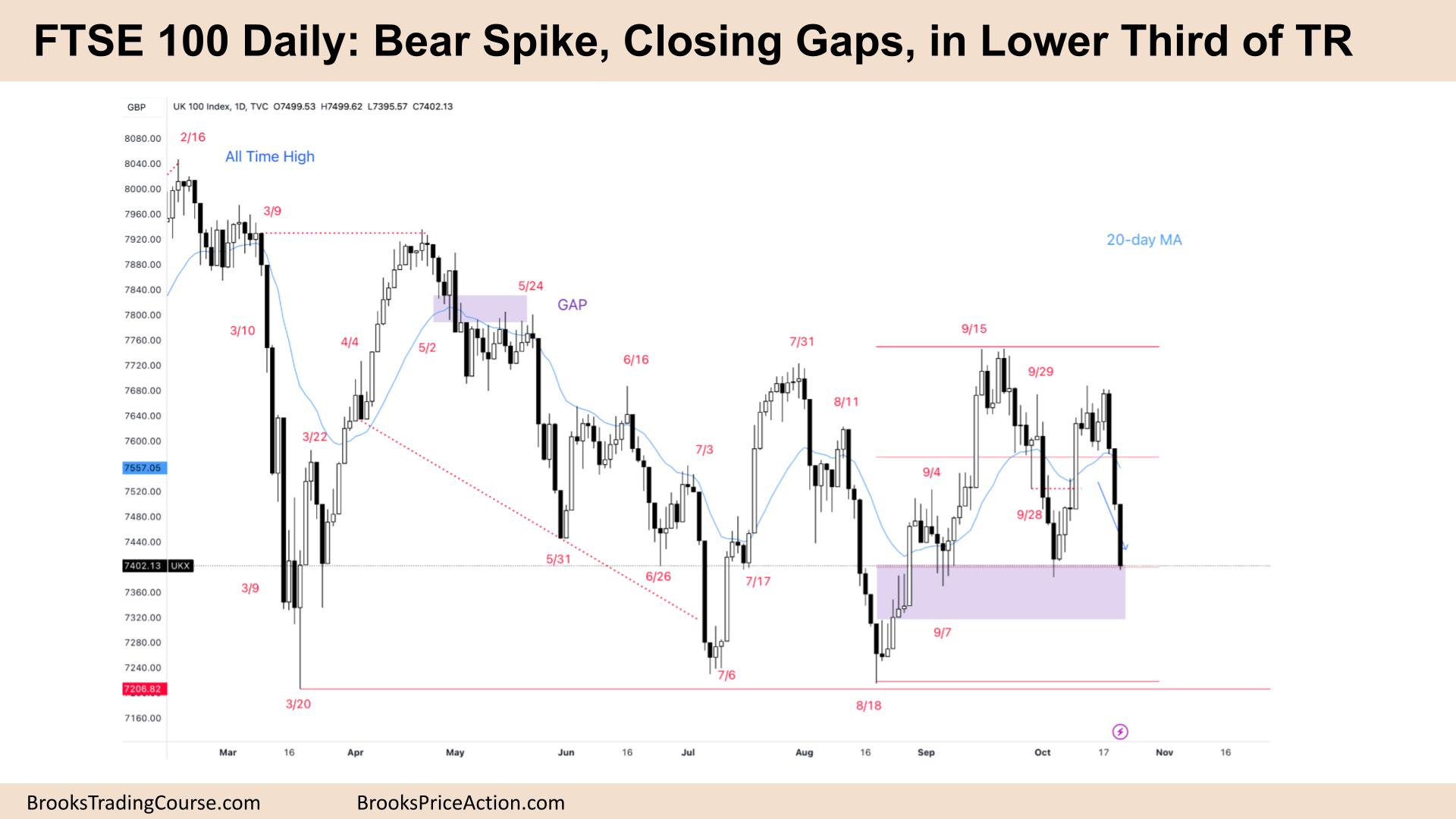

Market Overview: FTSE 100 Futures

The FTSE futures market moved lower last week with a give-up bar, a weak buy signal failing and creating a sell vacuum test of support. The daily chart has 3 strong bear bars, and a bear spike, so we should see a pullback and then a channel down form. Bulls expected a BO above the triangle; instead, it now looks like we will break below. Confusing, indecision, hallmarks of a TR. Most traders should be flat or looking to BLSHS.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures was a big bear bar, closing on its low and closing below the 100-week MA after a failed buy signal.

- It was a strong close, so we could gap down on Monday.

- It did not go above the prior week’s high, so it is not as bearish as it could be. If it had triggered the stop orders above, that would have created more sellers as the bulls had to exit.

- It was a strong second leg after the 3-bar bear microchannel.

- The bulls were expecting more, but it was disappointing after they saw the 3rd bar.

- It is BOM – breakout mode after 5 reversals in the middle of a trading range – a triangle. Most traders will lose money trading in BOM.

- In a triangle, you can be short or long – both entries are still live.

- Traders expect gaps to close and to break highs and lows.

- The bears want to break below August – at a strong trendline. Traders know that the first break is unlikely to succeed.

- Bears see a broad bear channel since the failed breakout above the ATH. But this HTF bull channel has had many attempts to break its low, but they all failed and became great buy signals.

- Bulls want a bull bar near the low of the TR. That would make an implied 2nd entry signal.

- It is a climax bar so buyers will be at the low and close – expecting this bar to fail to get a measured move. Because swing entries are low probability betting against them is higher probability.

- Most traders should be short or flat, waiting for a reasonable breakout and FT to trade a second leg. After the weak buy, some traders will wait for 2 legs.

- Expect sideways to down next week.

The Daily FTSE chart

- The FTSE 100 futures was a big bear bar, a bear spike, closing on its low on Friday, so we might gap down on Monday.

- 3 big bear bars, a bear surprise is a breakout and FT, so traders should expect a second leg sideways to down.

- It is a spike, so after a pullback, traders will expect a bear channel, closing the gap below and maybe getting a new low.

- We said last week we expected both gaps to close but were not sure about the order. It is now more clear that even with a pullback Mon / Tue, the gap below will close.

- Unless you are a bear profit-taking, it is a bad buy setup here. Most bulls will wait for an inside bar, or a strong reversal bar, and even then look to buy below.

- Other bears who missed it are looking to get in above the high of a prior bar. Expect the first reversal to fail.

- But trading ranges are confusing – look at August. Strong bear spike – sellers above the high, and one bar was all they got.

- It was not a strong sell signal – a bear outside bar at the bottom of a triangle. But it got a breakout and FT. So bulls exit after seeing so much strength, and some switch to short. We should go back and test the breakout point.

- Expect sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.