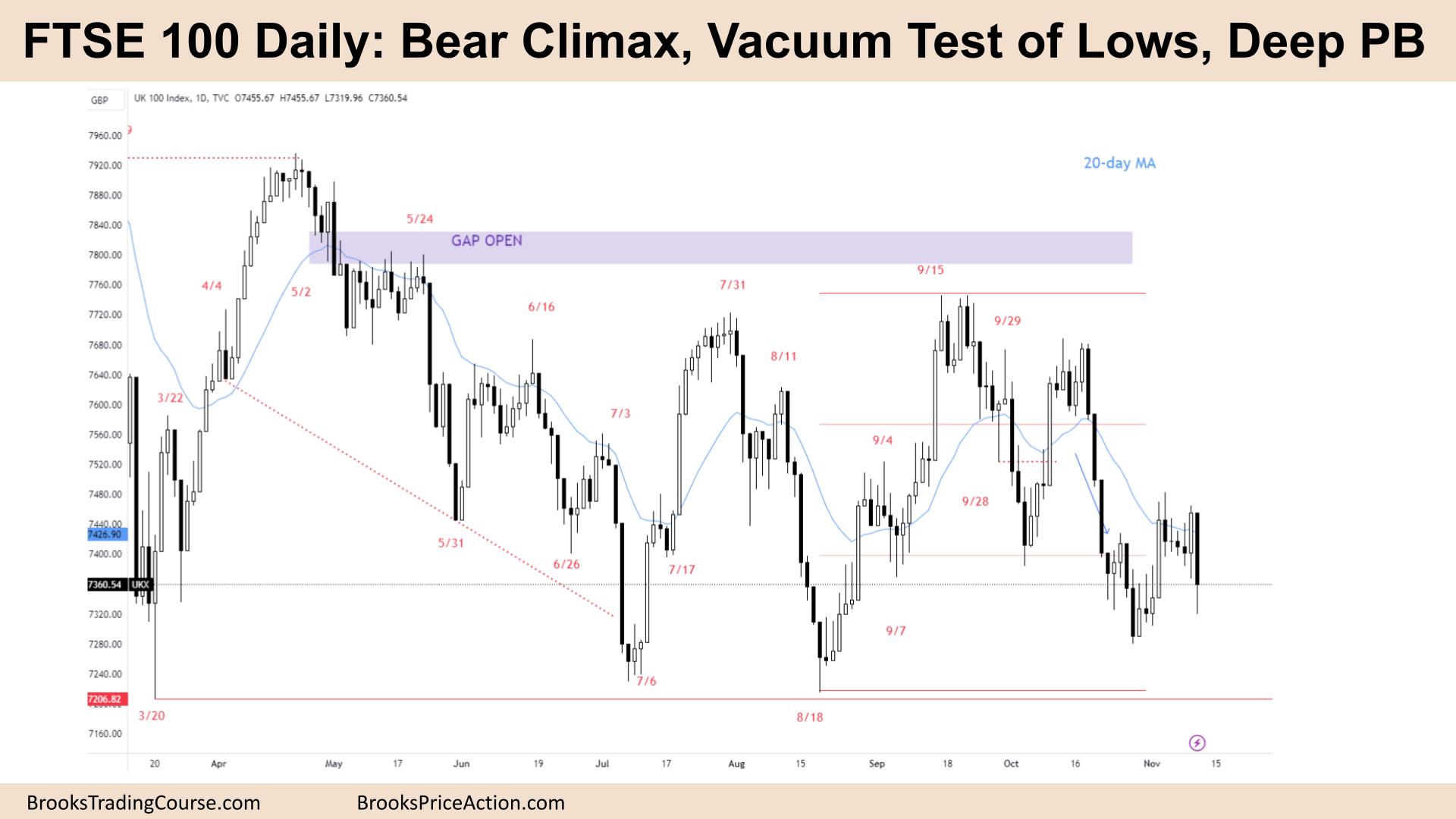

The Daily FTSE chart

- The FTSE 100 futures was a big bear bar, a sell climax on Friday.

- It was a vacuum test of the lows of the trading range.

- After two good bear bars, the bears had a sell signal, which failed. They got stuck. Traders had to sell the MA to return to their entries’ midpoint. But they got back, so made a good profit.

- That means the bulls are not strong yet.

- Bulls had a strong bull leg to the MA, but it was likely a leg 2 trap, highs of an expanding triangle. It was a low-probability buy up there.

- Now, bears can’t really sell this low, big risk; not much reward left, so bulls prob take over here and get back to the MA.

- It was an OO, an outside-outside setup on Wednesday and Thursday – that set targets at 7564 and 7271. We might hit both!

- An OO is an expanding triangle, and it had a bull breakout that was larger above the bar than below it. That means probably buyers below and scaling in lower.

- Bears want a follow-through, but more likely a doji next bar or a bull reversal. We expected buyers under the big bull bar low in the trading range – they will scale in lower.

- We didn’t always go in long, so it’s likely trading range and expect 2 legs in each direction.

- Expect sideways to up next week; buyers should be under the big bar, and high-probability fade low in a trading range.

- Bears need a follow-through bar to trap countertrend scalpers, test and move down.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.