Market Overview: FTSE 100 Futures

The FTSE futures market moved lower last week with a surprise bar and a break below the 100-week MA. Bulls have been buying here and lower and will likely buy the trendline as well. The bears see a possible LH DT and want a measured-move down. The best they might get in the TR is a small 2nd leg – maybe even one more bar.

FTSE 100 Futures

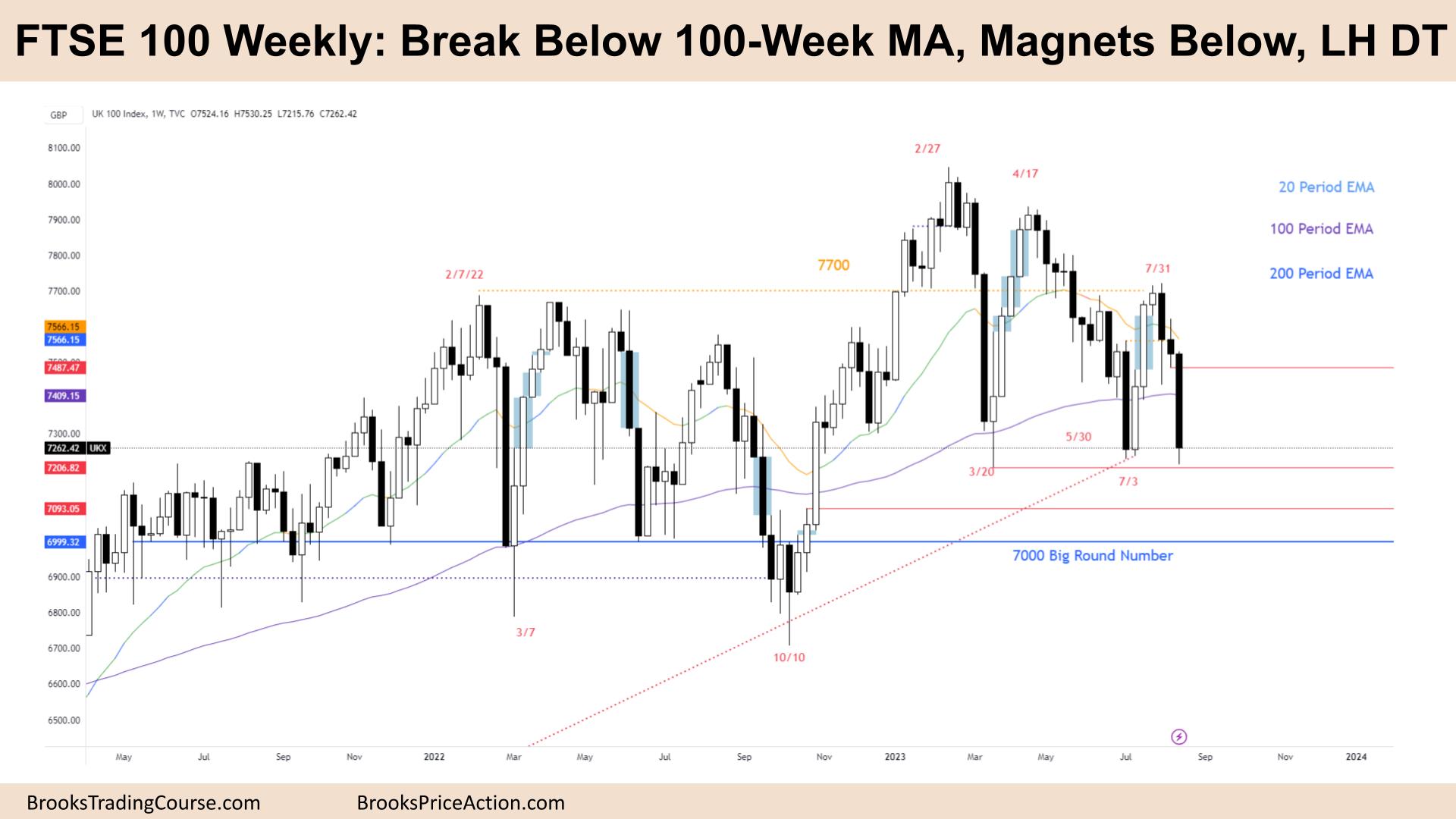

The Weekly FTSE chart

- The FTSE 100 futures last week was a big bear bar closing near its low, so we might gap down on Monday.

- It is the 3rd consecutive bear bar, so a bear microchannel. The first reversal should be minor.

- We are at the low of the inside bar on July 10th – so we might pause here. Inside bars are triangles and bring probability back to 50/50.

- The bears see a LH DT. And we dipped below the prior low on the week of July 3rd.

- The bears want a break below a breakout and then a FT bar to close below.

- This would set up a possible measured move target to 6700 – the prior trading range low.

- The bulls see strong buying pressure. A breakout above the ATH, and this is the 3rd leg down in a wedge bull flag.

- The bulls want a buy signal next week. This would be at the right place, a long-term trendline, the 100-week MA and the middle of the prior trading range.

- We’re in a trading range, so it’s likely to disappoint traders. Most traders should BLSHS.

- There will be buyers below the buy climax here. But we are so close to these other magnets, traders might decide we need to go and test them one more time.

- The bulls want to trap the bears below the bar and reverse up strongly.

- Consecutive bars below the moving average means we are always in short – but low in a trading range, the bears will be quick to get out.

- They need one more convincing bar to close.

- Expect sideways to down next week.

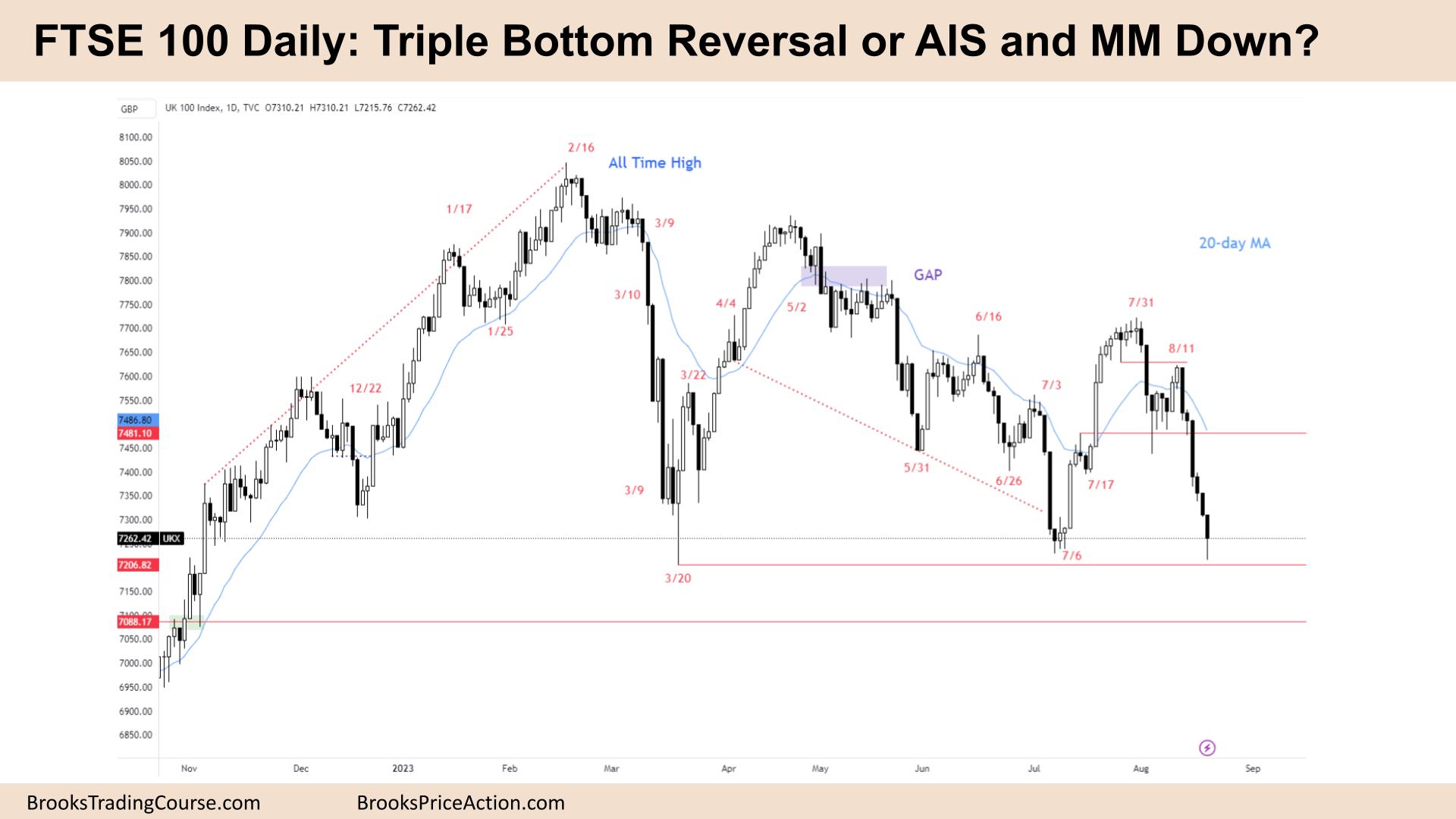

The Daily FTSE chart

- The FTSE 100 futures on Friday was a bear bar closing above its midpoint. So it is a pause.

- The first thing I notice about the daily chart – is that it is a fractal of the weekly chart. A giant wedge bull flag. That doesn’t mean it has to go up.

- Bulls need two bull days next week to defend this area.

- Bears got stuck down here in July and couldn’t avoid taking a loss. They just got a chance to get out breakeven.

- Bulls gave up last Friday and all week we went down. It was a strong leg up, but disappointing follow-through and big bear bars.

- The bulls see a triple bottom, a giant bull flag on the HTF. But they need a buy signal.

- It is the 6th consecutive bear bar, so a bear microchannel, the first reversal up should be minor.

- There is nothing to buy yet for the bulls. The tail on the bar will reduce the number of sellers below. But expect sellers above.

- There are 2 monthly / weekly magnets below, and the market might need to test them before deciding.

- Do we need to go back to 7000 Big Round Number, or is this the low for the next year?

- We don’t have a convincing bottom yet and that could be why we keep sliding back down.

- Probably buyers below the tight bull channel from July. Bears want to break below it for a measured move down.

- Expect sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.