Posted 6:55 a.m.

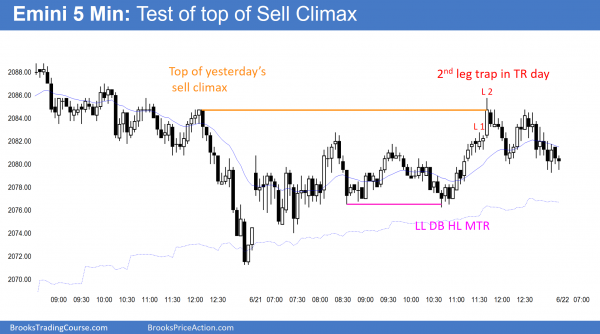

The Emini entered the day with a bull flag candlestick pattern before the Brexit vote. Limit order bulls and bears each made money on each of the 1st 3 bars. This increases the chances of trading range price action today. The Emini opened in the middle of yesterday’s sell climax at the moving average. Hence, more neutral price action. While a swing up and down will probably form today, it is too early to know which will come first. Traders are looking for a good buy or sell signal bar, or for a strong breakout with follow-through.

The 1st target for the bears is the bottom of yesterday’s sell climax, which is at the 60 minute moving average. Yesterday was also a sell signal bar on the daily chart. Because of the 2 sided trading today, a breakout below yesterday’s low will probably be bought.

The bulls want to get above yesterday’s sell climax. Again, the early 2 sided trading make it likely that the breakout would not get too far. A trading range day is likely.

Bull flag candlestick pattern before the Brexit vote

S&P 500 Emini: Pre-Open Market Analysis

The Emini daily chart had a strong buy signal on Thursday. Yesterday gapped above Thursday’s high and therefore triggered the buy. Although yesterday sold off all day in a bear channel, it ended with a sell climax at support. The support was Thursday’s high and the 60 minute moving average. The channel on the 5 minute chart formed a bull flag candlestick pattern before the Brexit vote on Thursday.

A bear channel is a bull flag. There is a 75% chance of a breakout above the bear channel. As a result of yesterday’s sell climax, there is only a 25% chance that today will be a strong bear trend day. Furthermore, there is a 50% chance of follow-through selling in the 1st hour or two. In addition, there is a 75% chance of at least a 2 hour sideways to up move. It begins by the end of the 2nd hour. With the Globex session up 8 points, there will probably be a gap above the channel on the open. Because of the sell climax, the above statistics still apply.

As a result of the June 8 wedge top on the daily chart, bears expected a 2 legged correction. While Thursday’s micro double bottom might have been the 2 legs down, the channel was tight. A tight channel is usually the first of 2 larger legs. This means that the Emini might rally for 2 – 3 days and begin a 2nd leg.

Cash Index

Because the cash index got to within 14 points of its all-time high 2 weeks ago, it is within the high’s magnetic pull. The selling since then was not a strong bear breakout. The reversal up last week was strong. The Brexit vote has the potential to create a big move up or down. Consequently, there is a 50% chance that the cash index will test its all-time high. As a result, the Emini would then make a new all-time high. Most noteworthy, it would be a 3rd push up on the daily Emini chart.

A reversal down, which is likely, would then be from a wedge top. This could create a bear swing lasting at least a few weeks. If the selloff is strong, it could continue to the bottom of the 2 year trading range.

Brexit and a neutral market

Brexit is a breakout mode event. Therefore, wherever the Emini is just before the announcement. it will be at the market’s perception of balance. At that moment, the bulls and bears would have a 50% chance of a breakout on the news. Without Brexit, the odds would favor one more leg down. However, as a result of Brexit, the odds of a new all-time high are 50%. This is the same as the odds for the end leg down.

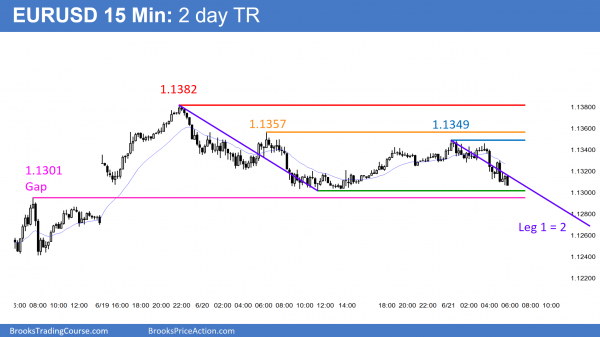

Forex: Best trading strategies

The EURUSD 15 minute Forex chart remains in a tight trading range. Support below is the 1.1300 round number, yesterday’s gap, and a Leg 1 = Leg 2 measured move target.

The EURUSD daily Forex chart had a higher low major trend reversal buy setup on Friday. Yesterday traded above Friday’s high and therefore triggered the buy signal. Because yesterday was a bear doji candlestick pattern on the daily chart, it was a weak entry bar. The bears see i as a sell signal bar for a lower high double top with the June 0 high.

The bulls see yesterday’s selloff on the 60 minute chart as a bear channel, Hence, it is a bull flag, and a pullback from Sunday’s bull breakout. Consequently, a breakout above the bear channel is likely.

Because the Brexit vote on Thursday is a major catalyst, all Forex markets will be neutral before the announcement. Hence, there will be a 50% chance of a bull breakout and a 50% chance of a bear breakout. Yesterday was mostly in a small trading range. Although there might be brief breakouts up or down before the vote, the odds favor quiet trading range price action.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Today was a trading range day. It was unusual because limit order traders who managed trades well made money all day, even after strong breakouts.

Today was a trading range day. The Emini is trying to be neutral going into the Brexit vote on Thursday. Hence, tomorrow will also likely have a lot of trading range price action. Logic favors the UK staying in the EU, but there is a chance that emotion and stupidity will win. There is a 50% chance of a sharp move up or down, regardless of the vote.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Logic over emotion and stupidity every time! Here’s hoping

Al, today was just a great illustration of your simple BLSH Scalp mantra for TR days. Thank you so much for your course.

Can you guys please share the information with us

I am not in the chat room. My comment was based on what I learned in the video course and my personal trading yesterday.

Learned a lot today, thanks Al. in the hourly chart, there was a two legged up move as a pullback, a second leg down might be coming!

Please share the information with us about what Al teach you in the room .so we can learn too

E-mini 60 min inverted Head and Shoulder beginning Jun 13 and completing Jun 20?

Yes, you are right. LL MTR, then HL MTR for the R shoulder. I mentioned that either in the weekend update or last week. Still in middle of the TR, and that is overriding force. The market is waiting for the Brexit vote.