Trading Update: Thursday August 19, 2021

Emini pre-open market analysis

Emini daily chart

- Yesterday had an Emini bear body (big) and it again broke below last week’s low. This time, it closed below.

- It also closed below the open of the month and below the 4400 Big Round Number.

- At the end of July, I wrote that August might rally in the 1st half of the month because July was strong, but then sell off to below the open of the month in the 2nd half because of the streak of 6 bull bars on the monthly chart is unusual. Yesterday traded below the open of the month.

- But will August close below the open of the month? Traders will find out over the next week.

- I have been saying that either August or September should have a bear body on the monthly chart since there has never been a streak of 8 consecutive bull bars on the monthly chart in the 25-year history of the Emini.

- I have also been saying that if August or September is a bear bar, the Emini will probably be sideways to down for 2 to 3 months, and fall 15 to 20 percent.

- The next target down is the bottom of the bull channel on the daily chart. It is currently around 4360.

- That is also near the August 3 low. The rally from the July 19 low has been a Spike and Channel Bull Trend. When it ends, it usually evolves into a trading range. The bottom of the trading range is often near the start of the channel, which was the August 3 low.

- That low is additionally important because it is the low of the month. If the Emini finishes the month on the low, not only will the month have a bear body, it will be a strong sell signal bar. That would increase the chance of a 15 to 20% correction.

- While the context is good for a reversal down, it is important to note that there have been many big 2- and 3-day selloffs since the pandemic low. Each one led to a new high.

- By the time traders believe that a reversal down will lead to a correction, the correction is typically about half over.

- If there is strong follow-through selling over the next few days, traders will conclude that the correction has begun.

- If not, they will buy again, expecting another new high.

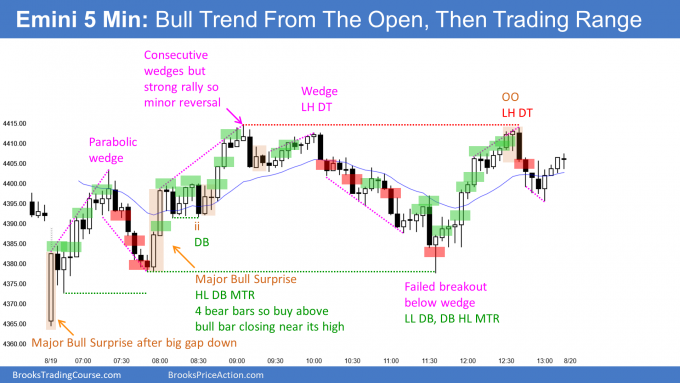

Emini 5-minute chart and what to expect today

- Emini is 32 points down in the overnight Globex session. There will be a big gap down.

- A big gap increases the chance of a trend day in either direction. However, after 2 extremely big bear days, a third big bear day would be unusual.

- Yesterday was a sell climax day. There is therefore only a 25% chance of another big bear day today. If there is a bear trend, it will probably not be strong. It would more likely be a Trending Trading Range Day or a Broad Bear Channel, both of which have a lot of sideways trading.

- But, there is a 50% chance of some follow-through selling in the 1st hour. If there is, traders should watch for a reversal up.

- Also, there is a 75% chance of at least a couple hours of sideways to up trading that begins by the end of the 2nd hour.

- With the Emini extremely oversold and still in a bull trend, there is an increased chance of a bull trend today.

Yesterday’s Emini setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- Yesterday broke slightly below the March 31/August 9 double bottom, but closed above it and it was a perfect doji bar (close at the open and in the middle of the bar).

- That is a neutral bar and not a strong buy signal bar, especially after the big bear bar on Tuesday.

- The bulls want a reversal up from a failed breakout below the March low and from a wedge with the lows of July 21, August 11 and yesterday.

- But the breakout below the March low so far is also weak.

- There was additional selling today, but today so far is back in the upper 3rd of the day’s range. If it closes around where it is, today will be a reversal bar with a small body. That would be a 2nd consecutive doji bar, which means more neutrality, despite the bear trend.

- Traders are still deciding if the selloff has to test the November low, which is the bottom of the yearlong trading range, or reverse up.

- A weak bear breakout and a weak buy signal creates confusion, which usually results in sideways trading for a day or two.

- Less likely, today could be a big trend day in either direction.

- The bears want strong follow-through selling, which would make a test of the November low likely. That is unlikely with today reversing up after an initial selloff.

- The bulls want a strong reversal up, which would make a test of the August 13 lower high likely within a week or so.

- With yesterday being a doji bar and today so far being a 2nd doji bar, a big bull will probably not form.

- The fight today could be over the close of the day. If there is a bull body, the bigger the body, the more likely the EURUSD will trade higher tomorrow.

- The bears want a bear body and the close to be below the midpoint. That would increase the chance of at least slightly lower prices tomorrow.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

End of day summary

- Big gap down, but then big Bull Surprise Bar. Became low of day.

- Parabolic wedge rally to EMA, then 50% pullback to higher low double bottom and higher low major trend reversal.

- A pair of bull bars were another big Bull Surprise, and bull trend resumed back above 4400 Big Round Number and the open of the month. Closed just below open of month.

- Remember, the bulls want August to close above the open of the month. I have been saying since late July that the open of August could be the most important magnet all month.

- On daily chart, test of April 3 low, which was start of bull channel after spike up from July 19. Should lead to a trading range for a week or two.

- High 1 on daily chart just above bottom of bull channel, but after 2 big days down so probably minor reversal. Might rally for a couple days, but trading range likely after Big Down, Big Up at support.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Dear AL Brooks,

After joining your course, my understanding about the markets has improved significantly & helping me in reducing many pitfalls.

With Kind Regards.

Hi Al, thanks for taking the time to reply to the comments above, greatly appreciated.

Hi Dr. Brooks,

Is one of the reasons that Bar 17 bounced where it bounced is because of a trend line projection from

Yesterday’s Bar 81 high to Today’s Bar 10 High anchored to Bar 1 Low for a broad bull channel.

Is it a correct assessment in saying that the Bullish Move from Bar 1 to Bar 10 was fairly tight and possible buyers below. Buyers did not come in at a 50% retracement, but they could come in at the broad channel projection, so even if the Bearish Move from Bar 10 to Bar 16 was tight, you have to respect the possibility of that broad bull channel holding and it’s safer to exit shorts at that price?

There were several reasons why the 17 low was where it was. That channel was one.

Although I did not mention it in the chat room, that low was an exact 50% retracement of the rally on the Globex chart to the 10 high from the 5:10 am PT low.

It was also a couple ticks beyond a measured move from the 10 high to the 12 low, which was an attempt at a bottom.

Hi Al,

I find it much easier to trade higher time frame charts (e.g 15min, 60 min). You once spoke about that but what would be your advice? Should I focus on trading a chart that I feel comfortable with instead of trying hard to trade the 5 min chart? What would be the reason for me reading better the price action on a higher time frame chart as opposed the 5 min chart?

Trading is a career. That requires 2 things… making money and being happy. If a person is happier trading a higher time frame, that is a good choice.

does individual traders need any internships or work experience in some trading firm inorder to become professional trader ?

There are many self-taught successful traders. It is hard to get a job at a major trading firm, and the work is very hard. Also, many traders are simply running algorithms and not learning how to day trade. Most Wall St. firms trade based on fundamentals.

If I was 22 years old, I might have gone to business school instead of medical school, and I might have ended up on Wall St., but I am very happy learning it on my own.

thanks

I am interested in trading and long term investments in markets which masters i need to choose because i am in mid twenties your answer will be helpful for me?

Is it M.S.finance or CFA

For an individual who wants to make a living through trading need to study these masters?

There is no easy way to become good at any career. It takes time to become a professional pianist, golfer, or house builder. I am not aware of any degree that would speed the process. I believe it is simply a matter of studying, which does not require a degree. Look at me… I have an MD degree.

thanks for your reply sir.