Emini awaiting Trump’s revision of Obamacare health care bill

Updated 6:52 a.m.

Today opened in yesterday’s tight trading range. The bulls need a break above a major lower high to convert the 2 day bear channel into a trading range. The bears want a strong break below yesterday’s low to create a measuring gap. They therefore want the reversal to fall to the bottom of the 3 week range. The odds are that today will break above the channel and at least one of yesterday’s lower highs. Yet, if there is a strong selloff, traders will swing trade their shorts.

This early tight trading range trading is similar to yesterday’s. It increases the chances of a lot of trading range trading again today. Traders need to see a series of trend bars, especially consecutive big trend bars, before they will convert to betting on breakouts instead of reversals.

Pre-Open market analysis

When yesterday traded below Tuesday’s low, it triggered a sell signal on the daily chart. Yet, the bulls created a reversal up. Yesterday was therefore a weak sell entry bar.

The bears need a strong follow-through bear bar today. Yet, after a weak entry bar, the odds are against it. Alternatively, if they form a 3rd consecutive bear bar closing below its low, traders will begin to suspect that there will be a swing down for several days.

Since the channel down was tight on the 60 minute chart, the 1st reversal up will probably be minor. Therefore, the bulls will need at least a small double bottom.

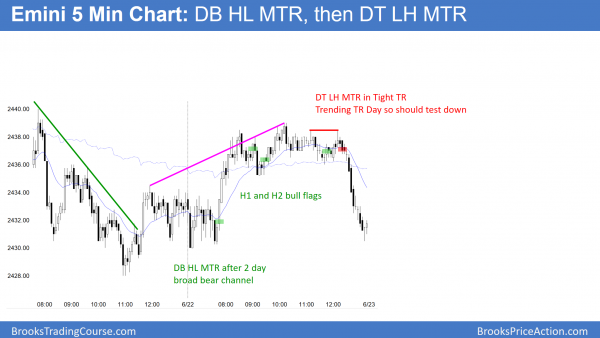

The Emini sold off in a broad bull channel for 2 days on the 5 minute chart. If there is a rally and then a test down, the odds are that it form a major trend reversal buy signal today.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex session. While the odds favor a bull break above the 2 day bear channel today, there is still a 40% chance of a bear breakout and a selloff to the June 9 low at the bottom of the 3 week trading range. If the bears could then break strongly below that support, the Emini would probably begin its 100 point selloff to the weekly moving average.

Today’s Senate healthcare plan could be a catalyst for a breakout up or down. Yet, most days over the past month have had mostly sideways trading, despite many news items. Consequently, the odds favor mostly trading range trading.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday.

EURUSD Forex market trading strategies

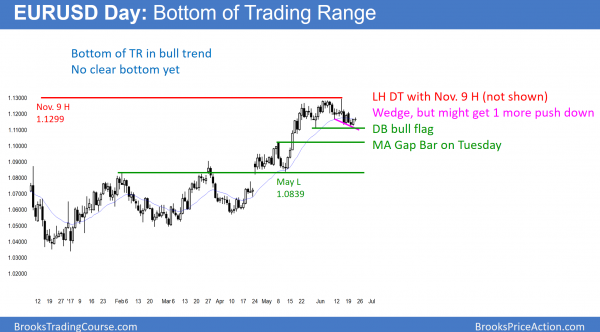

The EURUSD daily Forex chart has been sideways for 5 weeks.

The selloff from the small wedge top now has 3 pushes down and is a wedge bull flag. Yet, the 1st leg down was strong enough to have 2 more legs. Furthermore,

there is room to the bottom of the range. Hence, the odds still slightly favor one more push down before the bulls break above the November 9 major lower high.

The daily EURUSD Forex chart is in a 5 week bull flag at the moving average. In addition, there is a gap between Tuesday’s high and the moving average. It is therefore a moving average gap bar. Consequently, the odds favor a test of the high from 2 weeks ago. Furthermore, the momentum up in May was strong enough to make a move above the November 9 major lower high likely.

Yet, last week’s reversal down was strong. It was therefore likely a spike in a spike and channel bottom. Therefore, the odds favor at least one more 50 pip move down to the bottom of the 5 week range. Because there is already a wedge bull flag pullback to the moving average, it is possible that the pullback has already ended. The bulls need a strong rally to make traders believe that the EURUSD has resumed its bull trend.

There is always a bear case. At the moment, there is a 40% chance of a bear breakout below the 5 week range. If it is strong, the target would be a measured move down to around 1.0840. That is both the May pullback low and the top of the 5 month trading range.

Overnight EURUSD Forex trading

The 5 minute chart has been in a 20 pip range for the past 6 hours. Consequently, day traders are continuing to look for 10 pip scalps. They are waiting for a strong breakout up or down. This might come today when the US Senate reveals its healthcare proposal.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a 2 day bear channel, the bulls got a reversal up from a double bottom higher low major trend reversal. The rally stalled at yesterday’s lower high and formed an upper trading range. The Emini sold off from a tight trading range double top lower high major trend reversal late in the day. It had a sell the close finish.

The Emini broke above the bear channel today. However the breakout was weak. Furthermore, a bear channel usually evolves in a trading range. Today’s weak rally was consistent with that. After an early rally and then an upper trading range, the bears got a trend reversal down at the end of the day.

Tomorrow is Friday and the week is close to the open of the week. Because the weekly chart has never been this overbought in the 18 year history of the Emini, the odds favor a 100 point correction soon. If tomorrow closes near the low of the week, this week would then be a good bear reversal bar on the weekly chart. Hence it would be a good sell signal bar. In addition, the weekly rally from March is a tight wedge.

That therefore increases the chances that a selloff next week below this week’s low would be the start of a 2 month pullback. The odds always favor trend continuation. However, this is a good sell setup. Therefore traders need to be ready for a big bear trend day at some point in the next few weeks.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.