Market Overview: FTSE 100 Futures

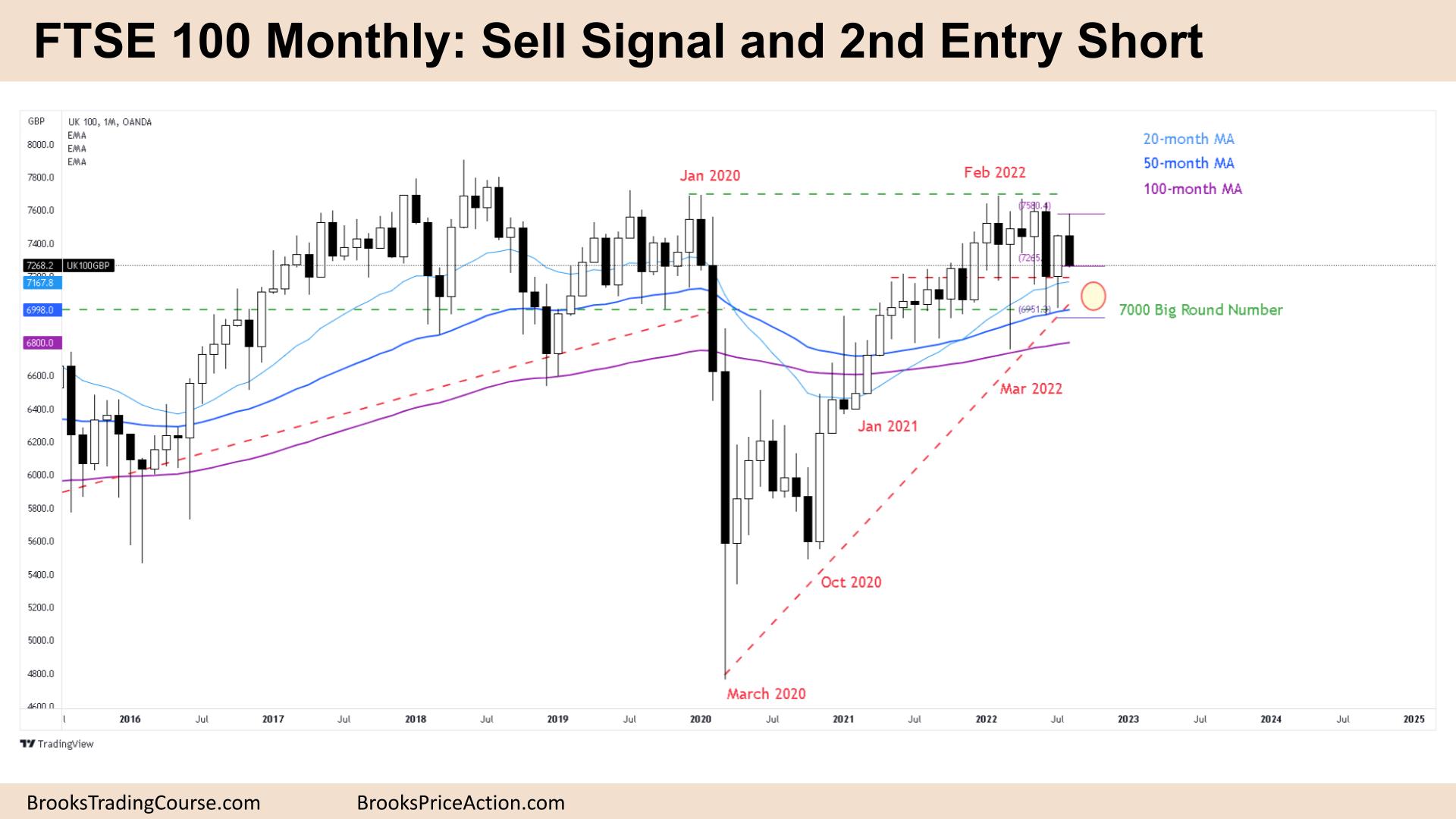

The FTSE futures market was a monthly sell signal and 2nd entry short. We have yet to see consecutive bear bars on the monthly chart for over 2 years, so next month will likely be bullish. There are many magnets below: The 7000 Big Round Number, the moving averages and a tight trading range from January. The bulls will buy below and at the moving average until is it no longer profitable to do so. Traders probably want to see what is below June and March before deciding where the trading range bottom is.

FTSE 100 Futures

The Monthly FTSE chart

- The FTSE 100 futures was a bear bar with a small tail above and closing on its low. It is a monthly sell signal and 2nd entry short entry below August.

- It’s a tight trading range so traders expect to trade with limit orders and scale in. Most traders should wait, as few stop entry swings appear and reversals are more common.

- If you look left, how many consecutive monthly bear bars have there been? None, in 2 years. So next month may move lower but will likely end up a bull bar.

- For the bulls, it’s a tight bull channel and they expect a pullback to the moving average to buy again. They have been buying below monthly bars for 2 years and will likely continue to do so next month.

- The bears see a tight trading range and final flag in Dec 2021 and so a failed breakout. They want a move back to the tight trading range as it is a magnet.

- The bears know the best they can get is a sideways trading range after such a big bull trend, but the bottom of the range is what they are pushing for now.

- The bulls saw July 2022 as a buy signal, a bull bar closing on it’s high and this as a pullback. They want it to stay above the low of July.

- The bears see a failed High 1 after last month and expect a pullback after a long trend maybe 2 legs sideways to down to the moving average.

- Interestingly, the last time a monthly bear bar closed on its low was January 2020, the pre-COVID crash – which is a good/bad sign.

- Better to be short or flat, the target would be 7000 Big Round Number but we might not go straight down.

The Weekly FTSE chart

- The FTSE 100 futures was a bear bar closing near its low so we might gap down on Monday.

- Two consecutive big bear bars mean that we are always in short, but at the bottom of a trading range and the 100-week moving average (MA).

- The bears see a lower high major trend reversal with June. They want a possible measured move down to break out of the range. Because it is a monthly sell signal they might encourage them to swing.

- 3 weeks ago was a bad sell signal so the following week we went back to let the longs out. Last week we moved down strongly.

- The bulls see a breakout test of June and pullback for a higher high major trend reversal. They see the bottom of a trading range where the math is better for buying.

- But two consecutive bear bars is a bad buy signal, so the best the bulls can do is buy below and scale in. The bulls want a big tail next week to buy above a High 1 which would be a higher probability trade.

- We can expect bears to sell the first High 1 as well to go for a second leg, which could push us out of the range.

- Expect sideways to down next week. If you had to be in, it’s better to be short or flat, and look to get out above a bull bar closing above its midpoint.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.