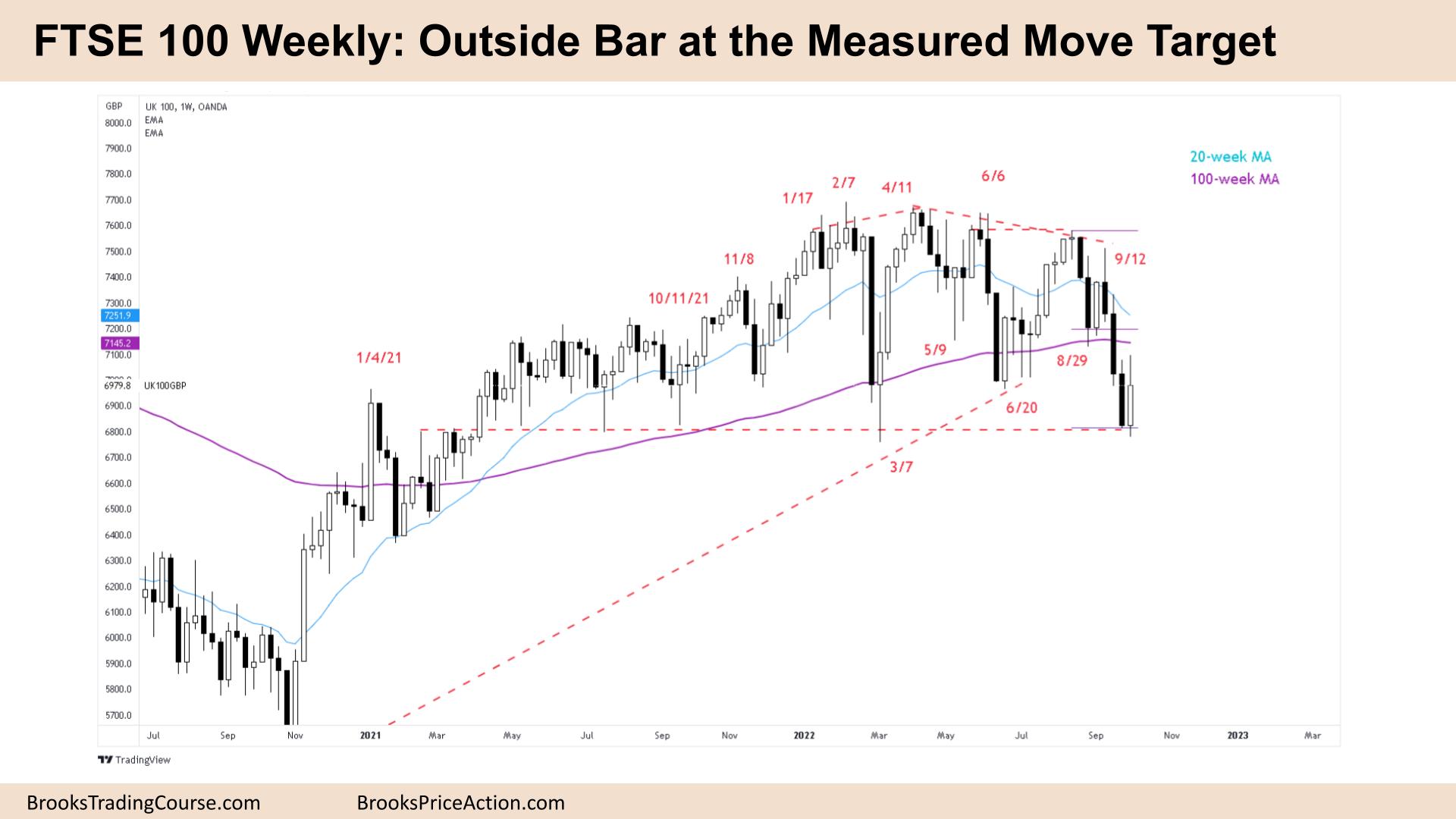

Market Overview: FTSE 100 Futures

The FTSE futures market reversed up last week at the trading range lows as an FTSE 100 outside bar so it’s in breakout mode. The bulls want a High 2 buy setup low in the trading range for a swing up. But after such strong bear bars, the odds favor a small second/third leg down. The bears want to break below the range and reach a measured move down, but the best they can get right now might be a wedge bottom around the July low.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures was a bull outside bar with tails above and below.

- It is a pause bar after 3 consecutive bear bars closing on their lows so we are still always in short.

- It is neither a great buy nor sell signal for next week so we might go sideways to down.

- It’s an outside bar so it’s a tight trading range and breakout mode so the probability is 50/50.

- An outside bar means it was a High 1 when we traded above last week and traders expected bears to sell there.

- For the bulls, it is 2 legs down after a tight bull channel up to the range highs. It is a lower low and deeper pullback. They see the sell climax after the first weekly bar to be completely below the 100-week moving average (MA.)

- But after 3 consecutive bear bars, it was not a great buy setup so most bulls are waiting for a High 2 or a follow-through bull bar before scaling in.

- It was a reasonable buy signal 4 weeks ago for the bulls. Trading ranges often go back to visit these reasonable opposite signal areas. So targets are 50% between the next buy setup and that one, and we might go above its high to let them out.

- The bears see a tight bear channel, two strong legs and expect another leg, but last week’s tail below will reduce the number of bears willing to sell below. They might retrace back to the moving average before selling again.

- The bulls want a wedge bottom and a buy setup to go long. A second entry would be an ideal low in the trading range. Some traders will wait for consecutive bars before buying.

- The bears want another leg down and they might get it We might need to close the gap below August 29th before continuing down.

- It’s a trading range so we can expect disappointment – perhaps a bear inside bar closing on its low or a follow-through bull bar with tails above and too high.

- If you had to be in the market it’s better to be short or flat. Traders can exit above last week and look to sell again.

The Daily FTSE chart

- The FTSE 100 futures was a bear doji with a very small body on Friday. It was a pause bar right at the 7000 big round number. It was an FTSE 100 outside bar on the weekly.

- The bulls see a reversal at the bottom of a trading range. Consecutive big bull bars, one being big and closing on its high so it was a breakout. It was a second entry buy low in a trading range which is a reasonable entry.

- The bears see a tight bear channel, at least 10 bear bars in a row so it was climactic and traders expected a reversal but not a strong buy setup. The bars are overlapping so it is not as bearish as it could be.

- The bulls want a second leg up – they want bars closing above the moving average for a “Walmart” trade reversal. They see the tails below Wednesday and Thursday as bulls buying pullbacks.

- The bears see this as a pullback in the second leg down and are looking to sell higher for a third push down and possibly break below the trading range – although it currently has a low probability because we have been in the range for 18 months. Hence the pause and outside bar as traders decide.

- Thursday was a Low 1 short after a bull breakout it was a low probability sell. Most limit bears will wait to sell above as most stop entries at the extreme of trading ranges are traps.

- It’s been 20 days under the moving average so it will be a 20-Gap bar sell setup when we get there possibly closing the gap below Sept 1st and Sept 9th.

- The bulls want more bull bars but might need a High 2 or High 3 to attract more buyers like in July. A sell climax bar here might also be good for the bulls as traders tend to do the opposite low in the range.

- Most always in bears exited Monday / Tuesday last week and will look to sell again with a reasonable sell signal. Most traders should be short or flat. If we get consecutive bull bars next week there might be a stop-entry buy but most traders should wait to see what happens at the moving average.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Would somebody be able to explain where the first entry buy was on the daily chart? Where Tim says ‘It was a second entry buy low in a trading range which is a reasonable entry.’ I see a bull bar closing on its high, 8 days ago, but it’s high was never broken. Does that still count?