Emini and Forex Trading Update:

Thursday June 4, 2020

I will update again at the end of the day.

Pre-Open market analysis

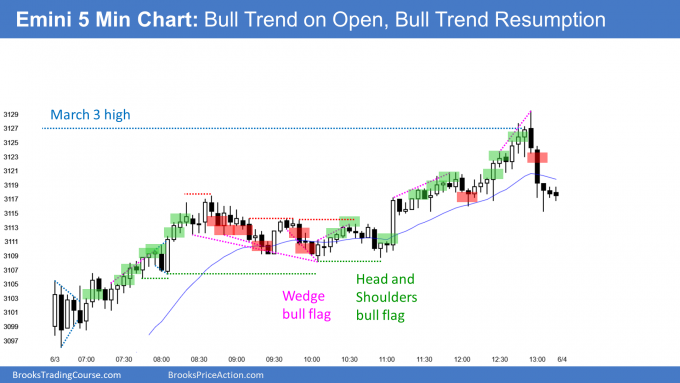

The Emini gapped up yesterday and broke above the 3,100 Big Round Number. Late in the day, it broke above the March 3 high. However, it sold off into the close. That was the start of the March crash and it is therefore an important target. Many bulls will take profits there and the bears will begin to sell for a trade down.

The Emini might trade around it for several days as traders decide if the rally will continue up to a new high or begin a 15% correction this summer. If the bulls get consecutive closes above that high, the Emini will probably make a new high this summer. Without that, the rally should exhaust itself and traders will expect the Emini to retrace about half of the 3 month rally.

Overnight Emini Globex trading

The Emini is down 16 points in the Globex session. It may open around yesterday’s low. That is interesting because yesterday was a big bull day on the daily chart and it came late in a bull trend. If the next day opens near the low of that day and sells off, it often leads to a reversal down. Consequently, if today opens near yesterday’s low, there is an increased chance that today will be a bear trend day closing near its low.

Can today be another big bull trend day? Probably not. This is the price where the bears have wanted to sell since the reversal up from the March low. The bulls will probably be unable to break strongly above it.

If they do, it will likely take several days to use up all of the supply here. Therefore, day traders will expect to sell rallies above the March 3 high. But they know that the Emini will should go sideways here for a few days. They will therefore look to buy selloffs. Finally, they know there is an increased chance of a bear trend day and the start of a reversal down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

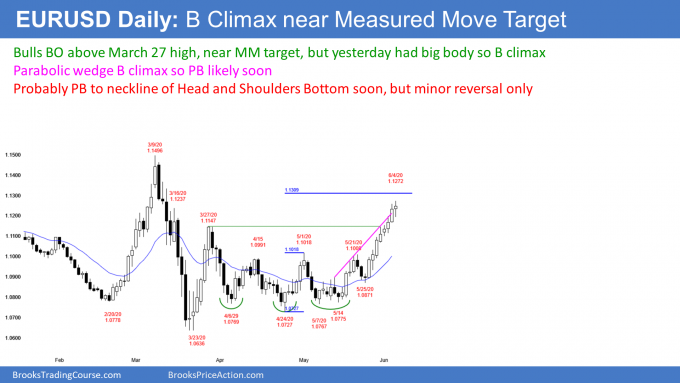

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has rallied strongly and it is near a measured move target. Yesterday’s body was bigger. When a bar is big and it comes late in a bull trend, it is usually a sign of exhaustion. There is often one more brief leg up for a couple bars, but there is then typically a pullback.

The 1st target is the bottom of that buy climax bar. At a minimum, that is around the March 27 high. More likely, the pullback will test the May 1 high. Another target is the neckline of the head and shoulders bottom. That is the May high, just above 1.10.

The bulls want this rally to go straight up to the March high without more than a 1 – 3 bar pullback. That would be unusual, especially after a buy climax day like yesterday. Traders should expect profit taking within the next days.

If today closes near the open, today will make other bulls take some profits. Also, bears will begin to scale into shorts.

But if today closes near its high, the EURUSD should reach the 1.1309 measured move target within a few days before pulling back. In either case, traders should expect a 100 – 200 pip pullback to begin within a week.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market sold off overnight and then reversed up to a new high, Over the past 30 minutes, it has pulled back to the open.

Today so far is a doji bar on the daily chart. Since yesterday was a big bar in a buy climax, it will attract profit takers. The selloff on today’s open and again on the rally to the new high are examples.

Will there be enough sellers today near the high of the day to cause the day to close near the open? That will attract other profit takers tomorrow.

Or, will the bulls buy every selloff and get the day to close near its high? The big reversals today are a sign that the bull trend on the daily chart is losing momentum. Day traders will be more willing to sell rallies. They will continue to buy selloffs.

Strong bull trends usually do not immediately reverse into bear trends. Therefore today will probably be sideways.

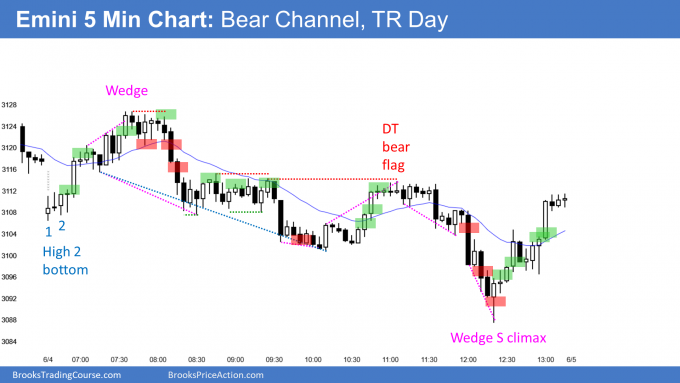

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

The Emini gapped down and rallied up to the March 3 high. Like yesterday, it reversed back down. It sold off to below yesterday’s low. There was some profit-taking at the end of the day and the day closed just above the open. Today was a doji day.

The Emini might spend several days around the March 3 high before either reversing down or breaking up. The odds favor a 15% pullback before a new all-time high.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Al,

I bought above bar 64, but I don’t see I should get out below the low of bar 65. So I ended up stopped out almost at the bottom of the big bear bar 66. Is there something wrong with my trade here? Thank you

Bar 64 was not a good enough setup to buy in a market making lower highs and lows and right after a bear breakout of a trading range that is now testing the bottom (resistance) of that range.

Hi Al, you mentioned that trader better to get out ASAP whenever he realized that he has made a mistake, the difficult part is that we can only have certain level of confidence on whether it is really a mistake or not, we never know 100% for sure. So when scalping, do you suggest to get out as soon as we suspect it “maybe” a mistake, or do you suggest to get out when we think it “for sure” is a mistake? (both are difficult to do, lol)

Do you try to quantify the “probability of mistake” (maybe subconsciously) to help make the decision? for e.g. if I am pretty sure (maybe more than 75% probability) it is a mistake I get out (normally the loss is big at this time…lol, but the exchange is that certain losing trade may eventually become breakeven or even profitable, because time factors in). Or to get out as soon as I started to ask myself the question “did I just make a mistake?” (the “probability of mistake” is probably just 60% at this time).

Scalpers are making high probability bets. If he is taking trades that are not or are no longer high probability, he cannot be in the trade.

If the trade does not do what he wants, he should get out. When in doubt, get out. If it is not unfolding the way he expected, it is no longer high probability. Since his risk is greater than his reward, he needs at least 70% certainty to make a living.

Sometimes he will decide in advance that scaling in might be needed. If that is not his thought when he enters and the trade goes bad, he should not switch to scaling in. Get out and take the loss.

Trade management in scalping requires quick thinking and flawless execution. Remember, you need perfection 70% of the time. Most people cannot do that trade after trade, year after year. Therefore, most people will lose money if they scalp. This is true even if they win more than 60% of the time.

Appreciate for the insights Al, as always! I have been experimenting different trading management recently and trying to find the one that best fit my personality. Will see how it goes.

I got a related question – you mentioned before that if a trader takes a reasonable trade but the market turns against the entry, then later the market usually gives the trader a chance to scale in and eventually get out breakeven. For example, when a context is big bull trend (on 15mins, hourly, daily and weekly chart), if I bought a H2 at a potential TR bottom, but the H2 turns out to be a bull trap and the market turns down and soon make another even better H2 (to augment the bull case let’s say the bear bar is not getting bigger and the bull bar does get bigger), I will be thinking to buy it again and hoping to get at least breakeven on the 2 trades together, in order to avoid a loss, or sometime take a minor loss. (Let’s also assume that I used a wide stop since the context is good)

When the first H2 failed, on one hand I know I just made a mistake and should get out ASAP (as you mentioned), but on the other hand I also know the second H2 is very possible based on the good context (again all bull trends on 15mins, hourly, daily and weekly chart). So if I change my mind after the first failed H2 and decide to expect the second H2 to scale in, is this a reasonable strategy for a scalper to use? (By the time I wrote to here, I am guessing I might have the answer for myself now, but would like your confirmation: it looks like my premise about the probability has not changed even I change mind after the first failed H2, so I guess in this particular scenario here I am doing the right thing? (to expect the second H2 instead of getting out after first H2))

To a scalper, I think above situation probably should only happen a few times in a month, if it happens very often to the scalper, the trader is probably doing something wrong. But the point I want to say is, if the scalper can breakeven for those “a few times in a month” without having to take a loss on the first failed H2, why not?

Again, thank you very much for you time! I have learned A LOT from you! (I have been learning your PA and trading for more than 3 years and I have to say it is definitely worth it!)

Hi Jushi. The comment section is meant for simple one-sentence questions for Al, straight to the point type thing that he can easily answer. Please keep it short.

Hi Jushi,

Further to Jakub’s concise and spot on comment, post comments are not suitable for complex discussions. The value of them is lost as time rolls on and post ages. Also, Al really does not have the free time to spend answering such complicated and lengthy questions. He is already doing far too much work each day.

Before upgrading the comments system we had a simple line above comments. Sadly, the new system does not support such, but we had the following: “Comments on Intraday and Weekly reports should be for clarifying points or fixing errors. Al answers specific trading questions in his trading room every day.”

We have a new Support Forum which is where you should be posting the above. Our trader community will answer questions there, not Al himself, so can you please edit/copy your last comment above into the 36 Trade Management or similar forum. I can then delete your comment from here.

Sorry for the long comment! Trust you understand. 🙂

Thanks Richard. I tried to make myself clear so it is easier for Al to answer a particular question, I can make it much shorter but it probably will be very difficult for Al to provide an answer because in trading a lot of times there is no absolutely right or wrong, as we all know. That is the very reason I hesitate to use the forum to ask this particular question, because honestly, as Al has mentioned before, only 1% of those who learn trading can become consistently profitable, so far Al is the only person I trust. (not saying others are not profitable, I just don’t know who else is or is not.)

I used to ask questions in trading rooms but again there was limitation on the length of the question too, (I did learned A LOT from the trading room though), but still occasionally I struggle to ask question in a way that is within the limitation but at the same time make my question clear & easy for Al to answer.

you can try to some trading statistics (交易统计) for one month or two, then you probably can answer this question yourself. We all have very personal strategies of our own trading style base on Al’s teaching. We need to test these strategies and find if they are working – how is the probability, how is the RRR, do I trade it with a lot of stress or peace, does it fit my personality,and so on. Give yourself some statistic numbers to build confidence and comfort zone.

Thank you for your suggestion. That is interesting to know, somehow I never really thought to test what Al taught because I consider everything he taught is reasonable thing to do when context is right (after years of seriously following Al’s teaching it is hard to not trust his system), but as you said not everything he taught fit everyone’s personality. I’d be very interested to understand how you test, do you mind connecting offline somehow?

qq: 953091095