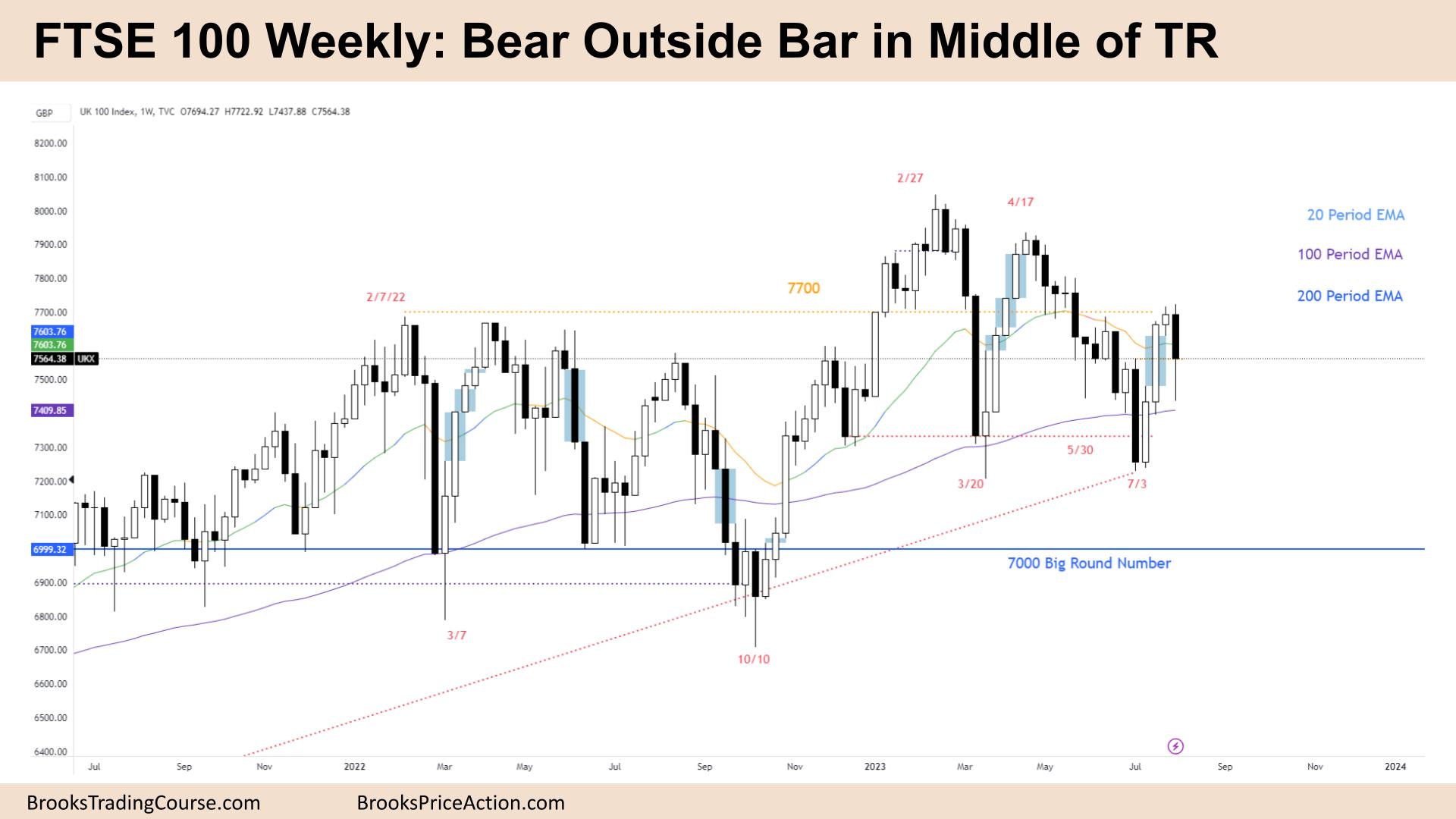

Market Overview: FTSE 100 Futures

The FTSE futures market moved down last week with a bear outside bar. That means we triggered buyers above after a bull microchannel in the middle of a trading range. There were buyers again at the 200-week MA. It might be difficult for bears to sell through it. This week is now a bad buy and a bad sell signal, so we might go sideways next week.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures was a bear outside bar last week.

- It triggered the buyers above a bull microchannel.

- The bull leg was strong, so we should get a second leg sideways to up. But the outside bar is disappointing, so it might be just one bull bar up to the trigger point.

- The bulls see an HL DB, a wedge bottom after a bull BO to a new ATH.

- They bought again near the 200-week MA; as all MAs are moving up, it is a bull trend.

- Bull trends encourage bulls to buy high, knowing they can buy lower if it forms a trading range and at least get out breakeven if disappointed.

- The bears see a trading range and failed BO above a TR. The bear legs have been too strong to call it a bull trend, so they will sell above the highs.

- There is a LH and a HL – so it’s a triangle, and we are right in the middle, which might be where we stay for the next few weeks.

- The bulls broke to a new high and bought pullback. The pullback was strong but failed at the MA – trapping them in.

- The bears could not run the bull stops, so we strongly reversed back to where they got stuck.

- Last week you can see they exited out of that position.

- Some aggressive bears shorted the bull microchannel because it was a BO from an inside bar, which is a reasonable fade trade.

- Consecutive bars closed above the MA, but a 20-bar MA gap bar sell worked.

- It’s a weak sell signal low in a trading range, so there are probably more buyers below.

- Expect sideways to up next week.

The Daily FTSE chart

- The FTSE 100 futures last week was small bull bar closing on its high, so we might gap up on Monday.

- The bulls closed the gap above after a strong BO from a bear channel. The trendline break was strong and did not allow bears to exit breakeven.

- Bears selling the MA also sold and got trapped. Both could exit on Thursday with that big tail.

- The bull leg was very strong, so traders will expect a small leg sideways to up.

- But the bear selloff was surprising as well – so they might get one more bar down.

- Now bulls are trapped above at the BO point and MA. Bulls want to move up quickly to let them out.

- The last bears are stuck on July 17th with a bear bar a reasonable sell signal at the MA. The trouble with that sell was it was late in a bear trend so most traders should not take it.

- We are behaving like a trading range, so traders should BLSHS and take quick profits.

- It is a bear outside bar on the weekly, so trading range behaviour and likely sellers above now.

- Friday was a small bar, so we will likely go above and below it. Most traders should wait for consecutive bull bars before buying.

- Now we are below the moving average, so we might go sideways for 2 more days before traders decide where to next.

- Bears might exit above this Friday’s bar. But it is too early to buy.

- Expect sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.