Posted 6:46 a.m.

Today opened with a big gap down, but it quickly traded back above the June 16 low. It will probably retrace 50% of the Globex range. The Emini is Always In Long. The 1st 3 bars were strong enough to make sideways to up likely for the 1st 2 hours and possibly all day. There is a 60% chance that the 1st bar will remain the low of the next several hours and possibly all day.

The bears will probably need at least 5 – 10 bars before they have a chance of a bear trend. At the moment, there is about a 30% chance of a bear trend back down to the open. More likely, the best the bears can get over the next 2 hours is a trading range. The bulls will buy the 1st reversal down. The bars are big so either trade small or wait.

Day trading the Brexit market crash

S&P 500 Emini: Pre-Open Market Analysis

The bears got their breakout overnight. The Emini had a big overnight range and is below the lows of about 20 prior bars. If the day session closes on its low, today will be a Give Up bar on the daily chart. In general, these bars have a 60% chance of leading to some type of measured move down. Yet, there is still a 40% chance of a failed bear breakout and a reversal up.

I adjust these percentages based on the context and the size of the bar. If today closes below the May low, a measured move down has a 60% probability. If it closes above the June low, it has less than a 50% probability. If there is follow-through selling next week, a measured move down has a 60% probability.

Traders cannot dismiss the opposite. Most breakouts fail, even when they are big like this. However, the context is that the Emini is repeatedly failing at its all-time high after a 7 year buy climax. Furthermore, there is a double top on the monthly chart from 2000 and 2007 at around 1500 that has never been tested.

Is this the start of the test? It is too early to know. I have been writing repeatedly for a year that there is a 60% chance of the test within the next 3 years. Reversals often begin with a huge bar. By the time traders conclude that this is the test, the Emini will already be below the 2 year low and halfway to the target.

Big gap down

Today will open with a big gap down. This means it will be far below the average price. When that happens, the Emini usually will have limited movement after a brief initial move up or down. It often has follow-through selling or a strong reversal for the 1st hour hour. Most noteworthy is that it then usually enters a trading range for 2 or more hours. It would therefore be in breakout mode. Hence, traders would decide between trend resumption down or trend reversal up later in the day.

Importance of closing below the breakout point

The key prices today are the June 16 low of 2040.75 and the May 19 low of 2013.00. The Emini fell far below both overnight. If it closes below both, there will be at least a 60% chance of a measured move down. These lows are breakout points. The bears need signs of strength. They need to make traders believe that the trading range has ended and a bear trend has begun.

Especially relevant is a close below breakout points. Trading ranges resist breaking out. Disappointment repeatedly comes after breakouts. The odds are that the breakout today will disappoint the bears. A close above both breakout points would greatly weaken the bear case and increase the chances of a continued trading range.

The Globex session

The emini fell to 1999.00 in the Globex session, yet is trading 40 points higher. It is far above the May low and at the June low. This weakens the bear argument and it creates uncertainty. Uncertainty is a hallmark of a trading range. There is at least a 50% chance that the Emini will be mostly sideways for 1 – 4 weeks as it decides whether this breakout will lead to a bear trend.

Sell climax, then trading range

Today’s range will be big. The bars will be big. Stops will be far away. Online day traders must use correct stops, which means that they must reduce their position size. If their size is so small that they cannot reduce it, they should just watch and not trade.

After a huge selloff and huge bounce, the odds favor a trading range day with big swings. Today is a Friday. That increases the chances of a big move in the final hour. Again, the key prices are the 2 breakout points. There will be a fight over whether today’s close will be below one or both. The bulls want this overnight breakout to be just a big down day in a trading range. They need to prevent the bears from creating signs of strength.

Forex: Best trading strategies

The EURUSD Forex daily chart has a big bear trend bar. The 5 minute chart crashed overnight. The bears want this to be the start of a bear trend. They will have a 60% chance if today closes below both lows and if there is follow-through selling next week. More likely, the EURUSD will be sideways for several weeks as it decides whether the trading has evolved into a bear trend.

The EURUSD fell overnight on the Brexit vote. The selloff reversed the March 10 bull breakout. Today will form a big bear bar on the daily chart. If it closes on its low and below the May 30 low of 1.1097, the odds of a measured move down will be about 60%. If there is then follow-through selling next week, the probability of a measured move would be more than 60%.

Yet, a close above the June 16 low of 1.1130 would reduce the probability of a measured move down to less than 50%. The fight today will be over these 2 breakout points.

While it is easy to see the bear case, traders must remember that the EURUSD is still in its 2 year trading range. Furthermore, most breakout attempts fail. While a huge bear bar is sometimes followed by a reversal and a measured move up, this is unlikely if there is follow-through selling next week.

EURUSD bear trend?

Is this the beginning of a selloff that will break below the bottom of the yearlong range? Again, most breakouts fail, no matter how strong they are. As a result, the chance that this is the start of a bear trend that will fall below the range is only about 50%. Big bars like this have a higher chance of starting a trend. Again, especially relevant is what happens next week. Will there be follow-through selling or a reversal up?

When there is a huge move, the EURUSD usually soon goes sideways for 2 or more hours. This is likely today. Unlike recent trading ranges, the trading range will probably 100 – 200 pips tall. The overnight rally off the low was almost 300 pips. Since the bars will be big, the stop will be far. When the bars and legs are big, day traders should reduce their position size so that they can use the appropriate stop.

A big range is usually followed by a trading range. Today’s range is huge. The trading range on the daily chart could last several weeks before traders decide between the start of a bear trend and a bear leg in a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

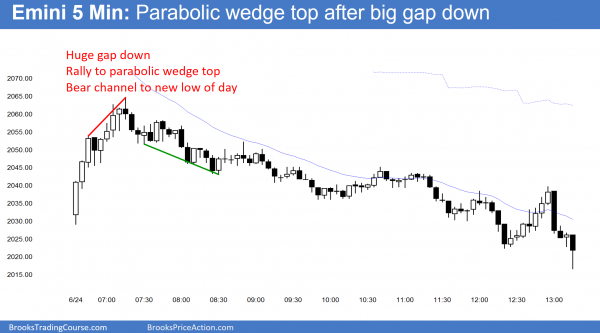

The Emini rallied strongly after a huge gap down. It then sold off in a bear channel from a parabolic wedge top.

Although the Emini failed to close below the May low, it did fall below the June 16 low. That is a neck line of a double top. As a result of a big gap down, a bear trend on the daily chart is more likely. It might gap below the May low on Monday. The selloff was so big that the Emini might have to go sideways for 1 – 4 weeks before resuming down. The bulls hope for a reversal up, but the odds on the daily chart favor the bears for the time being.

Can this crash on the daily chart, like it did on the 5 minute chart? That is unlikely. However, if the Emini trends down below the 2 year trading range, it would then try to get down to the 2007 high around 1500.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

In your comments 24 June 2016 section: “Importance of closing below the breakout point,” you stated, “The key prices today are the June 16 low of 2040.75 and the May 19 low of 2013.00.” I was able to find June 16 and verified the low 2040.75 on my chart. However, May 19 low on my chart is 2022. I’m using the /ES S&P 500 e-mini futures chart on the Think or Swim platform. Have I got the right chart that you are referencing?

Hi Elmer,

Allow me to answer for Al. Your chart for May is showing the old, expired June ES contract value.

You need to use a continuous contract chart to get the values Al is referring to.

BTC Admin,

Thanks for your quick reply. I thought the /ES was the continuous contract chart on the TOS platform. Do you know the symbol I should be using on the Think or Swim platform would be? Thanks in advance for your support.

Hi Elmer,

Sorry but I have no info on TOS to help here. But your TOS support forums or reference materials should help. This is a standard chart setup need for futures, so must be very easy to fix.

We do have some TOS users here so maybe they will step in. But hopefully you have fixed it already.

BTC Admin,

Thanks for your help. I found that using /ESU6 e-mini S&P500 Futures chart on Think or Swim (TOS) platform displayed the 5/19 low of the day at 2014. Much closer to the 2013 low of the day that Al mentioned. However, when I use the /ES chart it displays the 5/19 low of the day as 2022. Very confusing. I was told by TDAmeritrade that the /ESM6 contract displayed 5/19 as 2022 and that is why the /ES displays it that way too. So my question is why does the /ESU6 display the 5/19 low of the day as 2014 instead of 2022? Which one is right?

As noted, I am not a TOS user, but a search online suggests @ES being what you need?

Surprised TOS support cannot help. This is basic need for futures trading.

And that low should be 2013 which is 9 points below the existing contract figure of 2022.

Hope someone else here can help if @ES doesn’t work.

Al,

During the open I usually trade patterns from the previous day. Do you reckon that today is one where I should be watching patterns from the Globex instead? Thanks.

Dave

Many traders only watch the Globex session and that is fine. I would ignore yesterday. I am writing after the 1st hour and am trading today’s day session, ignoring yesterday.

Hi Al,

I have analyse what you did during the 2008 crisis when you catched the bottom of the S&P.

GBP/USD have hit 3 pushes down on the monthly chart and 2 legged monthly measured move target also hit. Currently bouce back strongly. Will we get 10bars 2 legs?

It is testing the bottom of a 16 year TR and that is more important than the 3 pushes down. Traders need more information. Is today a breakout that will lead to a measured move down, or is it and exhaustive sell climax that will reverse up. The wedge shape is not especially good. When charts are not clear, the market usually goes sideways for at least 5 – 10 bars. That is most likely.