Emini bear rally from sell climax at monthly bull trend line

I will update again at the end of the day.

Pre-Open market analysis

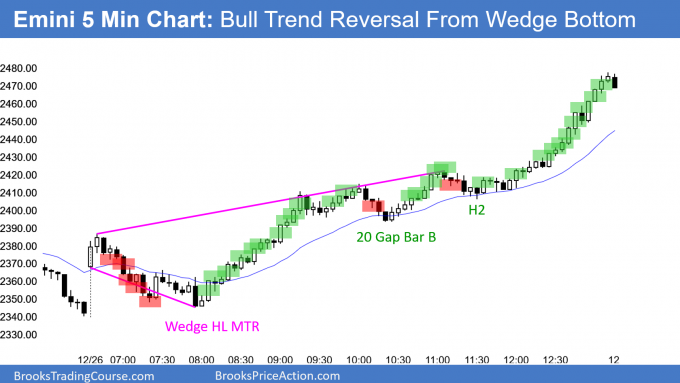

Before the open yesterday, I said that yesterday would probably be a bull trend day. This is because there were 10 consecutive bear bars on the daily chart and that has not happened in the 20 year history of the Emini. Furthermore, the Emini poked below the monthly bull trend line on Monday, and there are usually buyers at a monthly bull trend line.

Yesterday’s rally was a strong short covering rally. In addition, FOMO bulls (Fear Of Missing Out) bought all day. It was surprisingly strong. As a result, bulls will buy the 1st pullback. The odds therefore favor at least a small 2nd leg up within a week.

Bear rally and trading range likely over next several weeks

A 10 day sell climax means the bears are strong. Consequently, even if the bulls get a 1 – 2 week rally, it will probably be minor. Typically, the bulls need at least a double bottom or a micro double bottom to reverse a bear trend.

But, a bear rally can be strong. The 1st target for the bulls is Friday’s high. This is because it was the top of a 2 day sell climax. It will also be near the 20 day EMA and the 2500 Big Round Number. Last Wednesday’s high is a higher sell climax high. There is also a bear trend line on the 60 minute chart around the 2500 Big Round Number.

The bulls might need 1 – 2 weeks to get one or all of these targets. In addition, there is a 50% chance of another 1 – 3 day sell climax before the bear rally begins. Many bulls want at least a micro double bottom before buying.

The confusion that happens after a climax usually results in a trading range. Big Down, Big Up creates Big Confusion. That is what is likely over the next 2 weeks.

The bulls want a bull bar on the weekly chart when this week’s candlestick closes tomorrow. Therefore, they will buy dips below the open of the week. The bears do not want a strong buy signal bar on the weekly chart. They will therefore sell rallies, trying to put a tail on the top of this week’s candlestick.

Overnight Emini Globex trading

The Emini is down 36 points in the Globex session. Since yesterday was a buy climax, there is a 75% chance of at least 2 hours of sideways to down trading today that starts by the end of the 2nd hour. Even if today is a trading range day, the legs will probably be big enough to swing trade.

When there is a buy climax into the close, there is a 50% chance of at least some follow-through buying in the 1st 2 hours. But, there is only a 25% chance of a strong trend day up or down. Day traders expect at least one swing trade up and one down today. Because this is Christmas week, there is an increased chance of protracted tight trading range trading, despite yesterday’s strong trend.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

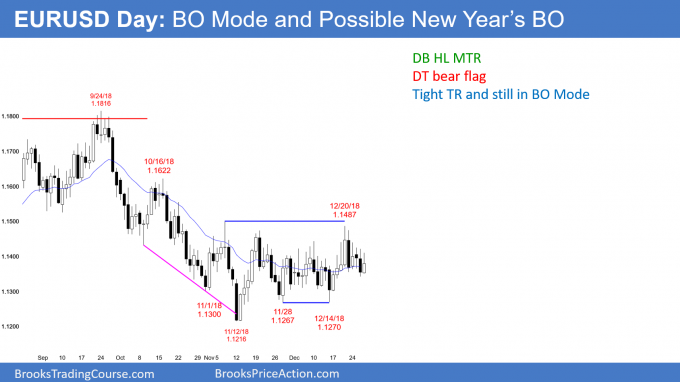

EURUSD Forex BO Mode with double top bear flag and double bottom higher low major trend reversal

The EURUSD daily Forex chart has been in a tight trading range for 2 months. It is therefore in Breakout Mode.

The EURUSD daily Forex chart is in a tight trading range. A trading range always has a credible buy and sell signal. Here, the bulls have a double bottom higher low major trend reversal. For the bears, it is a double top bear flag. Until there is a breakout, traders are buying low, selling high, and taking profits every 1 – 3 days.

Currency markets sometimes have breakouts on or shortly after New Year’s Day. Since this tight range has gone on for an unusually long time, there is an increased chance that traders are expecting a New Year’s breakout. When one comes, it can sometimes lead to a move that lasts many months.

When a market is in Breakout Mode, there is a 50% chance that the 1st breakout will fail and reverse within a few days. In addition, there is a 50% chance that the successful breakout will be up or down.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been alternating small trends up and down for several days. It rallied 60 pips last night, but retraced about half of that over the past 2 hours.

Day traders are scalping for 10 – 20 pips, as they have been for 2 months. However, tight trading ranges do not last forever. Two months is an unusually long time on the daily chart. Consequently, day traders will be quick to switch to swing trading once they see a big, sustained breakout on the 5 minute chart. That would correspond to a breakout on the daily chart.

But, until there is a breakout, there is no breakout. They will make more money scalping while they continue to wait.

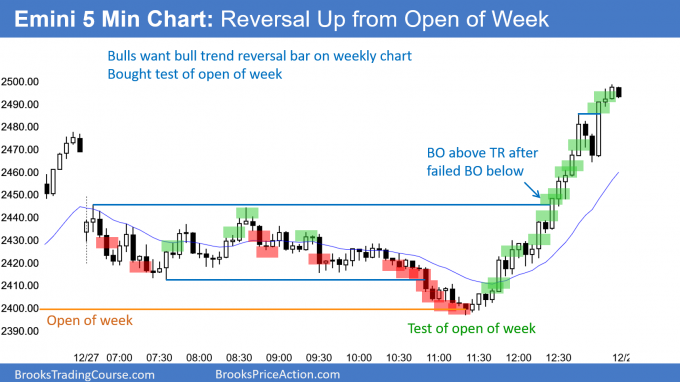

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

After a big gap down, today entered a trading range. Trading ranges are common between Christmas and New Year’s. After a late failed breakout below the open of the week, the bulls got a strong rally. Because there are now consecutive big bull bars, the odds favor higher prices over the next few days. The February low is a target since it is the breakout point.

As I have been saying all week, the open of the week is an important magnet, especially on Friday. This is because the bears want a bear bar on the weekly chart. That would be follow-through selling, and it would increase the chance of lower prices over the next few weeks.

However, the bulls want a bull bar. They would then see this week as a buy signal bar on the weekly chart for a failed bear breakout. Today tested the open and reversed up strongly. This increases the chance of higher prices next week.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

Tnx for the great report. I do remember that in your trading course you talk about the importance of the Open, Close, High, Low of last week and current week on Friday. But after reading your daily reports for a while I’ve realized that these key resistance and support lines could be important during the week as well. Could you elaborate on this? Should I always be looking for B.O, B.O. Failure & B.O. PBs setups around these support and resistance lines during the week.

Thank you very much.

The higher time frame support and resistance create fewer signals than those on the 5 minute chart. I do not think a traders needs to spend time looking at them. This is especially true if it distracts him from the chart in front of him. I am usually aware of major higher time frame prices, but I place trades almost entirely based on the 5 minute chart.

Al,

Hope all is well. In previous daily writes, not sure specifically which, you mention price falling below 2400 would be important. Price did fall below that point on 12-26. could we have a double bottom at that price level again, or do you thing otherwise. Thank you for all of your support and knowledge.

Happy holidays to you and your family-Richard

Yes, my point about 2400 was that the monthly bull trend line was just below. The Emini fell to it on Monday and reversed up strongly yesterday.

Every bear trend ends at a monthly bull trend line. However, the selloff was in a tight bear channel on the daily chart. Consequently, a minor reversal and trading range is more likely that a bull trend. That means that there will probably be a test back down after a 1- 2 week rally. At that point, the bulls will try to create a double bottom. If they succeed, they would have a 40% chance of a resumption of the bull trend.