Trading Update: Monday August 2, 2021

Emini pre-open market analysis

Emini daily chart

- First day of month. An Emini bear bar should form on August monthly chart.

- Friday triggered micro double top sell signal. Also was expanding triangle. However, Thursday was a bull bar and therefore a weak sell signal bar, especially in strong bull trend.

- High 1 buy signal but tail, 5-day tight trading range.

- Sideways for 5 days in bull trend so odds favor at least slightly higher.

- 5 sideways day increases chance of another sideways day today.

- July closed near its high, so August should trade above July at some point.

- After 6 consecutive bull bars on monthly chart, August should be bear bar, even if there is a new high early in the month.

- Traders are deciding if streak will continue in August. Since that has not happened in more than 10 years, August should close below today’s open of the month.

- Since August should have bear body, if there is a strong rally this week, it will probably be a bull trap and become the high for a few months.

- Since August should have bear body and be the start of 2 – 3 month pullback, there is increased chance of bear days in August. However, there might be a rally in the 1st half of the month.

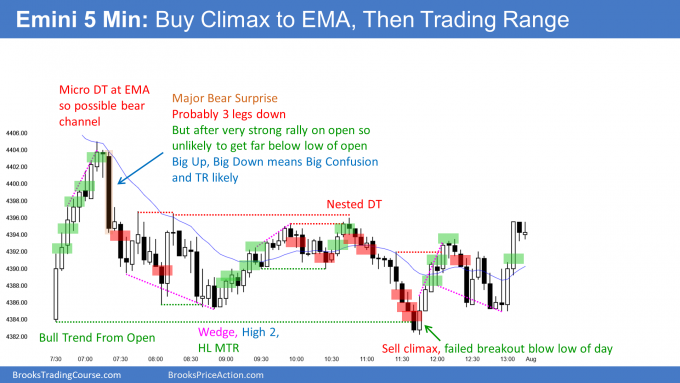

Emini 5-minute chart and what to expect today

- Emini is up 19 points in the overnight Globex session.

- Will probably gap above Friday’s high, but not above July high, which is all-time high.

- Gap might be small. If so, small gaps usually close in 1st hour.

- After 5 sideways days, increased chance of another sideways day.

Friday’s Emini setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

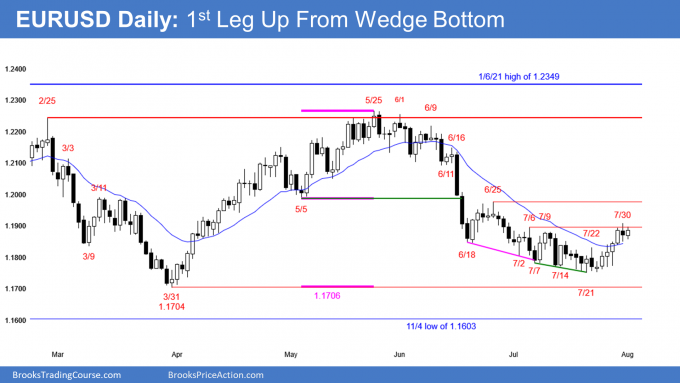

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- Friday was bear reversal bar and a failed breakout above the July 6 lower high.

- Friday is sell signal bar for double top with July 6 high.

- After consecutive wedge bottoms on July 21, odds favor 2nd leg sideways to up. Therefore, the bulls should buy a 1- to 3-day selloff. This should create a higher low and lead to 2nd leg sideways to up.

- Even though sideways in tight range for a month, the trading range price action began with the June 25 lower high. Therefore, should reach that high before breaking far below July 21 low.

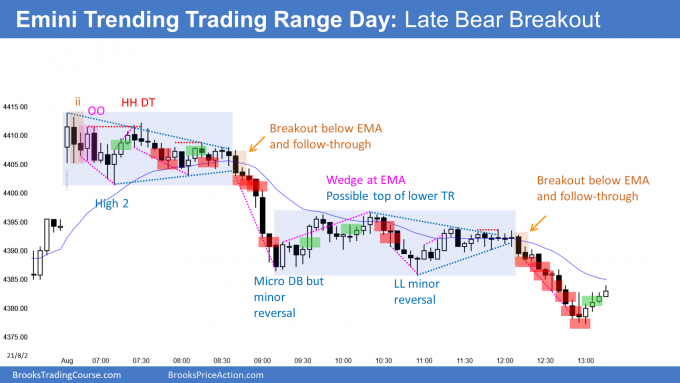

Summary of today’s S&P Emini futures price action and what to expect tomorrow

End of day summary

- Trading range open (triangle), then strong bear breakout below trading range, the 60 minute EMA, and the 4400 Big Round Number.

- Reversed up from lower low major trend reversal, but continued in lower trading range. A bull leg in the lower trading range is always more likely than a reversal into a bull trend.

- Late break below lower trading range in Trending Trading Range Day.

- The breakout fell below yesterday’s low to form outside down day, but at bottom of tight trading range on daily chart so not strong sell signal bar for tomorrow.

- On daily chart, 3rd reversal down from above July 14 high.

- 7-day tight trading range in strong bull trend so odds continue to favor at least slightly higher prices.

- Tight trading range might continue into Friday’s unemployment report.

- Should go above July high since it was a bull bar closing near its high on the monthly chart.

- However, August should close below open of the month (today’s open) and lead to a 2 to 3-month correction of at least 15%.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

sir i get a success rate of 40% in swing trading but for that i have to take 20 trades is it ok when considering 10 trades the probability is less than 30%.

As I said in the course, if a person takes reasonable swing setups, the winning percentage is about 40%.

Some traders are willing to use wider stops and go for bigger reward. These traders might win 30% of the time, but if the reward is at least 3 times the risk, the math is good. Many of those traders hold for the occasional trade that ends up at 5 – 10 times their risk. For them, 30% is no problem.

You’ve mentioned that professional traders often scale into losing positions. While it may be tempting for those that like to ‘win often’, I fail to see how it’s a rational strategy given that it’s increasing his risk (especially VaR as the market may run his stops) almost two fold, while his expected return per dollar, other things being equal and even neglecting VaR, should remain the same as if he’d exited his position and reentered at a subsequent signal. What am I missing here? Or does it mainly derive from the emotional difficulty of reversing an adverse position?

I could write a lengthy response, but I talk about it in the course. If you think about it, if a trader were willing to use no stop and then scale in many times in the Emini, his probability of winning would be essentially 100%. The bigger the risk, the higher the probability. At the other extreme, if he risked only 1 tick, he would lose about 99% of the time.

Experienced traders who are scaling in are obviously somewhere in between. They trade small enough so that they can scale in far from their initial price, yet not have an unacceptable risk. In the course, I gave the example of a Carl Ichan scaling in about 9 times in FCX (a stock) as it was collapsing, and I believe he made a fortune.

Cathie Wood is currently scaling into many positions as the stocks are falling, and she is a very successful fund manager.

Jim Cramer on Mad Money has often advocated that beginners scale into losing trades when buying a pullback or a bottom. I have heard him recommend dividing the purchase of a falling stock into 3 pieces and spread the buys over several days in case the stock continues to fall.

Thanks a ton Al! Very insightful as usual. I guess the key implication is judicious position sizing, and trading small enough that one doesn’t have to worry about the risk of ruin.

In this context, what would you make of a novice who risks 1% of his account per trade, allowing himself to scale in thrice (risking a max 3% per trade as you’ve mentioned in BTC), while scalping for 1 pt with a 4 pt stop in the E-mini?

1 point is not enough on the 5-minute chart on most days. I talk about the math in the course. 2 points is a better minimum scalp most of the time on the 5-minute chart.

Most experienced traders would mess that up enough to prefer simple swing trading. Just because the math is good does not mean that the approach is good. A person has to be having fun and making money. Many traders have the ability to do just that but choose to do other things because the other things are easier and more fun.

When traders start out, many try just about everything, and many like scalping because of the small risk. But most successful traders prefer bigger profits, and most traders have a much better chance of being consistently profitable if they focus on swing trading.

Also, while 3% does not sound like much, it is if a person is doing it regularly. There is a mathematical concept call risk of ruin, and it is substantially greater at 3%.

If a person were doing what you are proposing, he should trade very small, like 1 micro Emini. The goal is not to make money when starting out. It is to get experience and slowly grow the account.

Really appreciate it!